The Charles Schwab Corporation (SCHW) is a leading financial services firm based in Texas, offering brokerage, banking, wealth management, and advisory services. With a market cap of $173.6 billion, Charles Schwab serves retail and institutional clients with over $10.7 trillion in assets.

SCHW stock has surged 53.2% over the past 52 weeks and 31.2% on a YTD basis, significantly outpacing the S&P 500 Index’s ($SPX) 18.4% rise over the past year and 7.6% return in 2025.

Narrowing the focus, Charles Schwab has also outpaced the SPDR S&P Capital Markets ETF’s (KCE) 34% gain over the past year and 11.1% rally this year.

On Jul. 18, Charles Schwab reported record Q2 2025 results, with revenue rising 25% year-over-year to approximately $5.9 billion, driven by strong growth in trading, interest income, and asset-based fees. Adjusted EPS stood at $1.14, beating expectations. The firm added over 1 million new brokerage accounts and $80.3 billion in net new assets, pushing total client assets to a record $10.76 trillion. As a result, its shares popped 2.9% post earnings release.

For fiscal 2025, ending in December, analysts expect SCHW to report a 42.5% year-over-year growth in adjusted EPS to $4.63. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

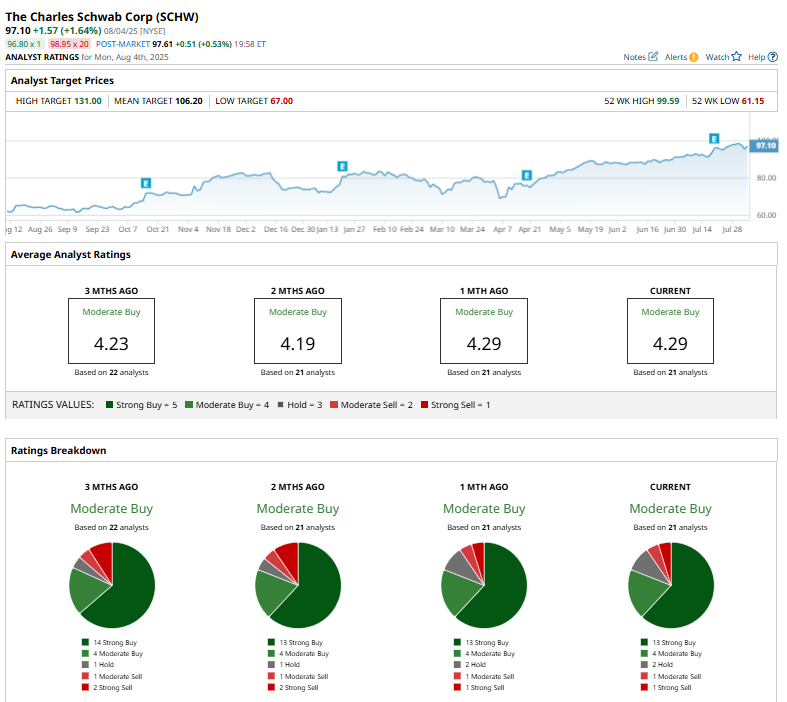

The stock has a consensus “Moderate Buy” rating overall. Of the 21 analysts covering the stock, opinions include 13 “Strong Buys,” four “Moderate Buys,” two “Holds,” one “Moderate Sell,” and one “Strong Sell.”

This configuration is notably less bullish than three months ago, when 14 analysts gave “Strong Buy” recommendations.

On July 29, Morgan Stanley (MS) analyst Michael Cyprys reiterated an “Overweight” rating on Charles Schwab and raised the 12-month price target from $117 to $131, signaling heightened confidence in the firm’s growth trajectory.

SCHW’s mean price target of $106.20 implies a 9.4% premium to current price levels, while its street-high target of $131 suggests a 34.9% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.