Houston, Texas-based APA Corporation (APA) operates as an independent energy company. It explores, develops, and produces natural gas, crude oil, and natural gas liquids. With a market cap of $8.4 billion, APA’s oil and gas operations span the United States, Egypt, the North Sea, and Suriname.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." APA fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the oil & gas exploration & production industry.

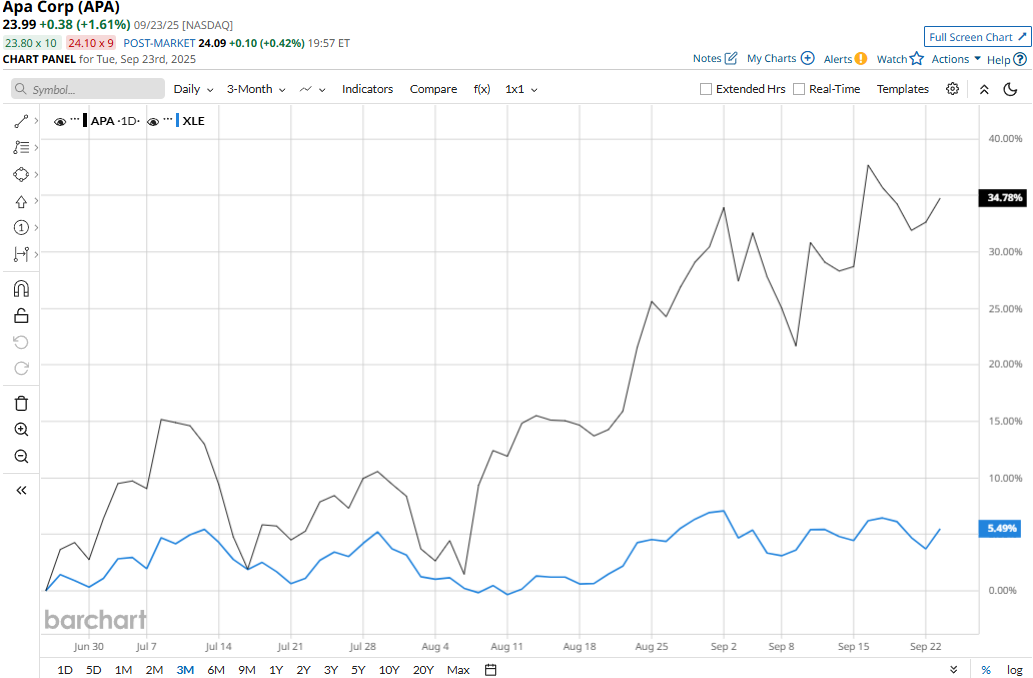

APA touched its 52-week high of $27.48 on Oct. 7, 2024, and is currently trading 12.7% below that peak. Meanwhile, the stock has soared 30.5% over the past three months, notably outperforming the Energy Select Sector SPDR Fund’s (XLE) 3.7% uptick during the same time frame.

Over the longer term, APA’s performance has remained grim. The stock is up 3.9% in 2025 and down 5.7% over the past 52 weeks, underperforming XLE’s 4.1% uptick on a YTD basis and marginal 7 bps gains over the past year.

APA has traded below its 200-day moving average until mid-August and mostly above its 50-day moving average since late May, with some fluctuations, underscoring its previous bearish trend and recent upsurge.

APA’s stock prices soared 7.8% in a single trading session following the release of its robust Q2 results on Aug. 6. The company reported production of 465,000 barrels of oil equivalent (BOE) per day during the quarter, exceeding its guidance. Overall, its topline came in at $2.6 billion, beating the consensus estimates by a massive 26.1%. Moreover, the company reported net cash provided by operating activities of $1.2 billion and adjusted EBITDAX of $1.3 billion, above Street expectations. Moreover, APA's adjusted EPS of $0.87 surpassed the consensus estimates by a staggering 93.3%, boosting investor confidence.

However, when compared to its peer, Marathon Oil Corporation (MRO) has soared 18.2% in 2025 and 12.8% over the past year, outperforming APA by a large margin.

Among the 29 analysts covering the APA stock, the consensus rating is a “Hold.” As of writing, the stock is trading slightly above its mean price target of $23.85.