Apple Inc. (NASDAQ:AAPL) shares jumped 2.42% in after-hours trading on Thursday, reaching $212.59, after the iPhone maker delivered third-quarter results that significantly exceeded Wall Street expectations.

What Happened: The Cupertino-based tech giant reported fiscal third-quarter revenue of $94 billion, beating analyst estimates of $89.04 billion by 5.6%. Earnings per share came in at $1.57, surpassing the consensus estimate of $1.42 per share, according to Benzinga Pro data.

Total revenue climbed 10% year-over-year, while EPS increased 12% compared to the same period last year. iPhone sales drove much of the growth, generating $44.58 billion versus $39.3 billion in the prior year quarter.

“Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment,” said CEO Tim Cook during the earnings call.

Products revenue totaled $66.61 billion, up from $61.56 billion year-over-year. Services revenue reached $27.42 billion, compared to $24.21 billion in the third quarter of 2024. Mac sales contributed $8.05 billion, while iPad revenue declined to $6.58 billion from $7.16 billion last year.

See Also: Amazon Q2 Earnings Highlights: Double Beat, ‘AI Progress Across The Board Continues’

Why It Matters: The company’s active installed base hit new all-time highs across all products and geographic segments, driven by high customer satisfaction and loyalty rates.

Apple ended the quarter with $36.27 billion in cash and cash equivalents. The board declared a quarterly dividend of 26 cents per share, payable August 14.

During the earnings call, Cook confirmed Apple remains “very open to M&A that accelerates our roadmap,” particularly in artificial intelligence. The company has acquired seven firms this year as it faces mounting pressure to compete with rivals like Meta Platforms Inc. (NASDAQ:META), Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) and Microsoft Corp. (NASDAQ:MSFT) in AI development.

Apple’s capital expenditures reached $3.46 billion in the third quarter, the highest since December 2022, though still modest compared to competitors’ AI spending. The stock closed regular trading on Thursday at $207.57, down 0.71%.

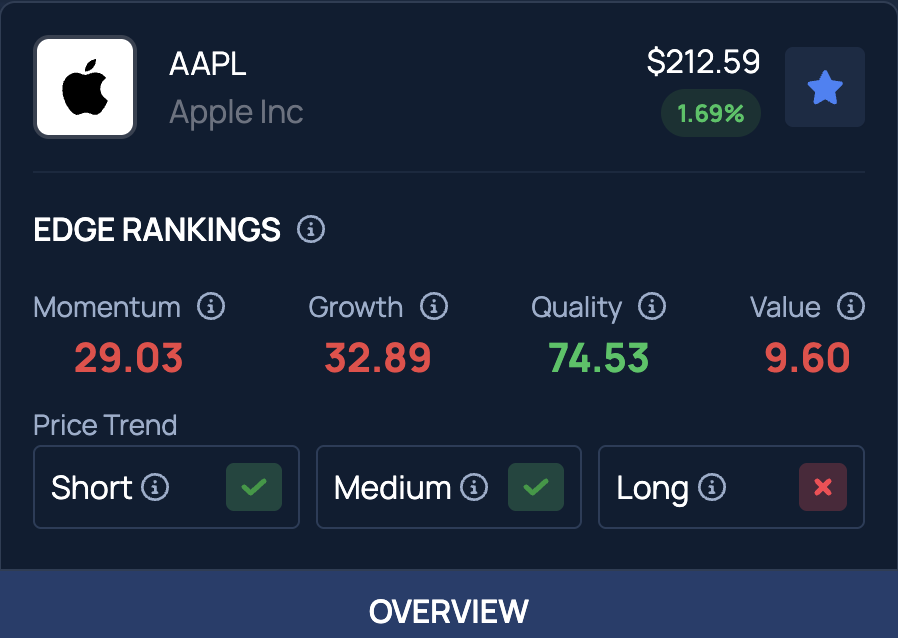

Benzinga Edge Stock Ranking shows AAPL has strong short- and mid-term momentum, but a weak long-term trend. More detailed performance insights are available here.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.