/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Pony AI (PONY) says it has partnered with Stellantis (STLA) on testing robotaxis in Europe.

According to its press release, initial tests will begin in Luxembourg before the end of this year, with plans of “a gradual rollout across other European cities” in 2026.

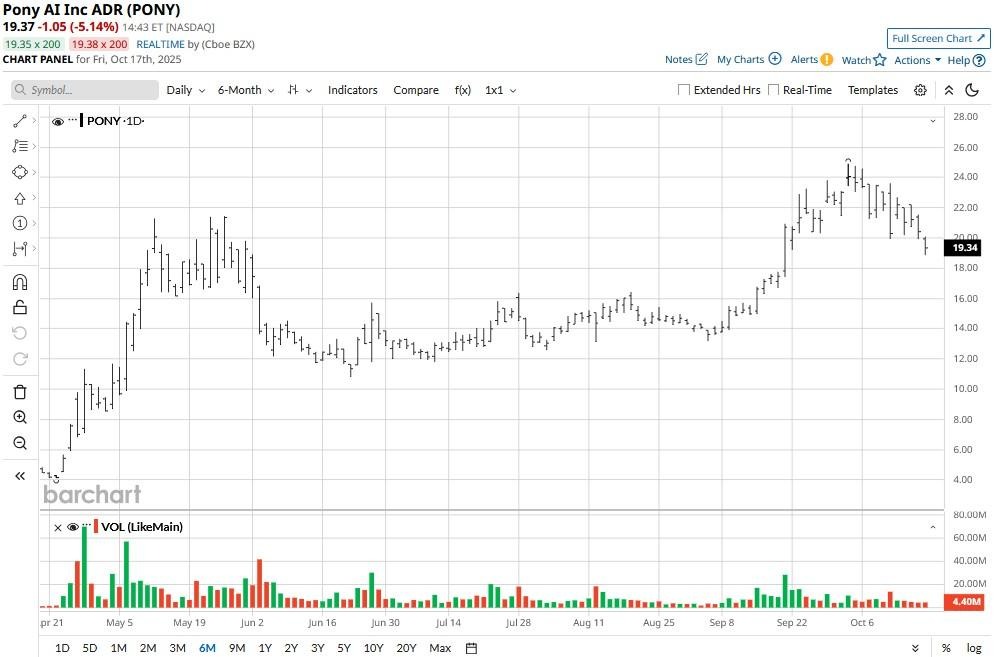

PONY stock has been a rewarding position since late April. At the time of writing, it’s up roughly 375% versus its year-to-date low.

Stellantis Deal Is Largely Positive for PONY Stock

Despite a muted initial response, teaming up with Stellantis is notably bullish for PONY shares as it signals the firm’s entry into the European Union’s autonomous mobility market with a credible global automaker.

Testing robotaxis across European cities in collaboration with the Jeep maker positions the Chinese company as a serious contender in international autonomous vehicle (AV) deployment.

Working with a legacy OEM doesn’t only diversify geographic exposure, it validates Pony’s tech as well.

For investors, it means long-term revenue potential, regulatory traction, and brand recognition. In short, the Stellantis deal could be a foundational step for Pony toward commercial scale and global relevance in AV.

The Case for Owning PONY Shares for the Long Term

Pony AI is a top robotaxi stock as it’s one of the few autonomous driving firms with dual regulatory traction in both China and the U.S., a rare feat in a geopolitically fragmented tech landscape.

Its hybrid approach to artificial intelligence stack development, combining perception, planning, and simulation in-house, gives it tighter control over system integration and safety.

The company has ties to Tier 1 suppliers and chipmakers, enabling much faster hardware-software alignment and its real-world data advantage, with over 30 million autonomous kilometers logged, is compounding.

As governments push for smart mobility and urban automation, Pony shares are an exciting long-term infrastructure play thanks to its mature technology and operational scale.

Pony AI Remains a ‘Buy’ Among Wall Street Firms

Wall Street firms also currently recommend sticking with PONY stock for the longer term.

At the time of writing, the consensus rating on Pony shares sits at “Strong Buy” with a mean target of $25.52 indicating potential upside of another 35% from here.