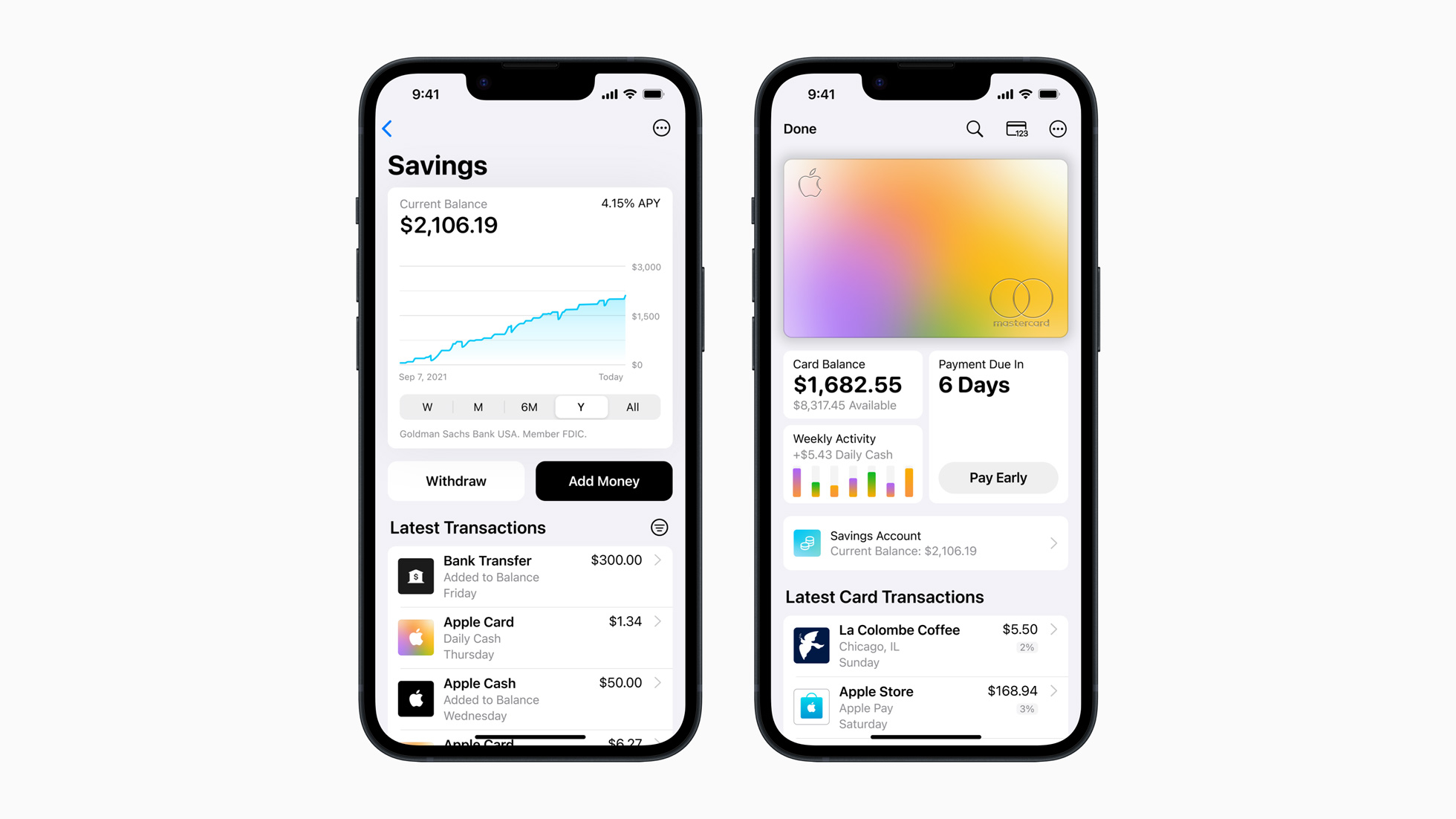

If you're an Apple Savings account holder you might have received a new push notification that explains some good news — you're getting more money. Or to be more precise, you're going to start to receive more interest on the cash that you're already saving.

The news comes via a push notification that is now being sent to owners of the Goldman Sachs-backed accounts, with interest rates increasing from 4.15% annual percentage yield (APY) to 4.25%. This happens to be the first time that Goldman Sachs has increased the savings rate for these accounts, and it also happens to come at a particularly interesting time for the bank and its relationship with Apple.

Goldman Sachs is currently in the process of finding a way to exit its Apple Card contract after losing an incredible amount of money on it. The process to ditch the card hasn't been easy, however, but it's unlikely that the Apple Card debacle is linked to this Apple Savings interest boost.

Saving up

The increase in savings rate was reported by MacRumors with people also sharing that they had received the same notification online. As the report notes, while this increase is obviously one that will be well received by Apple Savings account holders, the 4.25% APY is still short of the higher rates offered by more competitive options on the financial market.

The Apple Savings account is still only available in the United States thanks to its Goldman Sachs affiliations, much like the Apple Card. And while there have been periodic rumors that the Apple Card could break free beyond U.S. borders, the same hasn't been said of the savings account.

International banks are no doubt watching Goldman Sachs with interest to see how it deals with the breakup of its Apple Card contract. Reports have suggested that Apple has given the bank the chance to leave the partnership over the next 12 to 15 months, but finding a replacement could be problematic. Reports suggest that Apple's requirement that no cardholder data be sold to advertisers could be a sticking point moving forward, with potential suitors for the contract likely to want to recoup some of the costs associated with Apple Card by selling such data.

The Apple Card contract has always been a problematic one for Goldman Sachs. The card is subscription-free, with no other fees associated beyond interest on purchases. It's also said that Goldman Sachs' lack of familiarity with lending to people with weaker credit ratings ill-prepared it for the level of defaults that it has had to deal with since the Apple Card launched.

Taken to account

As for the Apple Savings account, it isn't clear whether the ditching of Apple Card will also impact its future. There has so far been no suggestion that its fate is associated with the Apple Card contract, but it's notable that Apple chose the same bank to back both financial initiatives. Whether that will be a requirement for any Goldman Sachs Apple Card replacement remains to be seen.

The Apple Card itself is entirely managed on a user's iPhone with payments and statement features all handled from within the Wallet app. Apple Pay is of course supported, while a physical card is also offered for those instances where contactless payments are not supported. That card is backed by Mastercard and has wide support across businesses. The card itself is made of titanium, much like the iPhone 15 Pro and Apple Watch Ultra 2.