/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

The world's most valuable company and chip giant, Nvidia (NVDA), recently revealed its new chip system, aimed specifically at AI-led video and software creation. Named Rubin CPX, Nvidia claims that the platform will boast 8 exaflops of AI performance and 100 TB of fast memory in a single rack.

Notably, this is also the first concrete product that has been unveiled under the Rubin architecture—the successor to the Blackwell chips. The Rubin CPX class of GPU is purpose-built for handling very long context, million-token scale, and generative video. Further, rather than chiplets or multi-GPU packages, the Rubin CPX uses a monolithic die design for efficient and specific performance demands.

Speaking about Rubin CPX, which will be deployed under the Vera Rubin NVL144 CPX platform, CEO Jensen Huang said, “The Vera Rubin platform will mark another leap in the frontier of AI computing—introducing both the next-generation Rubin GPU and a new category of processors called CPX. Just as RTX revolutionized graphics and physical AI, Rubin CPX is the first CUDA GPU purpose-built for massive-context AI, where models reason across millions of tokens of knowledge at once.”

So, Nvidia continues to push the boundaries of innovation with this latest development, making its investment case stronger. Why? Let's find out.

Financials as Good as Its Chips

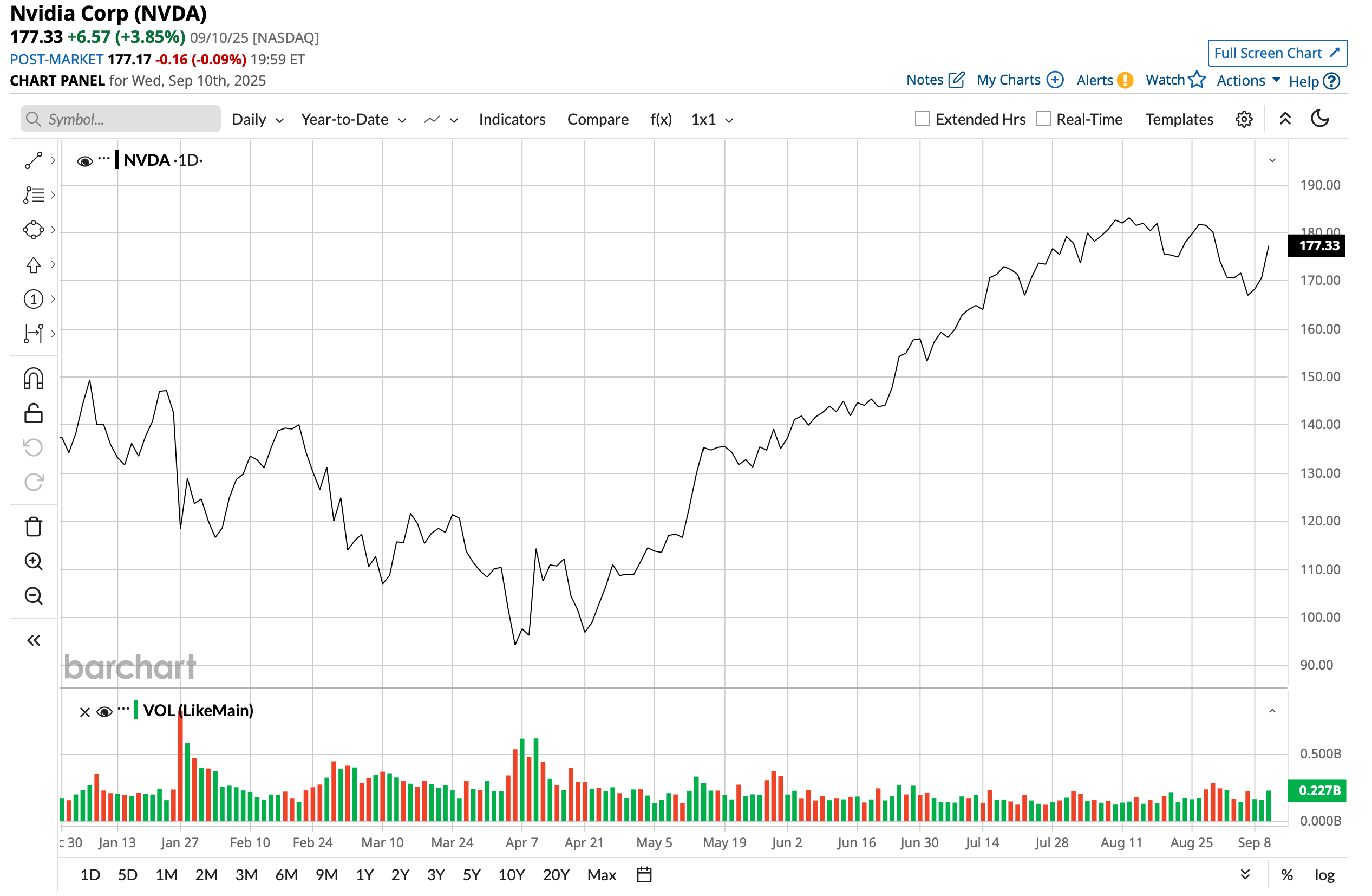

Nvidia has not reached the world's most valuable company status with a market cap of $4.15 trillion and an eye-popping share price rise of 1,358.3% over the past five years just on the back of its market-leading products. It has attained these heights with industry-leading margins, revenue growth, and an increase in profitability. In fact, even after skeptics questioned its valuations and raised issues about its China sales, the NVDA stock is up 32.1% on a year-to-date (YTD) basis, outperforming the S&P by almost three times.

In its latest quarter, Nvidia once again topped expectations on both revenue and earnings. The company posted revenues of $46.7 billion, representing a 56% year-over-year (YoY) increase, while earnings came in at $1.05 per share, up 54% from the prior year and ahead of the consensus estimate of $1.01. The data center division, its largest contributor, delivered revenues of $41.1 billion in Q2 2025, reflecting a 5% sequential gain and a 56% jump YoY.

