/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

PayPal (PYPL) just made a bold move by launching its PayPal Ads Manager on Oct. 7. The idea is simple but potent, allowing the small businesses in PayPal’s ecosystem to become their own retail media networks and generate new revenue streams. Investors cheered as PYPL stock jumped 4.7% following the announcement.

The new platform is designed to help millions of small businesses earn revenue by hosting targeted ads on their websites and apps. The move marks PayPal’s entry into the high-margin digital advertising space, aiming to replicate the success of retail media models used by industry giants.

The launch followed closely after PayPal introduced a 5% cashback offer on buy now, pay later (BNPL) purchases for U.S. customers, signaling a broader push to drive engagement and monetization. The platform further allows small businesses to participate in premium ad revenue streams with no upfront costs or commitments, while PayPal’s system automatically manages ad placements to ensure relevance and brand safety.

So, considering this strategic development, should you buy PYPL stock? Let’s discuss.

About PayPal Stock

PayPal is a leading fintech firm that operates a digital payments platform connecting consumers, merchants, and financial institutions across more than 200 markets. It offers a broad array of services, including peer-to-peer transfers, merchant processing, digital wallets, and consumer credit products. PayPal is headquartered in San Jose, California and currently boasts a market capitalization of $63.1 billion.

Over the past year, PYPL stock has endured a choppy ride, as it is down 17% despite occasional rebounds, reflecting investor skepticism amid broader tech volatility. On a year-to-date (YTD) basis, the stock is down 22%, weighed down by concerns over slowing growth and margin pressure. PYPL is also down 3% over the past month.

Still, PayPal’s unveiling of the new Ads Manager platform provides some optimism. The move signals a strategic push into monetizing its merchant network with advertising revenue. The announcement was met with immediate investor enthusiasm, driving a sharp intraday jump in the PYPL share price. PayPal's BNPL segment also continues to show strength.

That said, sustaining any momentum hinges heavily on whether PayPal can deliver on its ad monetization strategy, expand margins, and fend off intensifying competition in payments and fintech.

PYPL stock currently trades at a premium compared to the sector median but at a discount to its own historical average at 12.97 times forward earnings.

Mixed Q2 Performance

PayPal Holdings reported its second-quarter 2025 financial results on July 29. The company announced revenue of $8.3 billion, marking a 5% increase year-over-year (YOY) and surpassing analyst expectations. Adjusted EPS stood at $1.40, increasing 18% from the prior-year quarter and exceeding the consensus estimate.

In terms of operational performance, PayPal processed a total payment volume (TPV) of $443.5 billion, reflecting 6% YOY growth. Transaction margin dollars increased by 7% to $3.8 billion, driven by strong performance in branded and unbranded checkouts and card services. The company also reported a 2% rise in active accounts, reaching 438 million.

Despite the strong top-line performance, however, PayPal’s adjusted free cash flow declined to $656 million from $1.1 billion in the same quarter last year.

Following this performance, PayPal raised its full-year guidance. The company now expects adjusted EPS to be between $5.15 and $5.30, up from the previous range of $4.95 to $5.10. For the third quarter, adjusted EPS is projected to be between $1.18 and $1.22.

Analysts remain optimistic, as they predict EPS to be around $5.24 for fiscal 2025, up 13% YOY, before surging by another 10% annually to $5.78 in fiscal 2026.

What Do Analysts Expect for PayPal Stock?

PayPal has experienced notable shifts in analyst sentiment, reflecting a mix of optimism and caution. Earlier this month, Wolfe Research downgraded PayPal from “Outperform” to “Peer Perform,” citing concerns over the company’s ability to accelerate growth in its core branded checkout business. Despite operational improvements in areas like Venmo and Braintree, Wolfe expressed skepticism about PayPal’s ability to achieve its targeted 8% to 10% branded growth by 2027, labeling it a “show-me story.”

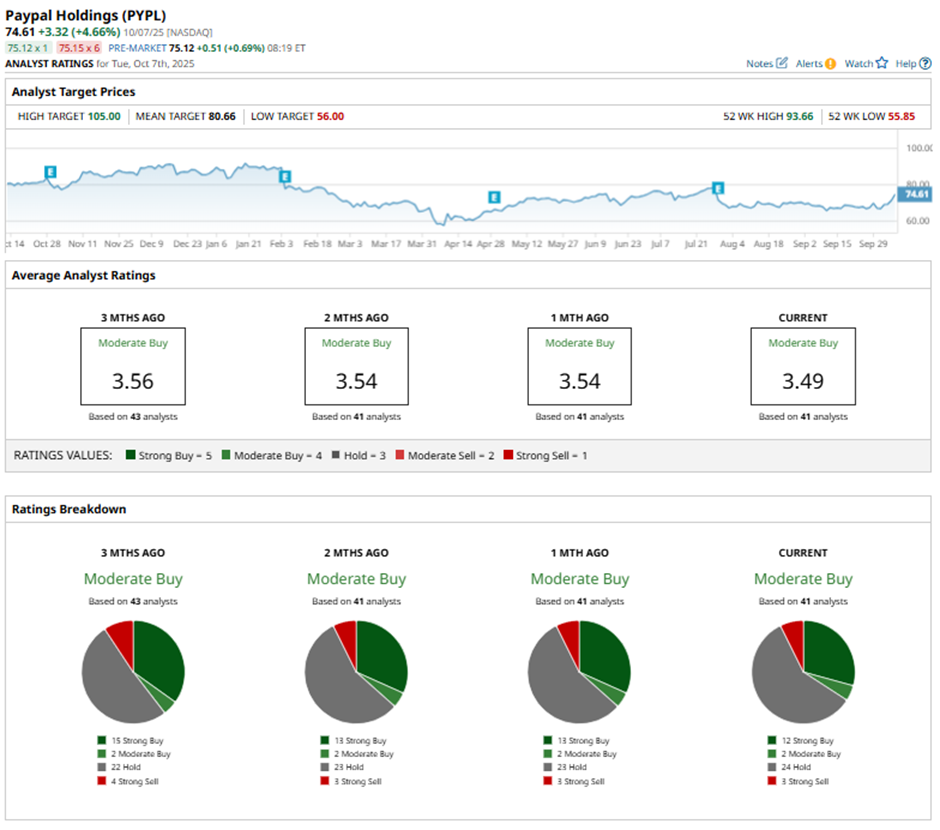

Wall Street remains moderately bullish on PYPL stock with an overall consensus “Moderate Buy” rating. Of the 41 analysts covering the stock, 12 advise a “Strong Buy,” two suggest a “Moderate Buy,” 23 analysts are on the sidelines with a “Hold” rating, and four rate it as a “Strong Sell.”

The average analyst price target for PYPL stock is $80.38, indicating potential upside of 21% from current levels. The Street-high target price of $105 suggests that the stock could rally as much as 59%.