/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

A key aspect of Microsoft's (MSFT) position as a prominent player in the fiercely competitive but fast-growing space of artificial intelligence (AI) is its $13 billion investment in OpenAI, the little-known startup that captured the imagination of the world and made AI mainstream at the end of 2022. Having a 49% stake in the profits of the company, a valuation that has soared above $300 billion, and integration in various forms across its line of products, Microsoft's investment in OpenAI has been a success.

Then, why is Microsoft looking to upend the applecart by developing its own AI models?

Microsoft Testing Its Own AI Models

Microsoft is testing two of its own in-house developed AI models, namely MAI-Voice-1 and MAI-Voice-Preview. While the MAI-Voice-1 is Microsoft’s first in-house AI speech generation model, designed for natural, expressive voice output used for narrated news, podcasts, and Copilot voice features, the MAI-1-preview is Microsoft's first fully in-house foundation model, built using a mixture-of-experts (MoE) architecture, to be used as a general-purpose AI assistant for text tasks—like answering questions, summarizing, writing, coding help, and reasoning.

Neither of the models is available for use on a large scale for the public, with MAI-Voice-1 accessible to the public inside specific Microsoft products like Copilot Daily and certain Labs features. And the MAI-1-Preview is available to public testers via LMArena and a small set of Copilot text features.

Speaking about Microsoft's plans for the future in terms of model development, the CEO of Microsoft's AI unit, Mustafa Suleyman, had this to say: “We have big ambitions for where we go next — model advancements, an exciting roadmap of compute, and the chance to reach billions of people through Microsoft’s products.”

On the other hand, OpenAI is also not just being a mute spectator, as it is reducing its own dependence on Microsoft by forming alliances with rivals such as Google (GOOG) (GOOGL) and Apple (AAPL).

However, amid all these changing scenarios and forming and breaking partnerships in the fast-changing world of AI, should Microsoft remain an investor's favorite? I reckon so, and here's why.

Superb Quarterly Results (Again)

Microsoft's results for the most recent quarter were marked by a beat on both the revenue and earnings fronts. This marked the ninth consecutive quarter of earnings beat from the company. This is no mean feat, and due to the regular nature of its occurrence for Microsoft, it is perhaps an aspect of the company that is a bit underappreciated.

Microsoft's revenues for the fiscal Q4 2025 quarter stood at $76.4 billion, up 18% from the previous year, as all the segments witnessed growth. Unsurprisingly, the cloud segment saw the highest year-over-year (YoY) growth at 25.6% to come in at $29.9 billion, with Azure clocking an even sharper growth rate of 39%. Meanwhile, earnings surged by 23.7% yearly to $3.65 per share, comfortably outpacing the consensus estimate of $3.38 per share. Notably, this marked the fourth straight quarter of double-digit YoY earnings growth from the company. Operating margins improved as well to 44.9% from 43.1% in the year-ago period, a testament to its competitive strength.

Growth in revenue and earnings was accompanied by an increase in net cash from operations to $42.6 billion, compared to $37.2 billion in the year-ago period, as the company closed the quarter with a mammoth cash balance of $94.6 billion, with no short-term debt on the company's books.

Thus, analysts are also predicting Microsoft to report industry-beating growth in revenue and earnings, with the forward revenue and earnings growth rates forecasted to be 14.72% and 15.45%, higher than the sector medians of 7.47% and 10.91%, respectively.

This opens up room for further upside of the MSFT stock, which is already up 19.5% on a YTD basis. Notably, Microsoft, with a market cap of about $3.8 trillion, is currently the second most valuable company in the world in terms of market cap.

Cloud, AI, and Beyond

As highlighted in my last piece for Microsoft, the Redmond, WA-based company is not solely dependent on the AI revolution (as powerful as it is) for its upward trajectory. There is much more to stay excited about with Microsoft. Azure remains the cornerstone of Microsoft’s growth story. It delivers a broad spectrum of capabilities, from computing power and data storage to networking, analytics, and artificial intelligence. In recent years, the company has expanded this platform with Azure AI Foundry, a framework built to help customers create, refine, and operate AI-based applications and agents at scale.

Microsoft has also positioned itself among the earliest movers in large-scale AI infrastructure. It is building gigawatt-class data centers equipped with liquid cooling, a technology designed to handle the immense energy and processing demands of advanced AI. This push is reinforced by its position as a full-stack AI provider, giving it the advantage of controlling both the infrastructure and the software layers. Its main large language models, developed in partnership with OpenAI under the GPT family, are continually upgraded to deliver better performance and more sophisticated capabilities.

Beyond cloud infrastructure, the company is capturing strong adoption with Copilot and GitHub. Copilot alone sees around 100 million active users every month, while its wider features reach over 800 million people. By embedding it directly into productivity tools such as Word, Excel, Outlook, Teams, and Windows, Microsoft is steadily reinforcing its position in the AI interface space—where everyday user interaction meets intelligent assistance.