Operating margins slipped slightly to 64.5%, compared to 66.4% a year ago, but remained robust. Meanwhile, operating cash flow strengthened further, rising to $15.4 billion from $14.5 billion last year. With no short-term debt and a sizable cash reserve of $56.8 billion, the company closed the quarter with a strong liquidity profile.

Looking ahead, Nvidia has guided revenues between $52.92 billion and $55.08 billion for the next quarter. The midpoint of this range suggests 53.8% growth YoY, while Wall Street forecasts stand at $53.14 billion.

The Streets Will Not Forget Blackwell

While Rubin continues to generate anticipation, it is Blackwell that remains at the forefront today, and its momentum is undeniable. In the second quarter, Blackwell posted a 17% sequential increase, with Nvidia initiating shipments of the Blackwell Ultra GPUs. Production is already averaging close to 1,000 racks per week, and management expects the ramp-up to accelerate further in the third quarter. Performance gains are equally noteworthy, with the AI superchip delivering ten times the token-per-watt efficiency compared to the Hopper line and as much as fifty times greater energy savings per token in inference workloads. For training, the GB300 recorded speeds seven times faster than the H100 when using NVFP4.

Since launch, Nvidia has succeeded in more than doubling Blackwell’s performance, which in turn enabled the GB200 to achieve a complete sweep across the MLPerf Training benchmarks, cementing its leadership position.

Attention is also turning to the upcoming Rubin platform, incorporating the Vera CPU, Rubin GPU, CX9 SuperNIC, NVLink 144, Spectrum-X, and silicon photonics. According to management, Rubin is currently in its final pre-production phase at TSMC (TSM) and remains on track for mass rollout next year.

Taken together, Nvidia is positioning itself to capture a data center and enterprise AI market that management estimates could expand to between three and four trillion dollars by the end of the decade. With its commanding 92% share of the GPU market, the company appears well-placed to continue delivering long-term value for shareholders.

