This dreadful September could be stuck in neutral. After the market saw a bit of a bounce on Monday, Tuesday, the Dow fell nearly 300 points, with broad losses across the other indices. The S&P 500 closed Tuesday at its lowest since Aug. 20, the Nasdaq

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

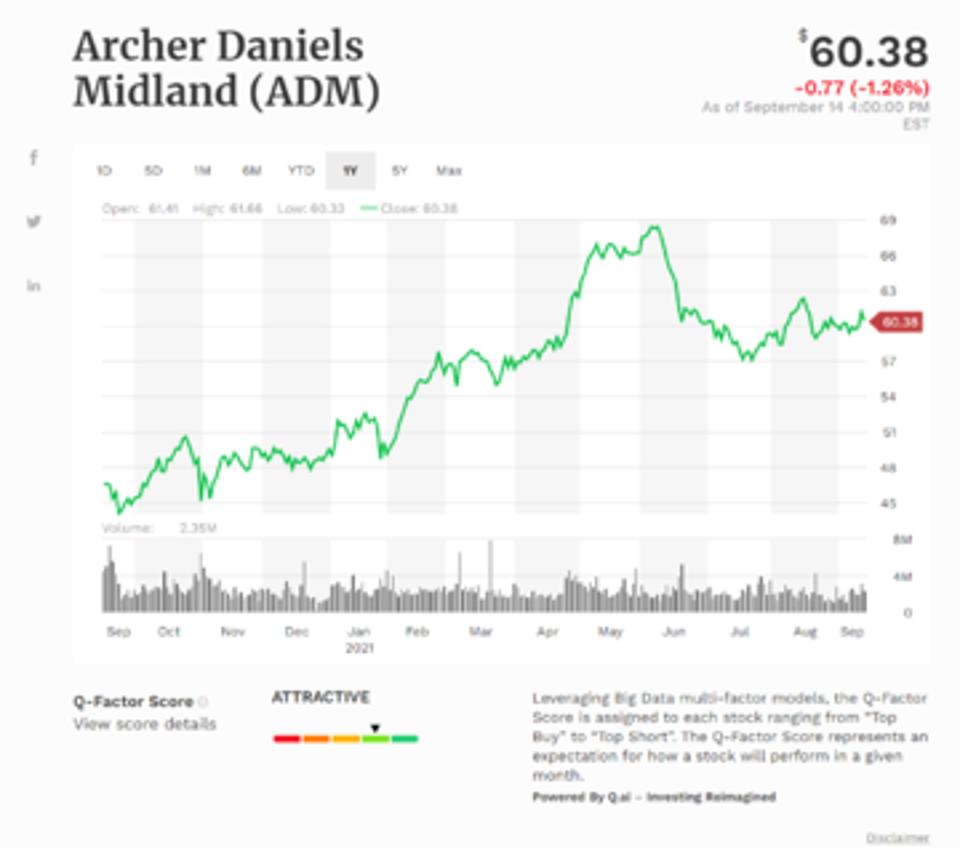

Archer-Daniels-Midland Co (ADM)

Food processing giant Archer-Daniels-Midland is our first Top Buy. The company operates more than 270 plants and 420 crop procurement facilities worldwide and also provides agricultural storage and transportation services. Our AI systems rated Archer-Daniels-Midland B in Technicals, B in Growth, and B in Low Volatility Momentum, and C in Quality Value. The stock closed down 1.26% to $60.38 on volume of 2,354,740 vs its 10-day price average of $60.04 and its 22-day price average of $60.26, and is up 21.07% for the year. Revenue grew by 16.42% in the last fiscal year and grew by 16.45% over the last three fiscal years, Operating Income grew by 46.95% in the last fiscal year and grew by 37.94% over the last three fiscal years, and EPS grew by 30.21% in the last fiscal year and grew by 28.57% over the last three fiscal years. Revenue was $64355.0M in the last fiscal year compared to $64341.0M three years ago, Operating Income was $1806.0M in the last fiscal year compared to $1924.0M three years ago, EPS was $3.15 in the last fiscal year compared to $3.19 three years ago, and ROE was 9.05% in the last year compared to 9.7% three years ago. The stock is also trading with a Forward 12M P/E of 13.99.

