Apple Inc. (NASDAQ:AAPL) is navigating a pivotal moment in its growth story, as its latest growth percentile ranking shows both dramatic improvement and underlying volatility.

What Does Growth Ranking Improvement Mean For Apple?

According to the latest Benzinga Edge Stock Rankings‘ growth report, Apple leapt from a score of 29.66 to a stellar 95.74 at the latest check—a change of 66.08 points that placed AAPL squarely among the top gainers for growth across all sectors.

Growth rankings, as described, measure the pace and sustainability of a company's expansion in earnings and revenues, reflecting both long-term potential and near-term momentum in comparison to industry peers.

Apple Beats Q4: Earnings Snapshot

This jump follows Apple's robust fiscal fourth-quarter results, where the tech giant posted revenue of $102.47 billion, beating Wall Street estimates, and delivered earnings of $1.85 per share.

With year-over-year revenue up 8% and EPS surging 13%, Apple’s services and product lines saw record sales, including all-time highs for iPhones and Services.

The Americas led regional sales at $44.19 billion, while Europe and Greater China followed with $28.7 billion and $14.49 billion, respectively.

See Also: Elon Musk’s Tesla Defies China Flop, Sovereign Fund Revolt, Momentum Soars To The Top Anyway

Apple’s ‘Deal Of The Year’ With Google

Apple's $1 billion Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Gemini deal for Siri's AI upgrade was termed as the "deal of the year" by analysts, while the company still pockets $20 billion annually from Google for search placement.

For the updated Siri, which could launch next Spring, the tech giant has previously weighed in several other third-party models, including OpenAI‘s ChatGPT and Anthropic‘s Claude. However, Apple ultimately chose to go with Google’s Gemini.

What Do Other Rankings Say About Apple?

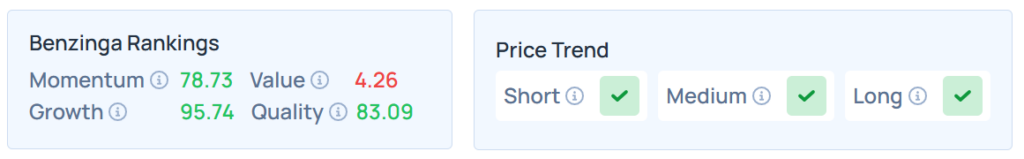

Apple retains strong momentum at the 78.73rd percentile and operational quality at the 83.09th percentile, but its value metric languishes at just 4.26—highlighting persistent investor concern over stretched valuations versus fundamentals, even as its quality score speaks to operational excellence.

The company nonetheless maintains a healthy price trend across short, medium, and long periods, supporting its positive near-term outlook. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

AAPL shares were trading 0.25% lower in premarket on Thursday. It closed 0.037% higher at $270.14 apiece on Wednesday, with a 10.78% year-to-date gain and 21.29% over the year.

While the S&P 500, Dow Jones, and Nasdaq 100 closed higher on Wednesday, the futures were lower on Thursday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock