/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

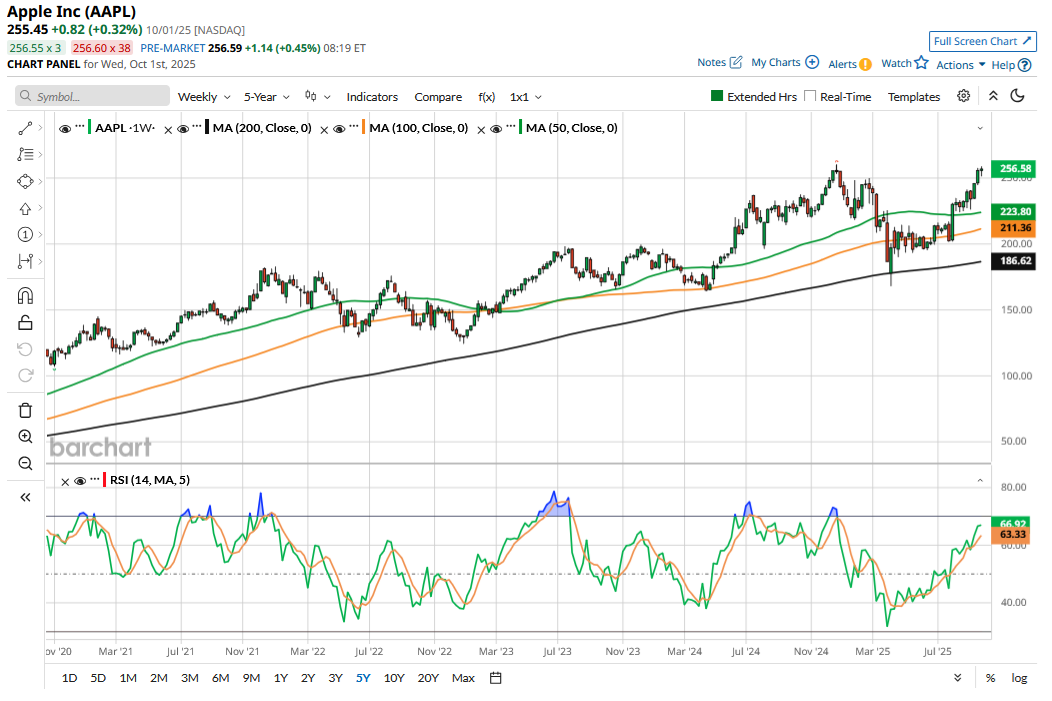

Thanks to the recent gains, Apple (AAPL) stock has turned positive for the year, and while the 2% return is not something that the iPhone maker would want to brag about, it is nonetheless a turnaround of sorts, as the stock was in the red for the most part this year, in part because of what many see as a laid-back and unimpressive artificial intelligence (AI) strategy.

Notably, Apple, which was the first-ever U.S. company to have a market cap of $1 trillion—and then $2 trillion, as well as $3 trillion—lost out in the race to reach a $4 trillion market cap, which was first scaled by Nvidia (NVDA) and then subsequently by Microsoft (MSFT).

Apple’s AI Strategy Has Failed to Impress

Apple generated a lot of enthusiasm for its Apple Intelligence features at last year’s Worldwide Developer Conference (WWDC), but when eventually released, these features were not exactly groundbreaking and, at best, incremental, lagging what other companies were offering.

The company failed to build upon its lead in digital assistants, and Siri’s updated version is running behind schedule. Markets gave a thumbs down to WWDC 2025 and then the “awe-dropping” iPhone 17 reveal event, which metaphorically turned into a “stock dropping event” for AAPL.

Apple’s AI initiatives have failed to impress, and there is a glaring “AI gap” with other tech companies. Many have called for CEO Tim Cook’s ouster amid concerns that Apple is losing out on the AI revolution under him.

