/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

In the rapidly evolving artificial intelligence (AI) infrastructure space, breakthroughs in model training and deployment can translate almost overnight into valuation shifts. On Oct. 8, CoreWeave (CRWV) dropped a major announcement, driving an 8.7% surge in shares with the launch of Serverless RL, a fully managed, autoscaling reinforcement-learning platform that promises to lower the barrier to entry for AI agents. Launched shortly after CoreWeave’s acquisition of OpenPipe, Serverless RL integrates RL tools with the Weights & Biases platform, leveraging CoreWeave’s AI cloud.

The move is bold, especially given the inherent complexities in RL training, variable workloads, straggler effects, and cost inefficiencies. CoreWeave claims the new service offers 1.4 times faster training and 40% lower costs versus local H100 GPU setups. If true, that could be a game changer.

So, does Serverless RL make CRWV stock a buy now? Or is this just another feather in the cap of an already hyped stock? Let’s dig deeper.

About CoreWeave Stock

Based in Livingston, New Jersey, CoreWeave was founded in 2017 and has transformed from its roots in cryptocurrency mining into a top-tier provider of GPU-optimized cloud infrastructure for AI training and inference. With a current market capitalization of about $66.9 billion, the company continues to expand its presence in the rapidly growing AI infrastructure market.

Since going public in March 2025, CRWV stock has garnered intense investor interest, propelled by surging AI demand and high-profile partnerships with industry giants like OpenAI, Microsoft (MSFT), and Nvidia (NVDA). Shares of the company debuted at $40 and soared to a peak of $187 on June 20 amid investor enthusiasm for AI-related plays. However, the rally has since cooled, with CRWV stock closing at $127.06 on Oct. 20.

Nevertheless, over the past month, CRWV is up 2% amid renewed enthusiasm. Recent momentum appears to be driven by a confluence of positive catalysts in the AI infrastructure space.

CoreWeave has secured several marquee contracts that bolster its revenue visibility — most notably, a $14.2 billion deal with Meta Platforms (META) through 2031, which expands its client base beyond Microsoft and OpenAI. In September, CoreWeave also struck a $6.3 billion capacity-purchase agreement with Nvidia, which pledges to purchase any unused compute capacity through 2032, providing a demand backstop and reducing downside risk. Additionally, the firm expanded its existing relationship with OpenAI in September via an up-to-$6.5 billion agreement, reinforcing its role as a critical backend for AI model training. Finally, on the product front, the launch of Serverless RL — which promises faster training and cost efficiency — is grabbing investor attention as a differentiating technological wedge.

All of these developments feed into bullish sentiment, and many investors are treating CRWV stock as a high-upside play in AI infrastructure.

The stock currently trades at 17.59 times forward sales, which is a premium compared to its peers.

CoreWeave's Strong Revenue Growth

CoreWeave reported its second-quarter 2025 earnings on Aug. 12, showcasing strong growth momentum amid booming AI demand. Revenue surged 207% year-over-year (YOY) to $1.2 billion, surpassing expectations, while the company’s backlog expanded to $30.1 billion as of June 30.

However, profitability remains under strain, although the firm demonstrated some improvement with a net loss of $290.5 million, or $0.60 per share. That marked an improvement from the $323 million net loss, or $1.62 per-share loss, in the prior-year period. On an adjusted basis, however, net loss widened sharply to $130.8 million from just $5.1 million in the prior year.

Adjusted EBITDA also rose to $753.2 million with a 62% margin, while adjusted operating income reached $199.8 million with a 16% margin.

Confident in the company's trajectory, management raised its full-year revenue guidance to between $5.15 billion and $5.35 billion. Management also projected for Q3 revenue of $1.26 billion to $1.3 billion.

Still, analysts anticipate losses to deepen in fiscal 2025, with loss per share expected to rise 100% YOY to $2.68, before improving 53% to $1.26 in fiscal 2026.

What Do Analysts Expect for CoreWeave Stock?

Earlier this month, Evercore ISI reaffirmed its “Outperform” rating on CoreWeave with a $175 price target, highlighting confidence in the company’s leadership in GPU cloud infrastructure. Its focus on high-performance computing and GPU workloads, rather than general-purpose cloud, has enabled partnerships with Nvidia and contracts with AI-focused startups. This specialization positions CoreWeave to capitalize on the surging demand for AI training, simulation, and rendering.

Evercore’s optimism also reflects the company’s ability to maintain strong revenue growth, retain a sticky customer base, and operate efficiently despite the capital-intensive nature of the GPU rental market.

Last month, Wells Fargo also upgraded CoreWeave from “Equal Weight” to “Overweight,” and raised its price target to $170 from $105. Wells Fargo pointed to robust AI-driven demand and ongoing supply constraints in the industry. The firm also increased its fiscal 2026 and fiscal 2027 revenue projections, emphasizing CoreWeave’s expanding partnerships with companies like Microsoft, continued hyperscaler capacity limitations, and Nvidia’s commitment to purchase any unused capacity through 2032.

However, some analysts are still on the sidelines. In September, Barclays reiterated an “Equalweight” rating and $140 price target on CRWV stock.

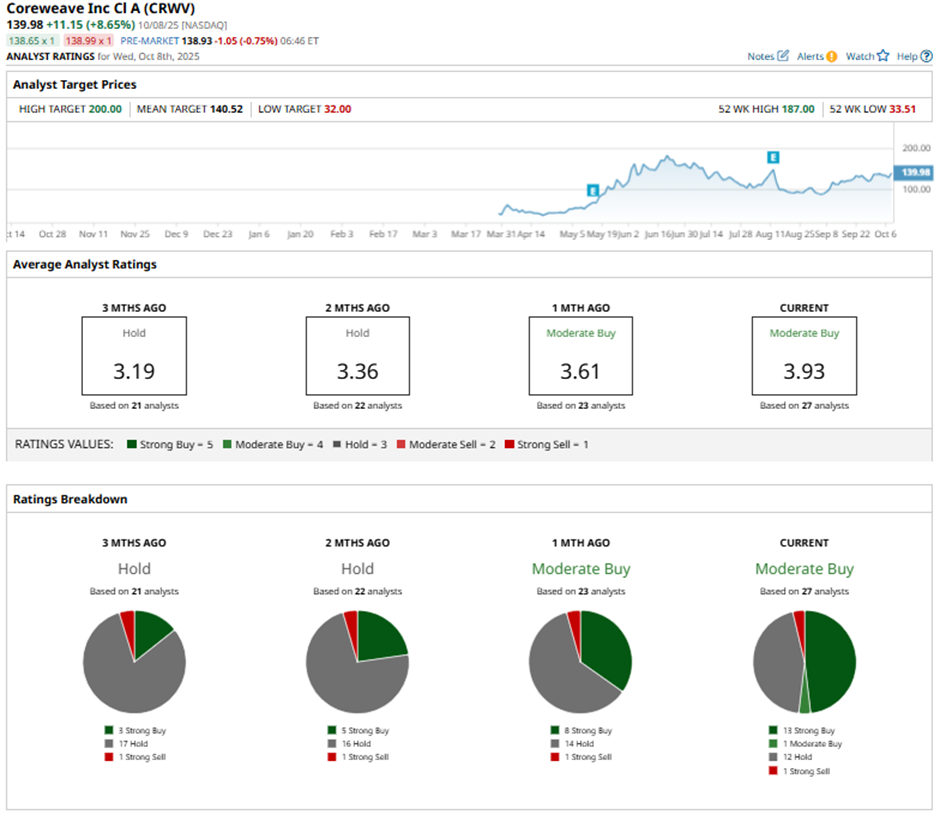

CoreWeave has a consensus “Moderate Buy” rating overall. Out of 27 analysts covering the stock, 13 recommend a “Strong Buy,” one gives a “Moderate Buy,” 12 analysts stay cautious with a “Hold” rating, and one has a “Strong Sell” rating.

CRWV stock’s average analyst price target of $140.52 indicates 11% potential upside from current levels. Meanwhile, the Street-high target price of $200 suggests 57% potential upside ahead.