Monster Beverage Corporation (MNST), headquartered in Corona, California, develops, markets, sells, and distributes energy drink beverages and concentrates. Valued at $79.5 billion by market cap, the company offers Monster Energy energy drinks, Monster Energy Ultra energy drinks, Java Monster non-carbonated coffee + energy drinks, and more.

Shares of this beverage company have notably outperformed the broader market over the past year. MNST has gained 65% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. In 2026, MNST stock is up 6.2%, surpassing the SPX’s 1.9% rise on a YTD basis.

Zooming in further, MNST’s outperformance looks more pronounced compared to the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has declined about 2.7% over the past year. However, the ETF’s 6.4% returns on a YTD basis outshine the stock’s gains over the same time frame.

MNST's outperformance is driven by global category growth, successful new product launches like Monster Energy Ultra, and effective pricing strategies. International markets, particularly EMEA, contributed significantly, with a record 43% of total net sales. The company's focus on zero sugar and female-focused energy drinks, plus viral marketing, is boosting margins and growth.

On Nov. 6, 2025, MNST shares closed down more than 2% after reporting its Q3 results. Its adjusted EPS of $0.56 exceeded Wall Street expectations of $0.48. The company’s revenue was $2.2 billion, exceeding Wall Street forecasts of $2.1 billion.

For the current fiscal year, ended in December, analysts expect MNST’s EPS to grow 22.8% to $1.99 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

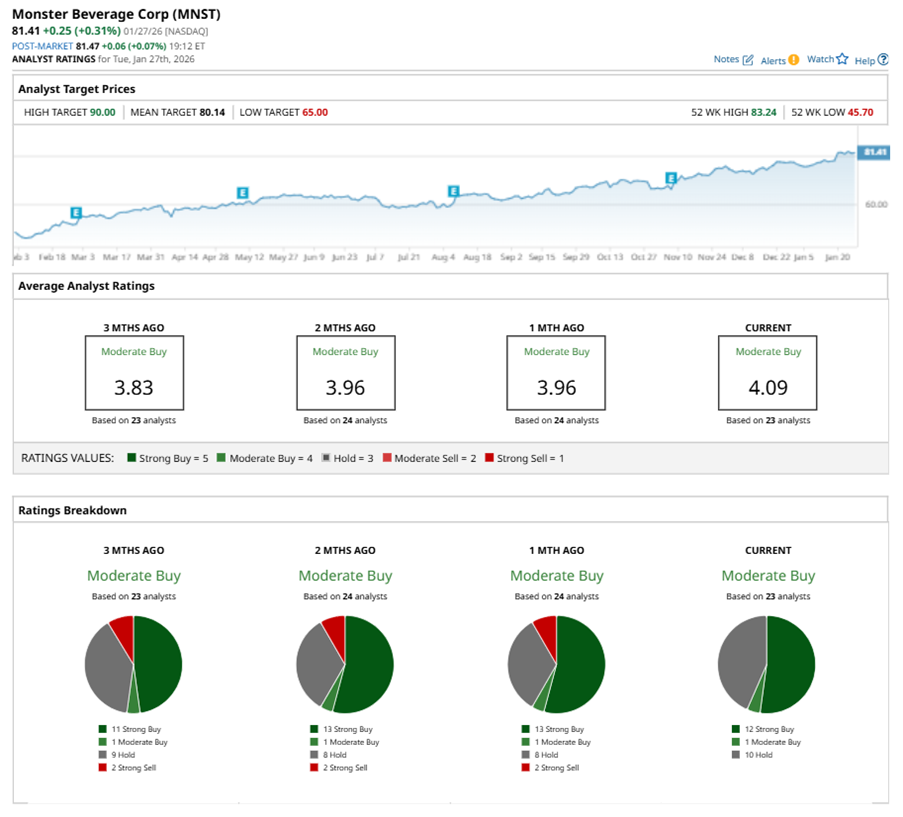

Among the 23 analysts covering MNST stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and 10 “Holds.”

This configuration is less bearish than a month ago, with 13 analysts suggesting a “Strong Buy,” and two recommending a “Strong Sell.”

On Jan. 26, Morgan Stanley (MS) kept an “Overweight rating” on MNST and raised the price target to $96, implying a potential upside of 17.9% from current levels.

While MNST currently trades above its mean price target of $80.14, the Street-high price target of $90 suggests an upside potential of 10.6%.