APA Corporation (APA), headquartered in Houston, Texas, is an independent oil and gas exploration and production company operating globally across the U.S., Egypt and other regions. Its market capitalization stands at around $8 billion.

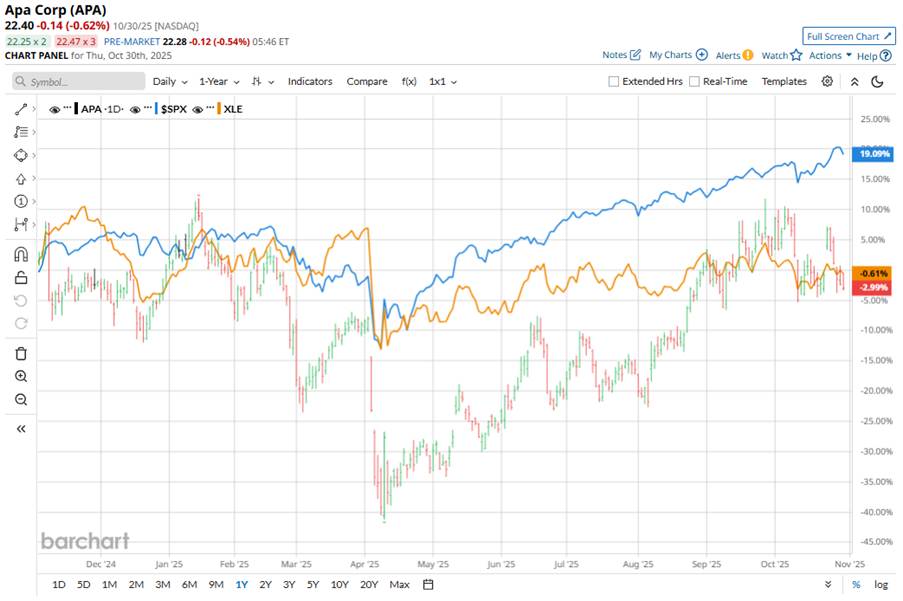

Shares of the company have underperformed the broader market. APA stock has declined 4.6% over the past 52 weeks, while the broader S&P 500 Index ($SPX) has gained 17.4%. In addition, shares of APA Corporation have dropped 3% on a year-to-date (YTD) basis, compared to SPX's 16% rise.

Looking closer, the oil and natural gas producer's shares have also lagged behind the Energy Select Sector SPDR Fund's (XLE) marginal dip over the past 52 weeks and 2.1% gain YTD.

APA’s shares have come under pressure largely due to weak commodity prices and adverse industry signals. Oil prices have faltered amid reports that OPEC+ is considering lifting production cuts earlier than expected, which dampens the outlook for producers like APA.

Moreover, APA operates in a sector that is facing systemic headwinds, like sluggish global demand growth, elevated supply, and investors favoring higher-growth industries over traditional upstream oil and gas companies.

For the current fiscal year, ending in December 2025, analysts expect APA's EPS to decrease 9.3% year over year (YoY) to $3.42. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

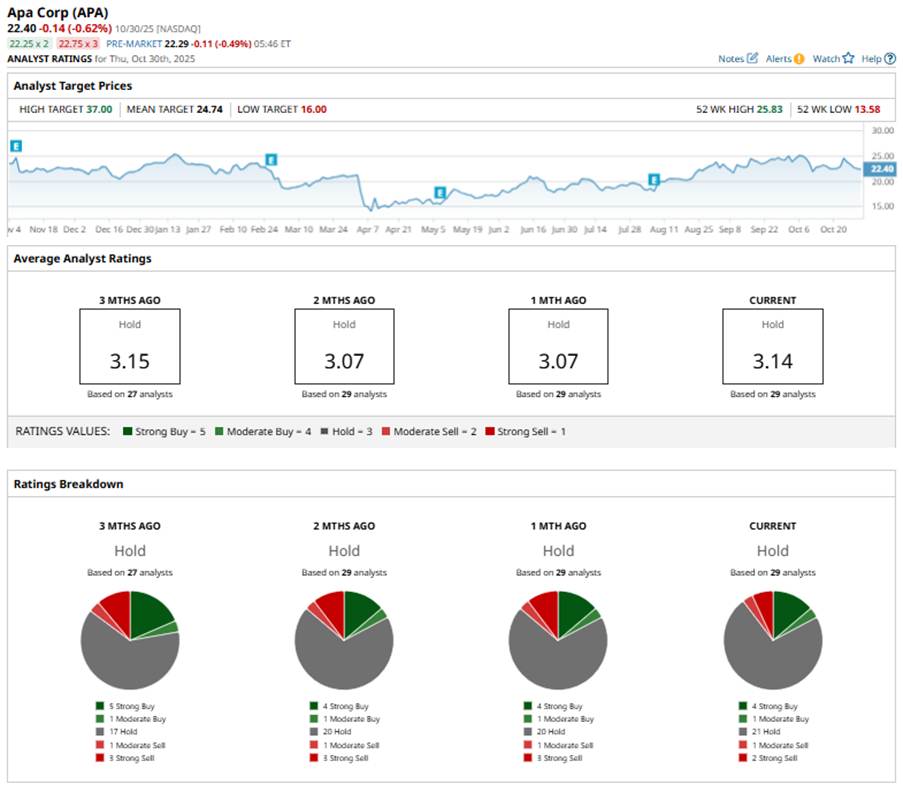

Among the 29 analysts covering the stock, the consensus rating is a “Hold.” That’s based on four “Strong Buys,” one “Moderate Buy,” 21 “Hold” ratings, one “Moderate Sell,” and two “Strong Sells.”

The configuration is less bullish than three months ago, when the stock had five “Strong Buy” ratings.

In October, UBS raised its price target on APA to $25 from $23, while maintaining a “Neutral” rating. The firm expects robust Q3 cash flow and continued strength in APA’s Permian and Egypt operations, but warned that industry risks limit further upside.

The stock's mean price target of $24.74 suggests an upside potential of 10.4%. The Street-high price target of $37 implies APA could rise as much as 65.2% from the current price levels.