GitHub, which it owns, is already the world’s largest collaborative coding environment, hosting over 500 million open-source projects and engaging more than 100 million developers. The introduction of GitHub Copilot is accelerating its evolution into a development platform built with AI at its core. Acting as a programming assistant, it can produce routine code quickly while also helping developers structure complex solutions more efficiently.

Lastly, the company is not limiting its innovation to conventional cloud computing. On Nov. 19, 2024, it announced a partnership with Atom Computing to bring the Azure Quantum compute platform to market. This was followed by a breakthrough in July 2025, when Microsoft successfully achieved the first operational deployment of a Level 2 quantum computer, an important step toward making quantum computing a viable commercial reality.

Analyst Opinion on MSFT Stock

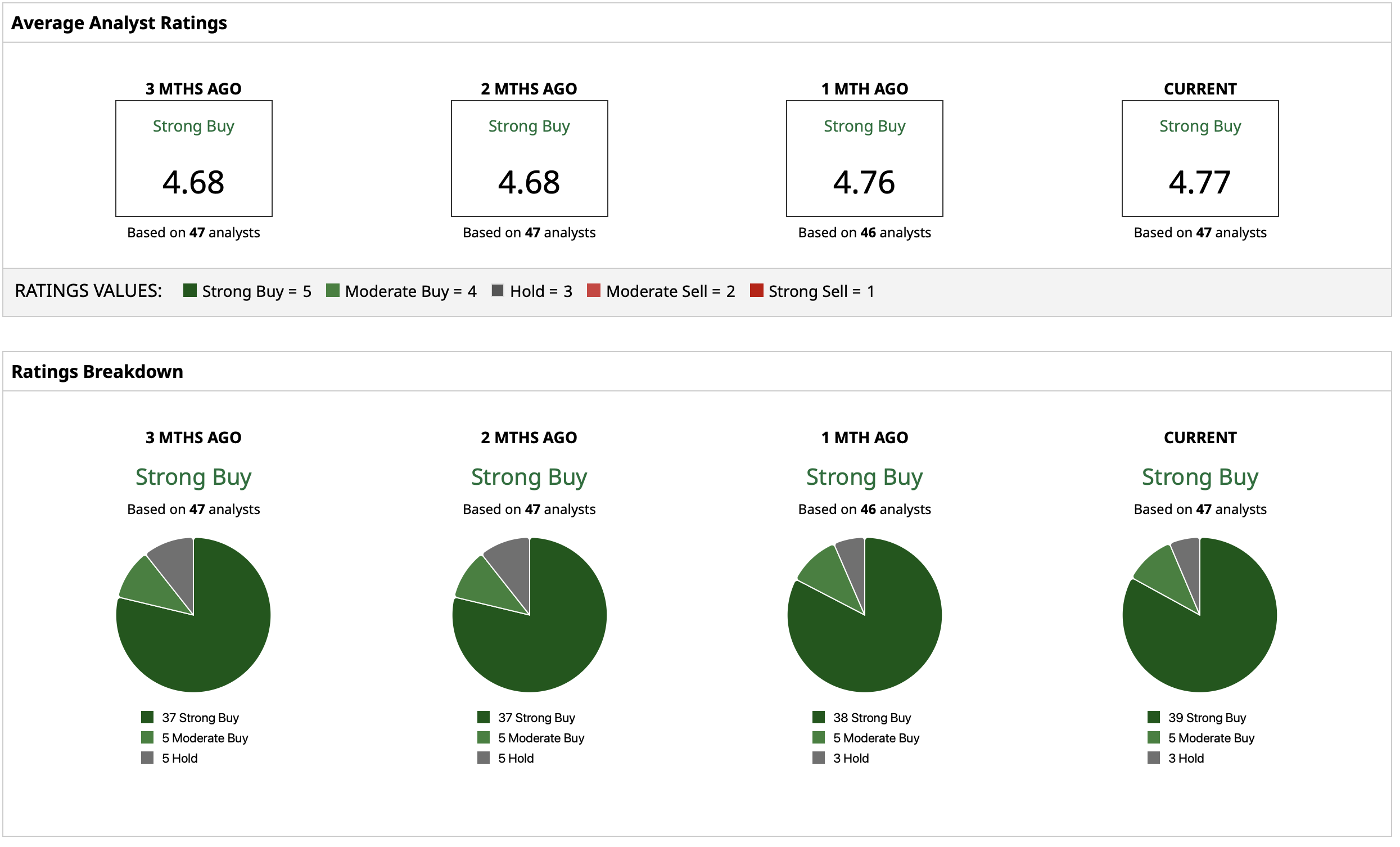

Thus, analysts have deemed the MSFT stock to be a “Strong Buy,” with a mean target price of $622.85. This indicates an upside potential of about 23% from current levels. Out of 47 analysts covering the stock, 39 have a “Strong Buy” rating, five have a “Moderate Buy” rating, and three have a “Hold” rating.