The AES Corporation (AES), based in Arlington, Virginia, is a global power generation and utility enterprise. It commands a market cap of approximately $10.4 billion and generates, distributes, transmits, and sells electricity. The company’s diversified portfolio spans around 32,109 megawatts (MW) and serves 2.7 million end users globally.

Over the past 52 weeks, AES stock has delivered a 30.4% return, decisively outperforming the S&P 500 Index ($SPX), which rose 16.1% during the same period. On a year-to-date (YTD) basis, AES’ shares have continued to maintain relative strength, jumping nearly 4% compared with the S&P 500’s 1.9% gain.

Within the utilities sector, AES stock has also moved ahead of peers, surpassing the State Street Utilities Select Sector SPDR ETF (XLU), which gained 11.9% over the past year. The leadership has extended into the current year, as AES stock exceeded XLU’s 1.7% YTD growth.

Momentum strengthened on Nov. 5, 2025, when AES stock rose 5.8% intraday, a day after the company announced its fiscal third quarter 2025 results. Revenue reached $3.35 billion, slightly below analyst estimates of $3.37 billion, yet still delivered a 1.9% year-over-year growth.

Earnings results drove confidence, as adjusted EPS increased 5.6% from the year-ago period to $0.75, exceeding the Street’s forecast of $0.69. Building on this visibility, AES’ management has reaffirmed its 2025 adjusted EPS guidance of $2.10 to $2.26, with growth expected from renewables additions, U.S. utility rate base expansion, and normalized results across Colombia and Mexico.

For the fiscal year 2025, which ended in December, analysts forecast AES to achieve EPS growth of 1.9%, reaching $2.18 on a diluted basis. Recent results show a balanced track record, with the company surpassing consensus estimates in two of the past four quarters and coming in below expectations in the remaining two.

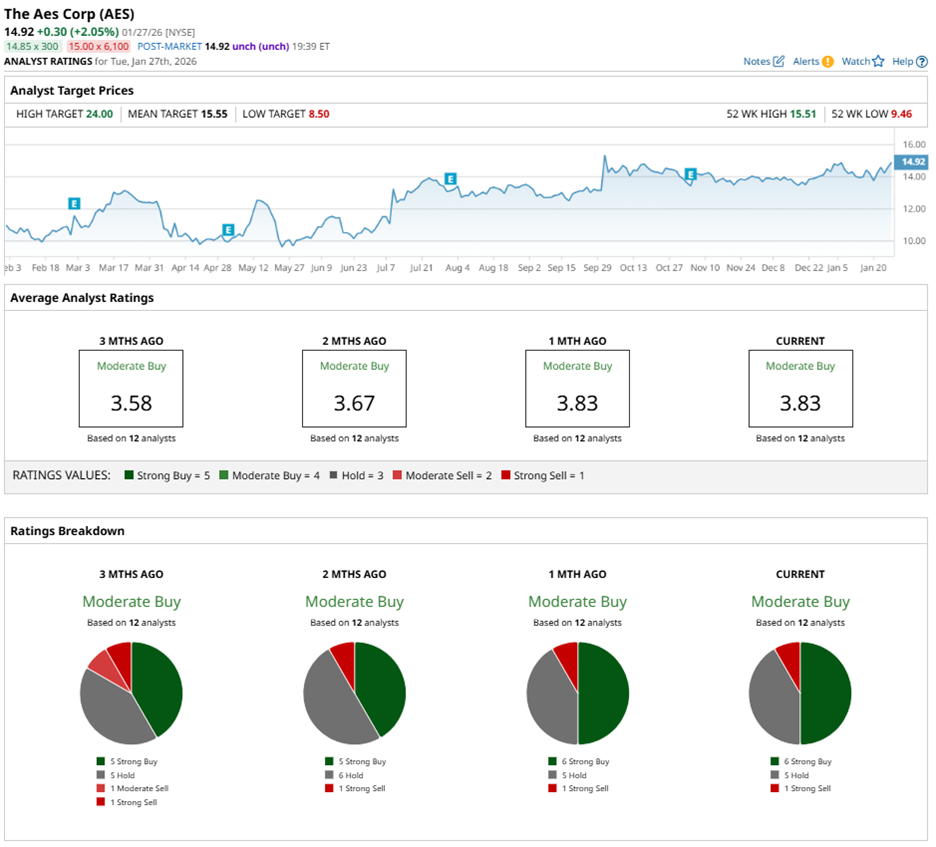

Given the sound fundamentals, Wall Street’s view on AES leans positive. Among 12 analysts covering the stock, the consensus rating stands at “Moderate Buy,” comprising six “Strong Buy” ratings, five “Hold” recommendations, and one “Strong Sell.”

The current analyst sentiment remains largely unchanged from three months ago, when five analysts assigned “Strong Buy” ratings.

Further reinforcing the steady outlook, analysts have continued to refine their views as company-specific catalysts emerge. On Dec. 5, 2025, Argus Research analyst John Eade upgraded AES stock from “Hold” to a “Buy” rating, citing accelerating renewables-driven earnings growth. He projects a price target of $18 based on expected portfolio expansion through 2027.

At present, the mean price target of $15.55 represents a 4.2% premium to AES’ current price levels. Meanwhile, the Street-high price target of $24 suggests a potential upside of 60.9%.