Disney (DIS) stock is down just over 1% this year and is underperforming the market by a wide margin. While the stock eked out a 23% gain in 2024, which was in line with the S&P 500 Index ($SPX), it underperformed the broader market in the previous three years.

The underperformance has been frustrating, to say the least, especially as there has been a marked turnaround at the company since Bob Iger returned as CEO in November 2022 and embarked on a transformation plan. The turnaround is evident in the company’s streaming business, which posted an operating profit of $346 million in the most recent quarter. For context, that segment posted an operating loss of almost $1.5 billion in fiscal Q4 2022, which was the last full quarter under former CEO Bob Chapek. However, despite the streaming turnaround, Disney has failed to win over Wall Street, and the stock has continued its underperformance.

Why Is Disney Stock Falling?

Disney is battling several issues, including low tourist arrivals in the U.S. as President Donald Trump’s immigration policies have deterred many would-be theme park attendees. On the domestic front, while Disney has tried to allay fears about the health of the U.S. consumer, markets are concerned about a slowdown in spending, which could take a toll on traffic at the company’s theme parks. Then there are lingering concerns over Disney’s linear TV business, which continues to be in a structural decline.

The company has also ruffled feathers on both sides of the political divide, leading to calls for boycotts.

DIS Stock Forecast

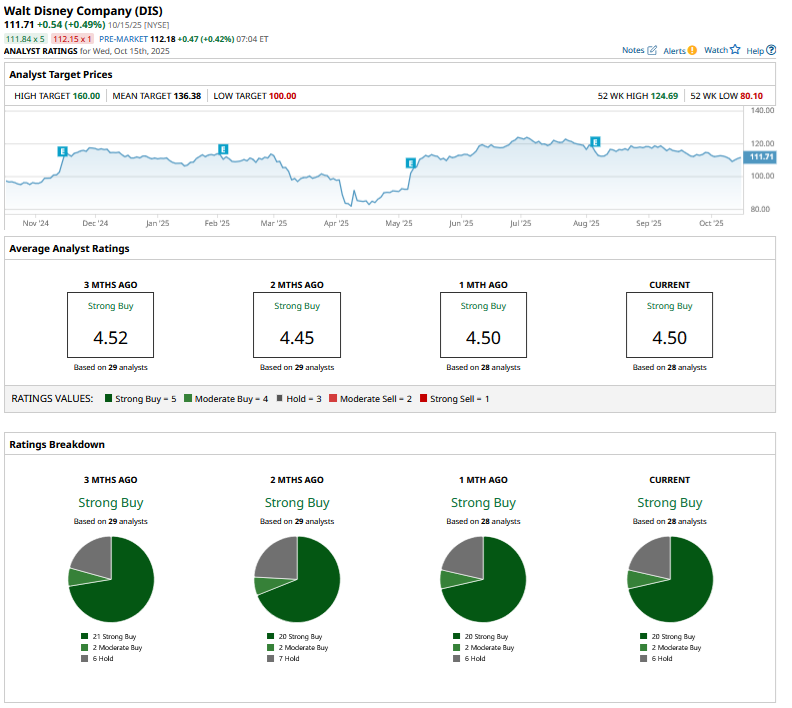

Sell-side analysts are meanwhile quite upbeat on Disney, and it has a consensus rating of “Strong Buy” from the 28 analysts polled by Barchart. The stock’s mean target price is $136.38, which is over 22% higher than the Oct. 15 closing price.

Should You Buy Disney Stock?

I find Disney stock a buy for the following reasons:

Streaming Business Continues to Do Well: While Disney’s streaming business has turned profitable, its margins are still on the lower side, and the company expects to eventually post double-digit margins like Netflix’s (NFLX). While that target might seem a bit lofty given where things stand today, there is a lot of room for Disney to improve that segment’s margins, especially as it scales up ad sales on the ad-supported tier. It is also increasing the prices for its streaming service, effective Oct. 21, which should further bolster that segment’s profitability.

Sports Business: Sports have been a focus area for Disney, and it launched the long-awaited direct-to-consumer (DTC) service for ESPN in August for $29.99 per month. The management expects the launch will be accretive to its earnings in the first year after the close of the transaction, despite paying a dividend to the NFL for the 10% stake it took in ESPN.

Expansion of Parks: Disney’s Parks are a key driver of its profitability, and in 2023, the company announced an investment of $60 billion spread over 10 years to revamp its parks. Disney is also expanding its parks, and earlier this year, it announced that it would set up its next theme park in Abu Dhabi in collaboration with Miral Group, which will provide capital for the project. The company estimates that 500 million potential customers live within short flying and driving distance from the region, which it described as the “crossroads of the world.” That park could be a key driver for Disney’s earnings in the long term, given the massive potential that region holds.

While Disney has tested my patience, I won’t give up on the company yet, as it has executed well. The importance of Disney’s recent box office success cannot be understated and goes way beyond the box office contributions to its earnings. In-house, quality movies are the literal flywheel for Disney and add to its streaming slate, making the offering even more valuable for subscribers. These also increase Disney’s connection with its customer base, which eventually translates to higher traffic at its theme parks.

To sum it up, at a forward price-earnings (P/E) multiple of just over 17x, Disney looks quite attractive, especially given where the broader market valuations stand, and I am looking to add more shares to my current positions.