Consolidated Edison, Inc. (ED), headquartered in New York, engages in the regulated electric, gas, and steam delivery businesses. With a market cap of $37.6 billion, the company is committed to providing safe and reliable energy services to millions of customers across its service territories.

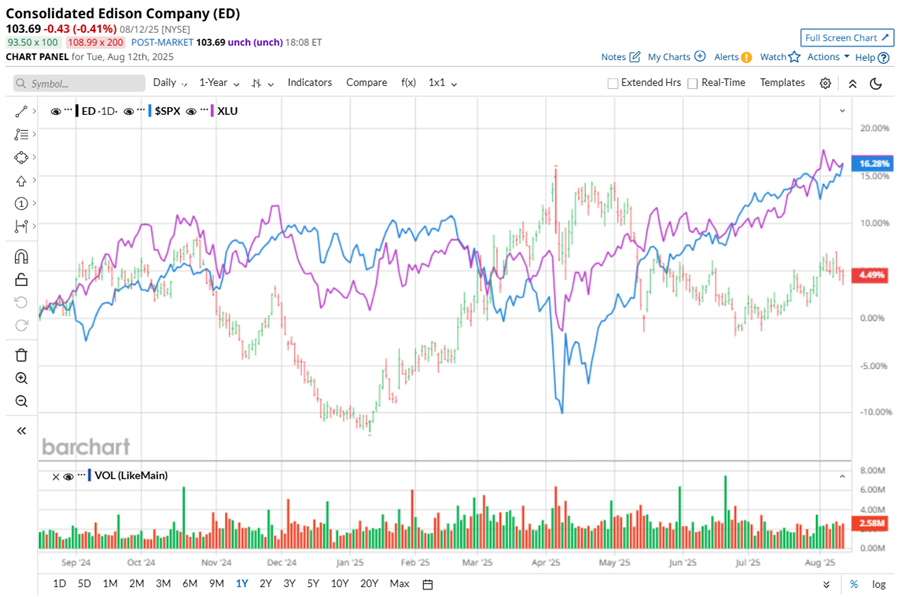

Shares of this leading utility have underperformed the broader market over the past year. ED has gained 1.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.6%. However, in 2025, ED’s stock rose 16.2%, surpassing the SPX’s 9.6% rise on a YTD basis.

Narrowing the focus, ED’s underperformance is also apparent compared to the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 17% over the past year. However, ED’s gains on a YTD basis outshine the stock’s 14% returns over the same time frame.

On Aug. 7, ED shares closed up marginally after reporting its Q2 results. Its adjusted EPS of $0.67 exceeded Wall Street expectations of $0.66. The company’s revenue was $3.6 billion, beating Wall Street forecasts of $3.4 billion. ED expects full-year adjusted EPS in the range of $5.50 to $5.70.

For the current fiscal year, ending in December, analysts expect ED’s EPS to grow 4.3% to $5.63 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

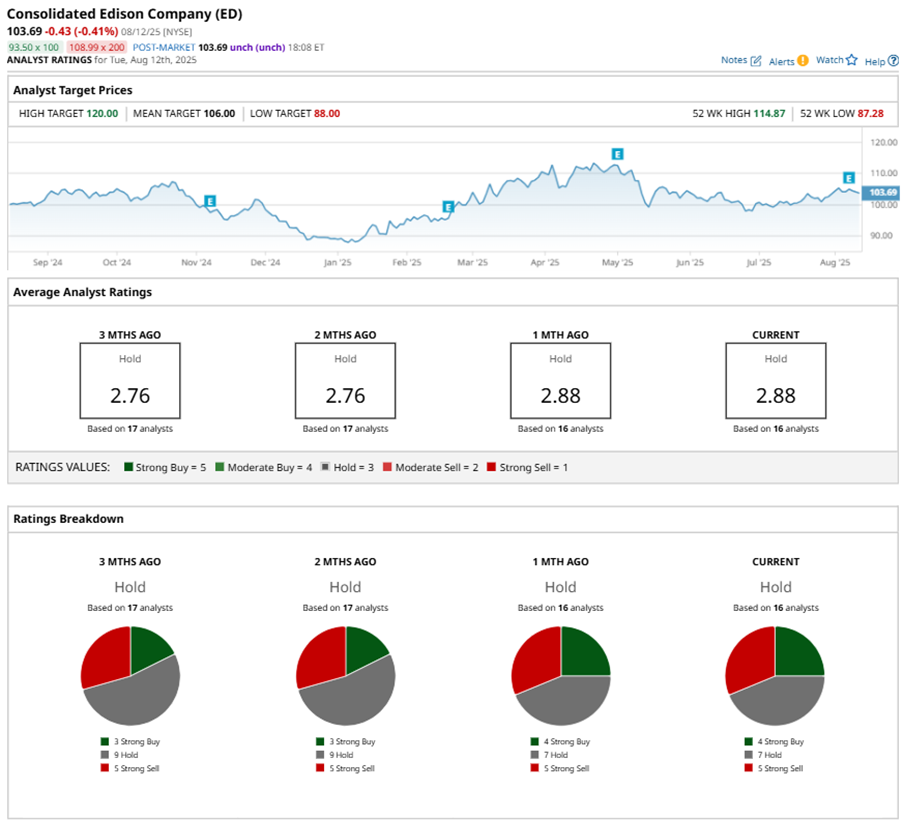

Among the 16 analysts covering ED stock, the consensus is a “Hold.” That’s based on four “Strong Buy” ratings, seven “Holds,” and five “Strong Sells.”

This configuration is more bullish than two months ago, with three analysts suggesting a “Strong Buy.”

On Aug. 8, Mizuho Financial Group, Inc. (MFG) kept an “Outperform” rating on ED and raised the price target to $112, implying a potential upside of 8% from current levels.

The mean price target of $106 represents a 2.2% premium to ED’s current price levels. The Street-high price target of $120 suggests an upside potential of 15.7%.