Apple Inc. (NASDAQ:AAPL) was hit with a class-action lawsuit on Friday alleging the tech giant illegally used copyrighted books without permission to train its artificial intelligence systems.

Authors Grady Hendrix and Jennifer Roberson filed the complaint in Northern California federal court, claiming Apple copied protected works without consent, credit, or compensation, Reuters reported.

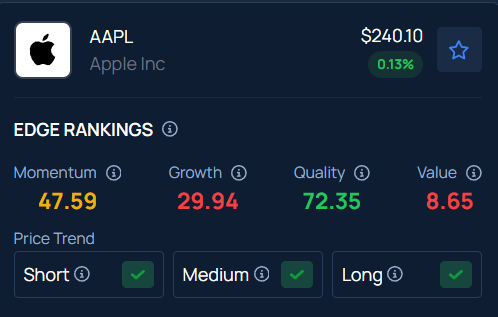

Check out the current price of APPL stock here.

The lawsuit specifically targets Apple’s “OpenELM” large language models, accusing the company of using a known dataset of pirated books. Both plaintiffs’ works allegedly appeared in the unauthorized training materials.

Industry-Wide Copyright Battle Intensifies

The tech giant’s lawsuit contributes to the rising number of legal challenges over AI training practices in the industry. Microsoft Corp. (NASDAQ:MSFT) faced similar claims in June regarding its Megatron AI model, while Meta Platforms Inc. (NASDAQ:META) and Microsoft-backed OpenAI continue defending against copyright infringement allegations.

This legal trend reflects broader industry tensions as AI companies struggle to balance innovation with intellectual property rights.

Anthropic Settlement Sets $1.5 Billion Precedent

The lawsuit comes days after Amazon.com Inc. (NASDAQ:AMZN) and Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG)-backed Anthropic agreed to pay $1.5 billion to settle similar copyright claims. The settlement provides $3,000 per book for approximately 500,000 titles used to train Anthropic’s Claude chatbot.

Plaintiffs’ lawyers called it the largest publicly reported copyright recovery in AI history, setting a precedent for future cases.

Mixed Legal Outcomes Shape AI Landscape

While some companies face substantial settlements, others have secured favorable rulings. Meta recently won summary judgment when a federal judge ruled its AI training practices constitute fair use under copyright law. The judge found no meaningful evidence of market dilution from Meta’s use of copyrighted materials.

With a strong Value Score of 72.35, Benzinga’s Edge Stock Rankings indicate that AAPL has a positive price trend across all time frames. Know how its momentum lines up with other well-known names.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.