/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

IonQ (IONQ), a prominent name in the quantum computing and networking industries, launched IonQ Federal on Sept. 10, a new division focused on leveraging its quantum computing and networking technologies to support U.S. government agencies and allied partners. Robert Cardillo will lead the unit as Executive Chairman of IonQ Federal, overseeing strategic operations and partnerships to expand the adoption of IonQ’s solutions in critical federal programs.

This move builds on some large existing government contracts — with IonQ seeing over $100 million with the U.S. Air Force Research Lab, DARPA, and others — and aims to better integrate and scale those efforts under a unified organization. The federal unit may unlock more predictable revenue streams, and if IonQ Federal can successfully land more contracts, that could help stabilize the business.

So, is now the right time to scoop up IONQ stock?

About IonQ Stock

IonQ is a quantum computing hardware and software company founded in 2015. Headquartered in College Park, Maryland, IonQ specializes in trapped-ion quantum computers, along with cloud software, quantum networking, and quantum cryptography tools. IonQ’s market capitalization is around $16.5 billion.

IonQ has been on a volatile but largely upward trajectory over the past year. Over the past 52 weeks, shares have delivered astounding returns of 654%, riding on investor excitement around quantum computing, government engagement, and strategic acquisitions. IONQ stock is down 1% from the recent high of $56.07 reached on Sept. 12, with overall YTD gains of 33%.

IONQ stock is currently trading at a lofty valuation compared to the sector median at 324 times forward sales.

Top-Line Growth Isn’t Translating Into the Bottom Line

IonQ’s second quarter of 2025, reported on Aug. 6, demonstrated strong top-line momentum. Revenue came in at $20.7 million, up 82% year-over-year (YOY), beating the consensus estimate. The company beat the high end of guidance for Q2 revenue by 15%.

However, the profitability picture remained weak, with a loss per share of $0.70, far worse than both analysts’ expectations and Q2 2024’s loss per share of $0.18. Operating expenses surged — especially R&D, which more than tripled — contributing to a net loss of $177.5 million, a sharp increase from about $37.6 million a year earlier.

On the positive side, cash, cash equivalents, and investments stood at $656.8 million as of June 30. After a $1 billion equity financing, pro forma cash rose to $1.6 billion as of July 9.

Furthermore, management raised its full-year revenue guidance to between $82 million and $100 million, up from its prior range, and projected Q3 2025 revenue of $25 million to $29 million. Despite the revenue upside, the widening losses and steep expenses dampened investor enthusiasm.

Analysts anticipate loss per share to improve 38% YOY to $0.97 in fiscal 2025, but then widen by 29% to a loss of $1.25 in fiscal 2026.

What Do Analysts Expect for IonQ Stock?

On Aug. 27, B. Riley initiated coverage on IonQ stock with a “Buy” rating and a $61 price target, citing its leadership in quantum computing revenue growth, with potential to exceed $1 billion in revenue by 2030. Analyst Craig Ellis highlighted IonQ’s strong $1.6 billion pro forma cash balance, robust product pipeline, and large addressable markets of $10 billion to $15 billion over five years and $28 billion to $86 billion over 10 years.

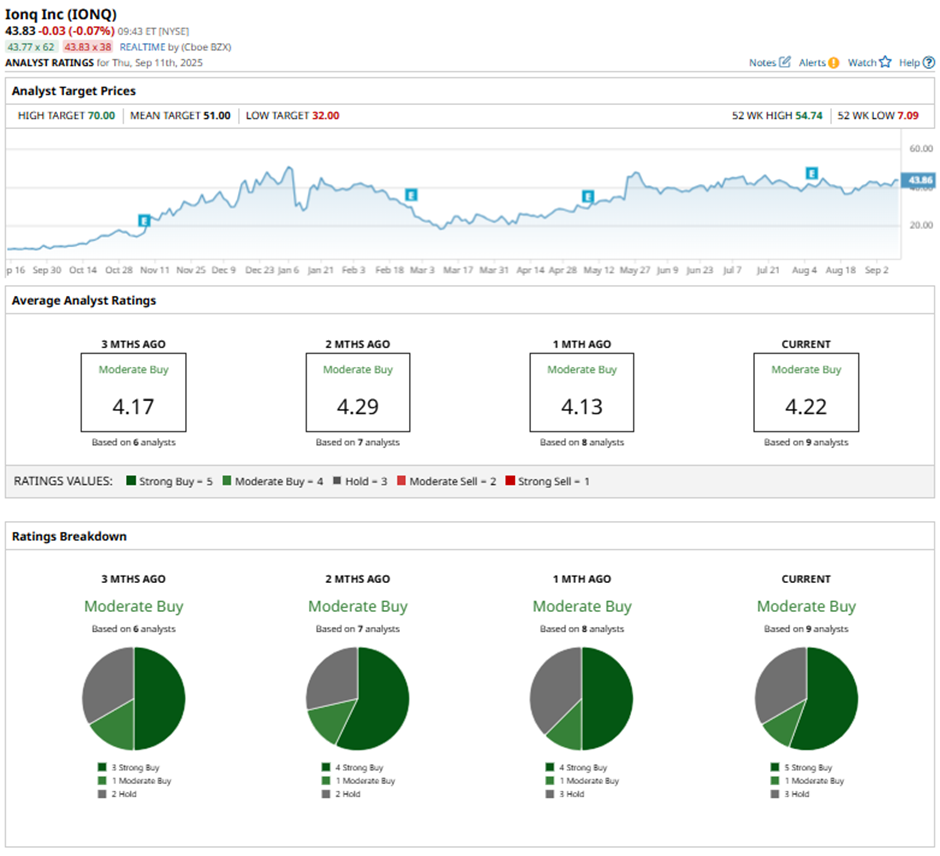

IONQ stock has a consensus “Moderate Buy” rating overall. Out of 9 analysts covering the quantum computing stock, five recommend a “Strong Buy,” one suggests a “Moderate Buy,” and three analysts stay cautious with a “Hold” rating.

IONQ stock’s average analyst price target of $51 represents downside from current levels. However, the Street-high target price of $70 suggests 26% potential upside ahead.