iBuying platform Opendoor Technologies Inc. (NASDAQ:OPEN) has appointed Kaz Nejatian as its new CEO, who previously served as the COO of Shopify Inc. (NASDAQ:SHOP). His illustrious background and new shareholder-aligned compensation package are being hailed by analysts, investors and even critics alike.

OPEN is reaching significant price levels. Check the market position here.

Alignment With Shareholder Value

On Thursday, investor and podcaster Anthony Pompliano, who has been an ardent promoter of Opendoor in recent months, lauded the company’s decision to appoint Nejatian as its new CEO.

See Also: Opendoor Returns To ‘FounderMode’—Stock Soars

In a post on X, Pompliano sent a pointed message to “$OPEN Naysayers,” saying that the company has just hired “a guy making a gazillion dollars at Shopify,” while paying him a salary of just “$1 per year,” unless he can get the stock to “appreciate a significant amount.”

“If he gets the stock to $82/share,” he says, referring to the stock’s early proponent, Eric Jackson’s original price target, then Nejatian ends up with “$6 billion personally.”

Pompliano highlights the alignment of the CEO’s pay package with shareholder value creation. “What do you think is going to happen? You willing to bet this guy can’t figure out how to create value for shareholders and himself?” he asks.

$1 Salary, $2.6 Billion Payday

Additional details regarding Opendoor’s CEO compensation package were revealed by iBuying data and analysis company, Datadoor.io, on Thursday, in a post on X.

Based on the company’s filings, the post says, Nejatian will receive 82 million shares of the company over the next five years, “if the stock price reaches all its targets up to $33.” This represents a 213% upside for the stock from its closing price on Thursday.

The post notes that this makes the compensation package worth $2.6 billion for Nejatian, which it highlights will be more than 10% of the company’s market capitalization of $24 billion, when it hits $33 per share.

‘A Big Win’ For Opendoor

Investor Martin Shkreli, popularly known as “Pharma Bro,” echoed Pompliano’s views, saying that the “new CEO is a big win for $OPEN.” This comes just days after Shkreli said that the company was “an obvious short,” adding that anyone who is long on it “should never invest again.”

Shkreli, however, continued to reiterate his concerns regarding the company’s business model, saying that it “seems fundamentally broken.”

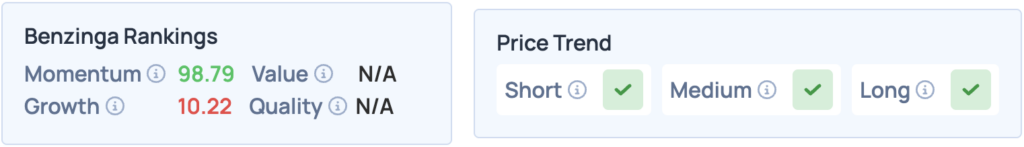

Opendoor was up 79.52% on Thursday, closing at $10.52, and is up 1,562% since its 52-week low of $0.51 per share in June this year. The stock is currently down 2.76% in overnight trade. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights.

Photo: Tada Images / Shutterstock.com

Read More: