/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) just unveiled CoreWeave Ventures, a venture capital arm fueling artificial intelligence (AI) innovation with funding. The cloud infrastructure firm, known for its Nvidia (NVDA) GPU-powered services for AI workloads, aims to provide capital, access to its cloud platform, and go-to-market support. It already has nine portfolio companies and plans to expand further. The announcement sparked immediate market enthusiasm, driving CRWV stock up 7% in intraday trading on Sept. 9.

Meanwhile, Brannin McBee — CoreWeave’s co-founder and Chief Development Officer — stated that the aim of CoreWeave Ventures is to provide “audacious, like-minded founders” with the support needed to “drive technical advancements and bring to market the next class of innovation.” So, amid all the hype, is CoreWeave stock a buy, sell, or hold right now?

About CoreWeave Stock

Based in Livingston, New Jersey, CoreWeave was founded in 2017 and has transformed from its roots in cryptocurrency mining into a major player in GPU-optimized cloud services for AI training and inference. With a current market capitalization of $57 billion, the company’s influence in the sector continues to expand.

Since going public in March 2025, CRWV stock has drawn strong investor interest, fueled by surging AI demand and high-profile partnerships with industry giants like OpenAI, Microsoft (MSFT) and Nvidia.

However, CRWV stock has seen significant volatility since its debut. After going public at $40 per share, the stock surged to a peak of $187 on June 20 as retail investors sought AI alternatives beyond Nvidia. However, shares have since retreated. The stock has declined 25% over the past three months and 19% over the past month, driven by investors’ concerns over quarterly losses and the expiration of its IPO lock-up.

CRWV stock currently trades at 15.6 times forward sales, which is a premium compared to its peers.

CoreWeave's Mixed Q2 Results

CoreWeave reported its second-quarter 2025 earnings on Aug. 12, showcasing strong execution amid booming AI demand. Revenue surged 207% year-over-year (YOY) to $1.2 billion, surpassing expectations, while its backlog reached $30.1 billion as of June 30, 2025.

However, rising costs weighed heavily on profitability, with the company posting a net loss of $290.5 million, or $0.60 per share, compared to a loss of $323 million, or $1.62 per share, in the same period last year. Adjusted net loss widened to $130.8 million, up sharply from $5.1 million a year ago.

On the positive side, adjusted EBITDA climbed to $753.2 million with a 62% margin, and adjusted operating income improved to $199.8 million with a 16% margin.

Confident in ongoing demand, management raised its full-year revenue outlook to $5.15 billion to $5.35 billion and guided for Q3 revenue of $1.26 billion to $1.30 billion. Still, despite robust topline growth and upbeat forecasts, shares fell as investors focused on the company’s mounting losses.

Analysts anticipate loss per share to increase 100% YOY to $2.52 in fiscal 2025, before improving by 45% to reach a loss of $1.38 in fiscal 2026.

What Do Analysts Expect for CoreWeave Stock?

On Aug. 27, Cantor Fitzgerald initiated coverage on CoreWeave with an “Overweight” rating and a $116 price target, citing strong AI market opportunities in LLM training and inference despite execution risks. H.C. Wainwright also recently upgraded CoreWeave to a “Buy” rating from “Neutral” with a $180 price target, calling it a leader in the neocloud space. The firm attributed recent stock weakness to lockup-related selling rather than fundamentals and highlighted the company’s raised 2025 revenue guidance.

However, on the other hand, MoffettNathanson maintained a “Neutral” rating while raising its price target to $65 from $56. The firm remains cautious, citing competitive pressures that could limit returns.

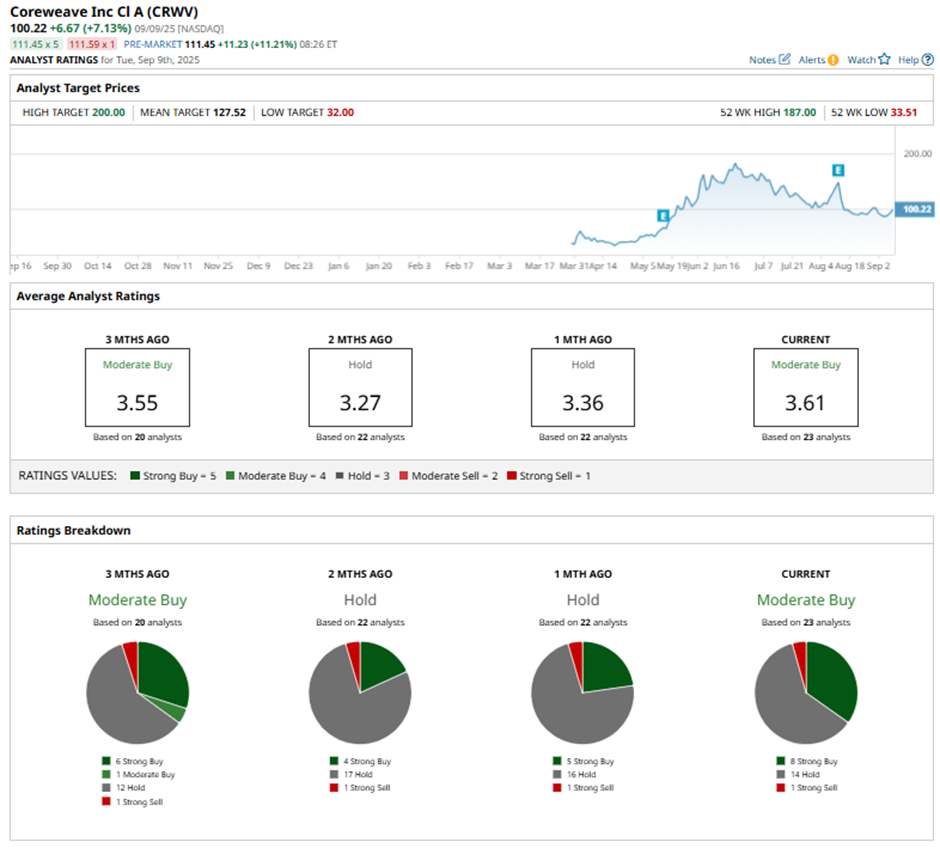

CoreWeave stock has a consensus “Moderate Buy" rating overall. Out of 23 analysts covering the tech stock, eight recommend a “Strong Buy,” 14 analysts stay cautious with a “Hold” rating, and one has a “Strong Sell” rating.

CRWV stock's average analyst price target of $127.52 indicates potential upside of 13% from current levels. Nevertheless, the Street-high target price of $200 suggests 77% potential upside ahead.