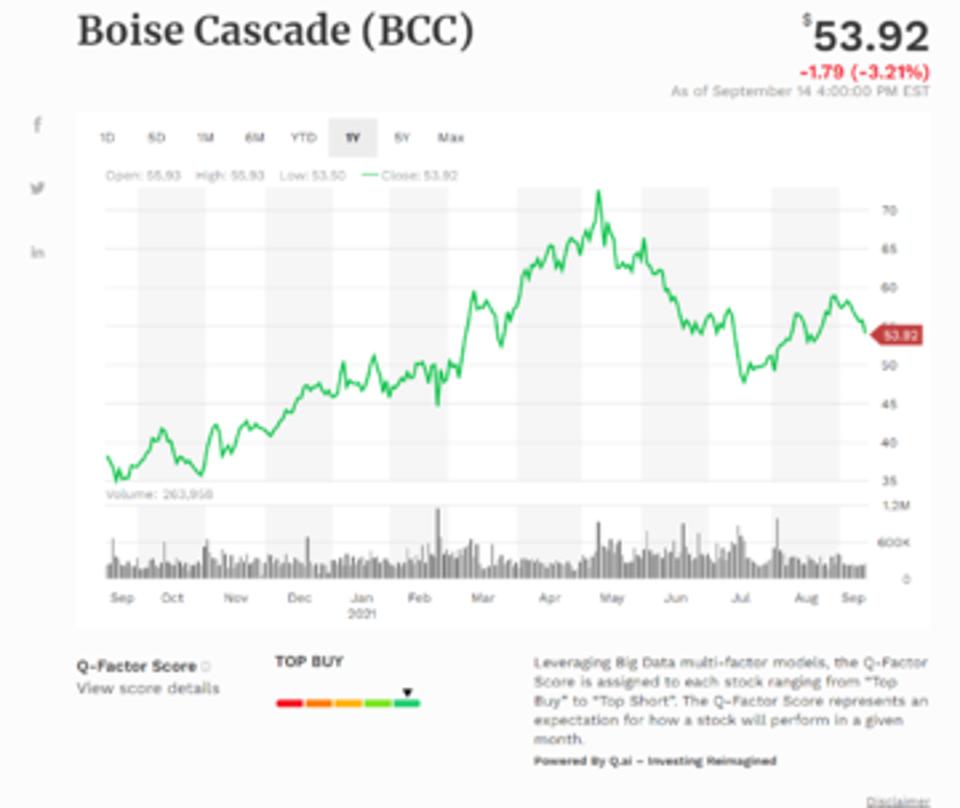

Boise Cascade Co (BCC)

Boise Cascade Co is our second Top Buy today. Boise Cascade manufactures wood products and is also a wholesale distributor of building materials. With inflation causing the price of building materials to skyrocket, Boise Cade is a company to keep a close eye on. Our AI systems rated the company B in Technicals, A in Growth, B in Low Volatility Momentum, and A in Quality Value. The stock closed down 3.21% to $53.92 on volume of 265,941 vs its 10-day price average of $56.68 and its 22-day price average of $56.02, and is up 12.83% for the year. Revenue grew by 33.81% in the last fiscal year and grew by 46.66% over the last three fiscal years, Operating Income grew by 151.52% in the last fiscal year and grew by 523.38% over the last three fiscal years, and EPS grew by 230.92% in the last fiscal year and grew by 2725.56% over the last three fiscal years. Revenue was $5474.84M in the last fiscal year compared to $4995.29M three years ago, Operating Income was $344.28M in the last fiscal year compared to $138.91M three years ago, EPS was $4.44 in the last fiscal year compared to $0.52 three years ago, and ROE was 22.55% in the last year compared to 3.04% three years ago. The stock is also trading with a Forward 12M P/E of 8.17.

