Apple Inc. (NASDAQ:AAPL) is reportedly preparing to launch its first foldable iPhone by 2026, and Wall Street analysts say a Chinese glassmaker could reap the biggest rewards.

What Happened: According to a July 14 report from Citigroup, Chinese firm Lens Technology is positioned to become a "key beneficiary" of Apple's entry into the foldable smartphone market, reported CNBC on Sunday.

The analysts estimate that Apple's foldable device could account for 5% of Lens Tech's revenue in 2026 and 12% by 2027.

Lens Tech, which just raised over $600 million in a high-profile Hong Kong IPO, is expected to supply ultra-thin cover glass for Apple's upcoming foldable iPhone.

Also Read: Apple Undergoing Major Management Overhaul, But CEO Tim Cook To Stay On

The company did not name Apple, but disclosed in its prospectus that its largest customer is a Nasdaq-listed U.S. firm founded in 1976, the report said.

U.S. hedge fund manager Steve Cohen has also taken notice, increasing his stake in Lens Tech to 8.41% following the IPO, according to exchange filings.

Why It’s Important: While Apple has yet to confirm the product, analyst Ming-Chi Kuo previously said that the device is likely to use Samsung Electronics Co.'s (OTC:SSNLF) Display's crease-free OLED panels and could debut as early as late 2026.

Bloomberg columnist Mark Gurman also reported that Apple's foldable phone will be priced around $2,000, similar to Samsung's Galaxy Z Fold.

The global foldable smartphone market is growing rapidly, especially in China, where brands like Huawei Technologies, Honor and Vivo dominate. Apple's entry — even without radical innovation — could drive mainstream adoption thanks to its powerful brand and global reach.

For Lens Tech, the foldable iPhone could be a catalyst for long-term revenue growth and international expansion. The company plans to use 30% of its IPO proceeds to scale up foldable display production, including facilities in Vietnam and Thailand, the report said.

UBS also issued a buy rating on Lens Tech and expects its earnings to grow 20% annually through 2027, fueled not only by Apple but also AI glasses and robotics.

Lens Tech currently trades on both the Hong Kong and Shenzhen exchanges.

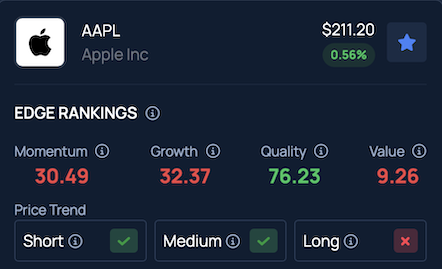

Benzinga’s Edge Stock Rankings show that AAPL maintains strong upward momentum over the short and medium term, though its long-term trend points downward. The stock scores high on quality, but its value rating lags. Additional performance insights are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock