With a market cap of $42 billion, The Kroger Co. (KR) operates as one of the largest food and drug retailers in the United States. It runs a variety of store formats, including combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses, offering groceries, general merchandise, and fuel both in-store and online.

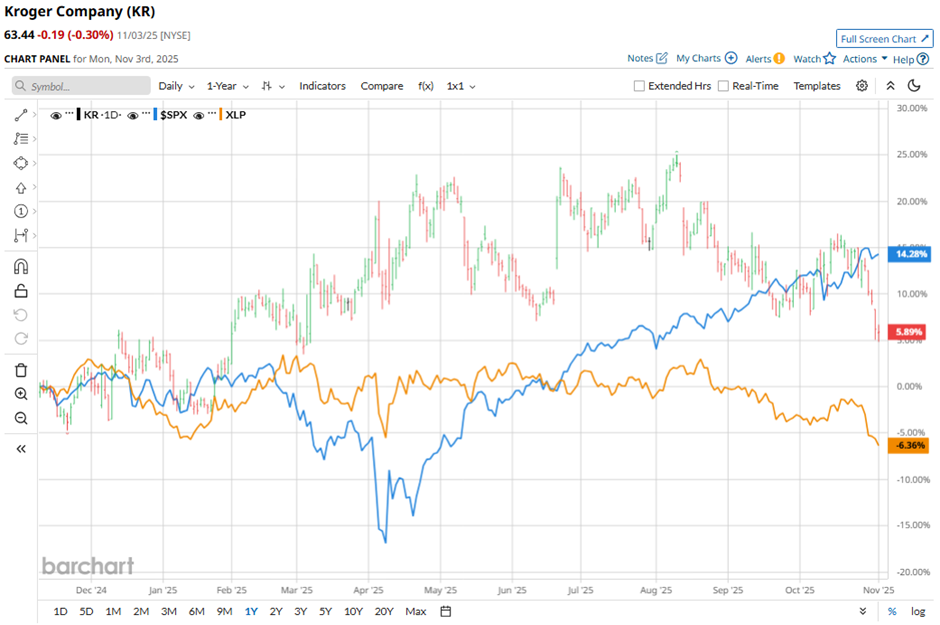

Shares of the Cincinnati, Ohio-based company have underperformed the broader market over the past 52 weeks. KR stock has risen 12.1% over this time frame, while the broader S&P 500 Index ($SPX) has increased 19.6%. In addition, shares of Kroger are up 3.7% on a YTD basis, compared to SPX’s 16.5% gain.

However, shares of the supermarket chain have outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.6% decline over the past 52 weeks and 3.7% drop on a YTD basis.

Despite reporting weaker-than-expected Q2 2025 revenue of $33.94 billion, Kroger’s shares recovered marginally on Sept. 11 because its adjusted EPS of $1.04 beat estimates. The company also raised its full-year sales forecast to 2.7% - 3.4% and lifted the lower end of its adjusted EPS outlook to $4.70 - $4.80. Confidence was further boosted by strong identical sales growth of 3.4%, driven by price cuts on over 3,500 products and higher demand for private-label items as Americans continued eating at home.

For the fiscal year ending in January 2026, analysts expect KR’s adjusted EPS to grow 7.2% year-over-year to $4.79. The company’s earnings surprise history is strong. It beat or met the consensus estimates in the last four quarters.

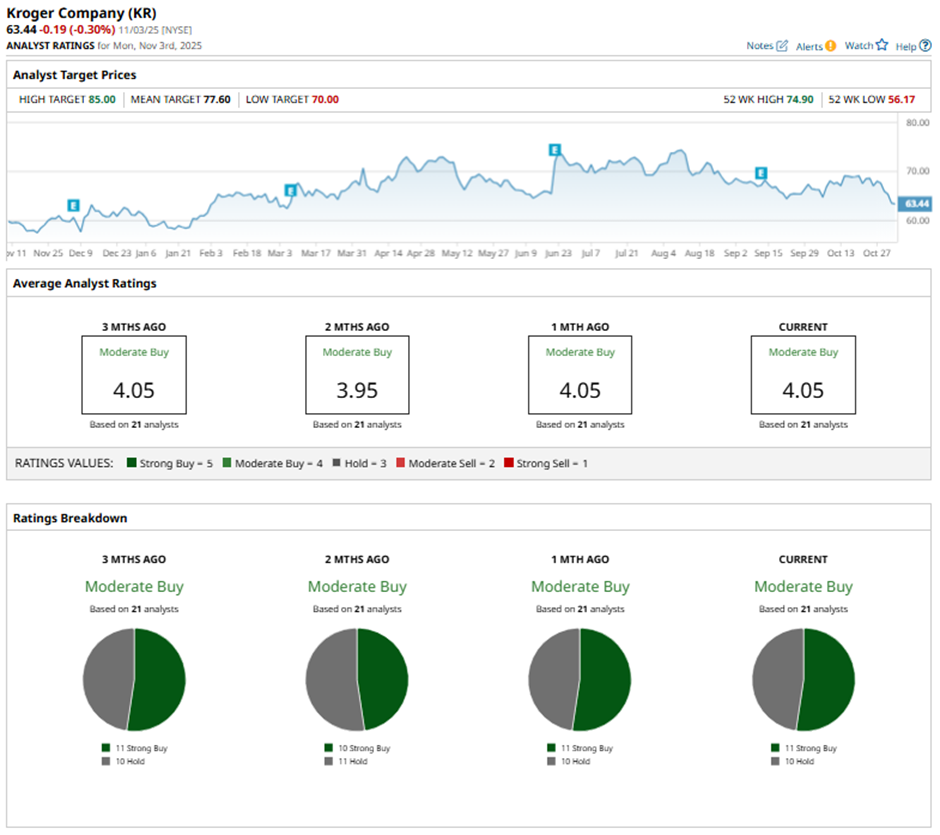

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings and 10 “Holds.”

On Sept.13, Guggenheim analyst John Heinbockel maintained a “Buy” rating on Kroger and set a price target of $78.

The mean price target of $77.60 represents a 22.3% premium to KR’s current price levels. The Street-high price target of $85 suggests a nearly 34% potential upside.