Federal Realty Investment Trust (FRT), with a market cap of $8.3 billion, is a real estate company that owns, operates and redevelops high-quality retail-based properties located primarily in major coastal markets. The North Bethesda, Maryland-based company’s retail properties are anchored by supermarkets, drugstores, or high-volume, value-oriented retailers, which provide essential 1consumer necessities.

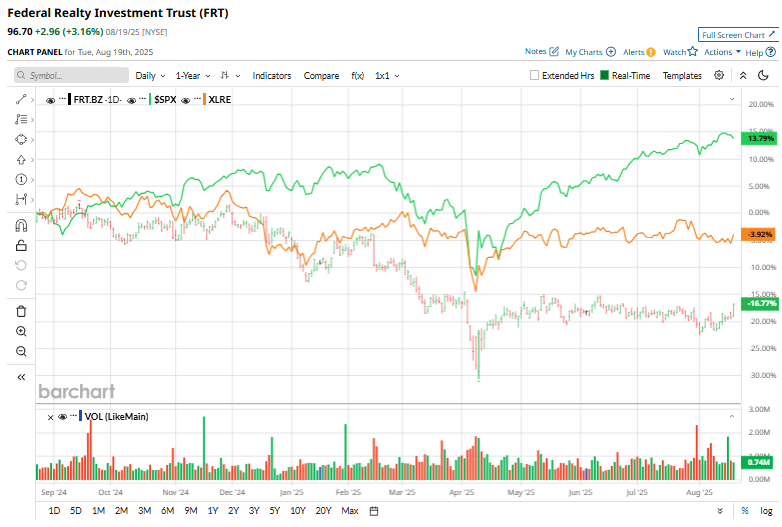

Shares of this retail REIT have underperformed the broader market over the past 52 weeks. FRT has declined 14.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. Moreover, on a YTD basis, the stock is down 13.6%, compared to SPX’s 9% rise.

Narrowing the focus, FRT has also lagged behind the Real Estate Select Sector SPDR Fund’s (XLRE) 1% uptick over the past 52 weeks and 2.5% return on a YTD basis.

On Aug. 6, Federal Realty reported Q2 results that topped Wall Street expectations. Its funds from operations stood at $165.5 million, or $1.91 per share, beating the consensus estimate of $1.73 per share. Net income was $153.9 million, or $1.78 per share, while revenue came in at $311.5 million, slightly above forecasts of $310.7 million. The company projects full-year funds from operations in the range of $7.16 to $7.26 per share. Shares of the company declined marginally post the announcement.

For the current fiscal year, ending in December, analysts expect FRT’s FFO to grow 5.9% year over year to $7.17 per share. The company’s FFO surprise history is mixed. It exceeded or met the consensus estimates in three of the last four quarters, while missing on another occasion.

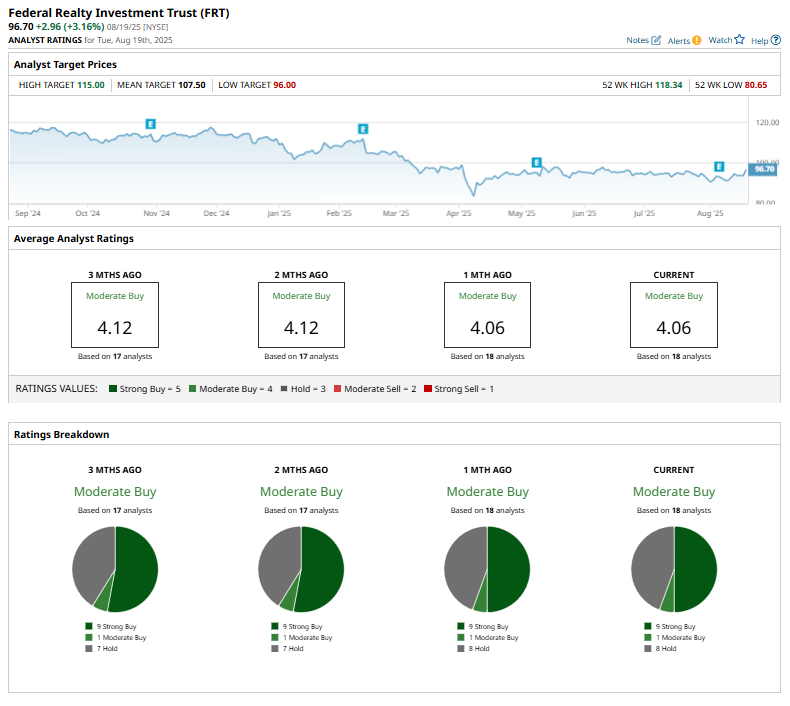

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on nine “Strong Buy,” one “Moderate Buy,” and eight “Hold” ratings.

This configuration has been consistent for the past months.

On Aug. 8, Evercore ISI analyst Steve Sakwa reaffirmed an “Outperform” rating on Federal Realty Investment while slightly lowering the price target from $109 to $107, a 1.8% reduction.

The mean price target of $107.50 represents an 11.2% premium from FRT’s current price levels, while the Street-high price target of $115 suggests an upside potential of 18.9%.