Valued at $21.3 billion by market cap, San Francisco-based Williams-Sonoma, Inc. (WSM) operates as a multi-channel specialty retailer of premium quality home products. The company offers various cooking, dining, home decor, and related products through its brands like Pottery Barn, West Elm, Rejuvenation, etc.

Williams-Sonoma has notably underperformed the broader market over the past year. WSM stock prices have declined 1.4% over the past 52 weeks and 6.8% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 10.5% gains over the past year and 11.2% returns in 2025.

Narrowing the focus, WSM has also underperformed the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) 3.1% uptick over the past 52 weeks and 1.4% dip in 2025.

Despite reporting better-than-expected results, Williams-Sonoma’s stock prices declined 3.4% in the trading session following the release of its Q3 results on Nov. 19. The company’s comparable brand revenues increased by a solid 4% year-over-year, leading to a 4.6% year-over-year growth in net revenues to $1.9 billion, surpassing the Street’s expectations by 1.5%. Meanwhile, its EPS inched up 4.8% year-over-year to $1.96, exceeding the consensus estimates of $1.87 by a notable margin.

For the full fiscal 2025, ending in December, analysts expect WSM to deliver earnings of $8.56 per share, down 2.6% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

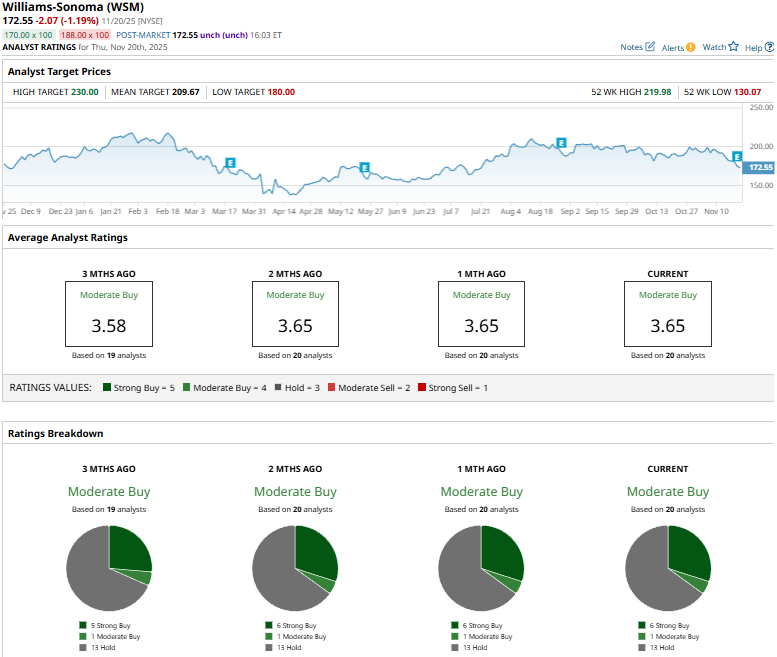

Among the 20 analysts covering the WSM stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buys,” one “Moderate Buy,” and 13 “Holds.”

This configuration is slightly more optimistic than three months ago, when five analysts gave “Strong Buy” ratings.

On Nov. 20, UBS (UBS) analyst Michael Lasser maintained a “Neutral” rating on WSM, but lowered the price target from $184 to $175.

WSM’s mean price target of $209.67 represents a 21.5% premium to current price levels. Meanwhile, the street-high target of $230 suggests a notable 33.3% upside potential.