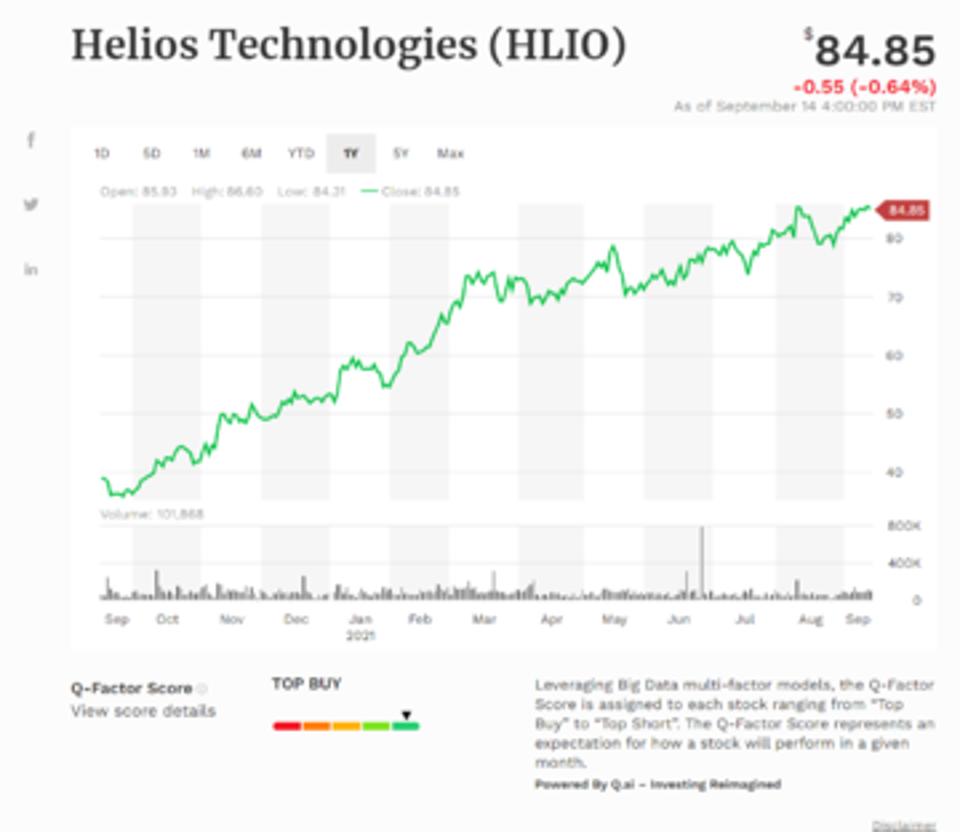

Helios Technologies Inc (HLIO)

Helios Technologies is our next Top Buy. Helios Technologies is a global leader in highly engineered motion control and electronic controls technology for industries such as construction, material handling, agriculture, energy, recreational vehicles, marine, health and wellness. Our AI systems rated the company C in Technicals, B in Growth, A in Low Volatility Momentum, and A in Quality Value. The stock closed down 0.64% to $84.85 on volume of 102,274 vs its 10-day price average of $84.1 and its 22-day price average of $82.3, and is up 63.42% for the year. Revenue grew by 34.31% in the last fiscal year and grew by 38.28% over the last three fiscal years, Operating Income grew by 48.64% in the last fiscal year and grew by 45.67% over the last three fiscal years, and EPS grew by 403.97% in the last fiscal year and grew by 49.61% over the last three fiscal years. Revenue was $523.04M in the last fiscal year compared to $508.04M three years ago, Operating Income was $78.4M in the last fiscal year compared to $80.0M three years ago, EPS was $0.44 in the last fiscal year compared to $1.49 three years ago, and ROE was 2.4% in the last year compared to 11.63% three years ago. Forward 12M Revenue is expected to grow by 4.5% over the next 12 months, and the stock is trading with a Forward 12M P/E of 22.14.

Lowe's Cos Inc (LOW)

Lowe's Cos Inc is our next Top Buy today. Lowe’s is a big-box home improvement retailer and ranks just behind Home Depot

Otc Markets Group Inc (OTCM)

Otc Markets Group is our final Top Buy today. This is the type of stock for penny stock and microcap investors. OTC Markets Group is an American financial market providing price and liquidity information for almost 10,000 over-the-counter securities. OTC-traded securities are organized into three markets based on opportunities and risks: OTCQX, OTCQB, and Pink. Our AI systems rated Otc Markets Group C in Growth, C in Low Volatility Momentum, and A in Quality Value. The stock closed up 1.38% to $47.0 on volume of 704 vs its 10-day price average of $47.03 and its 22-day price average of $45.94, and is up 34.29% for the year. Revenue grew by 19.51% in the last fiscal year and grew by 38.44% over the last three fiscal years, Operating Income grew by 38.64% in the last fiscal year and grew by 51.26% over the last three fiscal years, and EPS grew by 31.3% in the last fiscal year and grew by 47.76% over the last three fiscal years. Revenue was $65.4M in the last fiscal year compared to $56.46M three years ago, Operating Income was $21.43M in the last fiscal year compared to $19.64M three years ago, EPS was $1.53 in the last fiscal year compared to $1.36 three years ago, and ROE was 98.2% in the last year compared to 107.53% three years ago. The stock is also trading with a Forward 12M P/E of 24.1.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.