Apple Is Stepping Up the Gas in AI

Meanwhile, even as Apple has long been highlighting the opportunity that AI brings to the company, it now seems to be putting words into action. During the most recent earnings call, Apple said that it has increased its capex towards AI and is “reallocating a fair number of people to focus on AI features within the company.” Amid rumors of it previously considering a bid for Perplexity, Cook said that Apple was open to acquisitions that can “accelerate” the company’s “road map.” He even touted the possibility of a major acquisition—something not very common for Apple—and said, “We are not stuck on a certain size.”

Apple Is Reportedly Doubling Down on Glasses

In the most recent instance of Apple fine-tuning its AI strategy, it has reportedly shelved plans to revamp its Vision Pro mixed-reality headset—a product that never really took off in the first place—to focus on smart glasses. The pivot would come at a time when the race for the next computing platform for the AI era looks open. While Meta Platforms (META) has taken the initial lead in glasses, Alphabet (GOOG) (GOOGL) is also developing its own glasses. OpenAI has also upped the ante by acquiring Jony Ive’s startup, io Products, for $6.5 billion. Ive was a former chief design officer at Apple, where he helped design the iPhone, and io Products is rumored to be developing a hardware platform to interact with AI, although official details are scarce.

Is AAPL Stock a Buy?

One of the reasons Apple is visibly running behind in AI is the company’s focus on privacy, which is atypical in a technology era that feeds on massive amounts of data. However, I believe it could be the company’s unique selling proposition (USP), as users who are concerned about AI companies snooping upon their data would find solace in the Apple ecosystem, which has user privacy as its core.

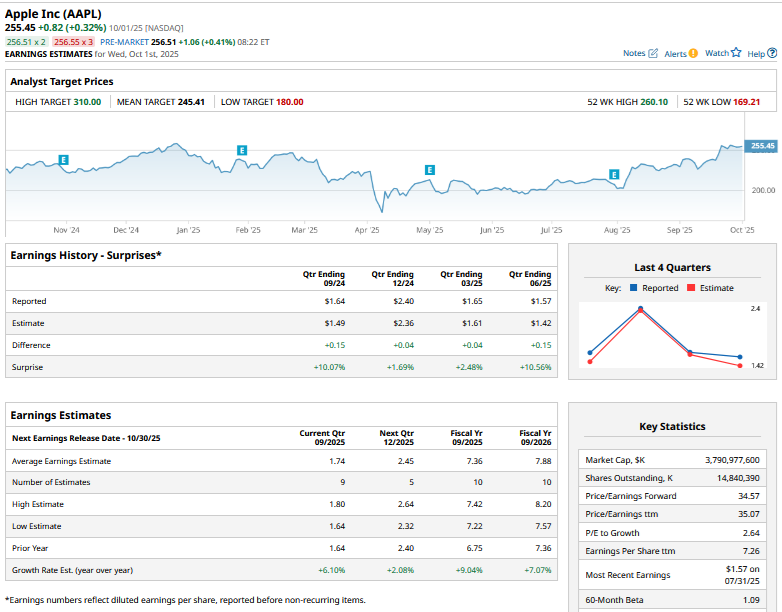

While Apple has been visibly fine-tuning its AI strategy, its valuations have been a lingering concern. AAPL stock trades at a forward price-to-earnings (P/E) multiple of 34.6x, which appears stretched, especially given the single-digit earnings growth that it is expected to generate in the current and next fiscal year.

That said, these estimates as well as sentiments could be up for a revival if iPhone 17 sales take off. Initial reports have been mixed, though. While previously some reports said that the demand for the Pro model is quite strong, in a recent note, Jefferies said that the momentum is fading, pointing to falling lead times. Importantly, the brokerage noted that the U.S. is the weakest market among the six markets that it tracks.

Overall, Apple has a lot to prove, and the company cannot afford to lose in AI. It remains a show-me story, and among others, I would watch out for comments on iPhone 17 sales during the company's upcoming earnings call. It would be the second handset with Apple Intelligence features, and a tepid response to the model would put a question mark over Apple's AI strategy.