Lithium Americas (LAC) stock almost doubled on Wednesday after news broke that the Trump administration is pursuing an equity stake in the Canadian mining company. LAC stock rose by 95% to $6.01, hitting session highs above $6.23 as investors digested the potential government partnership. Today's session is seeing LAC stock once again hit new highs at around $7 with a year-to-date (YTD) gain of over 140%.

The proposed equity investment comes as Lithium Americas renegotiates the terms of a $2.2 billion Department of Energy loan for its Nevada-based Thacker Pass project, which is expected to become one of North America's largest lithium sources by late 2027.

This deal is the latest move by the Trump administration to secure direct ownership in critical mineral supply chains. Earlier this year, the U.S. government acquired a 15% stake in rare earth miner MP Materials (MP), which has seen a 410% YTD increase in its stock price.

The government wants to invest in the mining company because lithium is critical for manufacturing electric car batteries. Moreover, LAC is also working with General Motors (GM) on its flagship mining project.

Is LAC Stock a Good Buy Right Now?

Lithium Americas presents a compelling investment opportunity as one of the few pure-play lithium developers globally. Its Thacker Pass project is among the world’s largest known lithium reserves, which positions the miner as a critical component of America's domestic battery supply chain strategy. Construction momentum at Thacker Pass continues to accelerate, with over 300 workers currently on-site, and this number is expected to increase to 1,000 by year-end.

The project maintains its late 2027 production timeline, supported by 70% completed detailed engineering and advancing steel installation. This execution de-risks schedule and cost concerns that plague large-scale mining developments.

Lithium Americas ended Q2 of 2025 with more than $500 million in cash. However, according to estimates, its free cash outflow is expected to total $2.5 billion between 2025 and 2028. This means the mining company will have to raise additional capital, potentially resulting in shareholder dilution.

The miner’s strategic partnerships include a $2.26 billion Department of Energy loan at favorable rates and a $945 million investment from General Motors for a 38% joint venture stake, with guaranteed offtake agreements.

The broader market dynamics strongly favor lithium demand, with the U.S. battery market expected to grow fivefold from its current size of $16.9 billion. Government support through the DOE loan and a potential equity stake underscores the strategic importance of national energy security. However, investors should consider the execution risks inherent in large construction projects and potential volatility in lithium prices.

What Is the Target Price for LAC Stock?

While Lithium Americas is currently pre-revenue, it is forecast to increase sales from $95.8 million in 2027 to $500 million in 2027. It is forecast to report a positive free cash flow of $22 million in 2029.

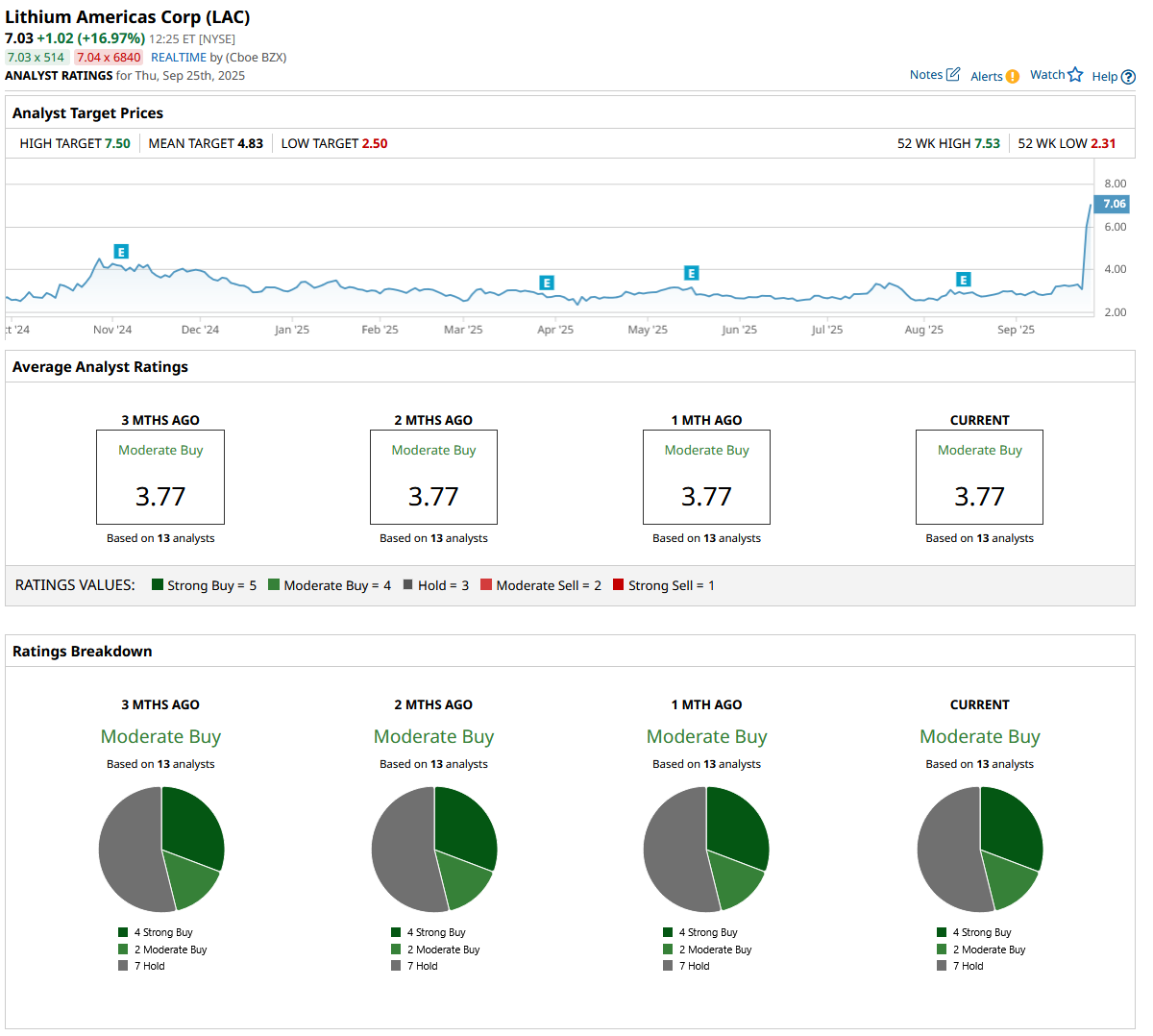

Out of the 13 analysts covering LAC stock, four recommend “Strong Buy,” two recommend “Moderate Buy,” and seven recommend “Hold.” The average LAC stock price target is $4.83, which is well below the current trading price of $7.

The recent stock surge following the Trump administration’s announcement of its equity stake may have reduced the immediate upside, but long-term fundamentals remain attractive for investors seeking exposure to America's lithium supply chain independence. The combination of world-class resources, strong partnerships, and government backing creates a differentiated investment thesis in the critical minerals space.