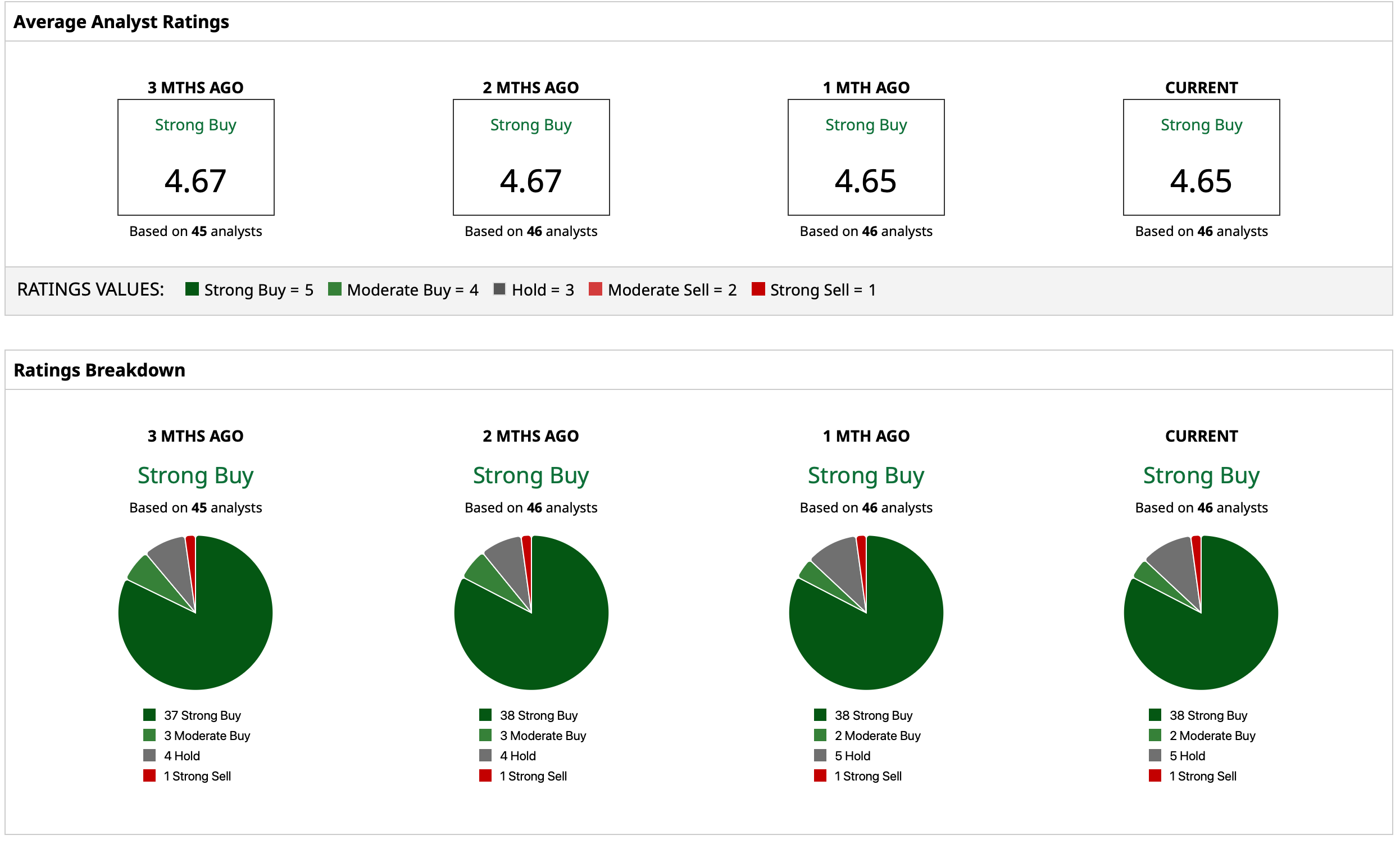

Analyst Opinions on NVDA Stock

Taking all of this into account, analysts continue to be optimistic about NVDA by attributing to it a rating of “Strong Buy,” with a mean target price of $211.07. This alludes to an upside potential of about 19.1% from current levels. Out of 46 analysts covering the stock, 38 have a “Strong Buy” rating, two have a “Moderate Buy” rating, five have a “Hold” rating, and one has a “Strong Sell” rating.