As Wall Street has been rallying behind the iPhone maker, led by Tim Cook, to dive into the artificial intelligence (AI) race, Fundstrat’s Tom Lee says that Apple Inc. (NASDAQ:AAPL) could be ready to surprise investors.

Check out the current price of AAPL stock here.

What Happened: While a slew of opinions on Apple’s acquisition of Perplexity AI make rounds on mainstream media and among top Wall Street experts, Lee’s post on X highlights his belief in Apple’s enduring strength and strategic timing in the market.

He suggests that Apple is poised to make significant moves that could surprise investors.

In a snippet of his conversation with CNBC, reshared on X, Lee says, "For me, Apple has been quietly ready to pounce on AI. But I don’t think they need to pay up for any of these models. So, I think Apple is going to surprise people."

While Lee doesn't specifically vouch for Apple's acquisition of Perplexity AI, he seems confident that Cook to make a strategic move into AI.

Meanwhile, Lee's peers Daniel Ives of Wedbush Securities and Jim Cramer have been urging the iPhone maker to acquire Peplexity.

According to Bloomberg Opinion’s U.S. technology columnist Dav Lee, Apple should continue its measured approach to building AI capabilities by hiring individual talent, rather than acquiring entire AI companies.

He highlights that large acquisitions might seem tempting to quickly enhance Siri and other AI tools, but it carries significant risks of cultural clashes, operational hurdles, and regulatory distractions.

Why It Matters: Cramer, in a recent X post had reiterated his views that "If Apple buys Perplexity, we would have our winning bot and the stock would soar."

Cramer also calls out Apple on its buyback program and said that "Continued buybacks will do nothing." This comes as Apple spent the most on stock buybacks in 2024.

The recommendation is influenced by the U.S. government’s antitrust ruling against Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL), expected by August, which may force Google to end default search deals with Apple’s Safari browser.

Similarly, Ives said at the beginning of July that Apple’s “treadmill approach” needs to end, and it needs to eye a big, splashing partnership with either Perplexity or Anthropic.

“Look, it’s about the developers. If you look at OpenAI, if you look at Google, if you look at Microsoft, they (Apple) need to get into the game. That is something that can’t be done in Cupertino,” he added.

Price Action: Shares of Apple were up 0.13% in premarket on Tuesday. It has fallen by 12.86% on a year-to-date basis and 5.13% over the past year.

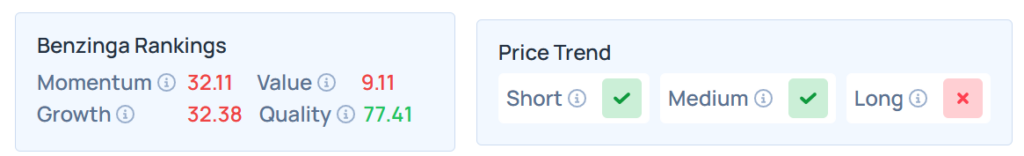

Benzinga Edge Stock Rankings shows that Apple had a weaker price trend over the long term but a stronger price trend over the medium and short term. Its momentum ranking was poor, and its value ranking was also bad at the 9.11th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.09% at $628.16, while the QQQ declined 0.23% to $562.88, according to Benzinga Pro data.

Read Next:

Image via Shutterstock