Nvidia shares edged higher in early Monday trading after a pair of analysts issued big price target changes on the AI tech giant ahead of its highly anticipated first-quarter-earnings report on May 22.

Nvidia (NVDA) have surged more than 86% this year, adding more than $1 trillion in market value, as investors continue to reset earnings and revenue forecasts tied to its dominant position in the market for artificial intelligence-powering processors.

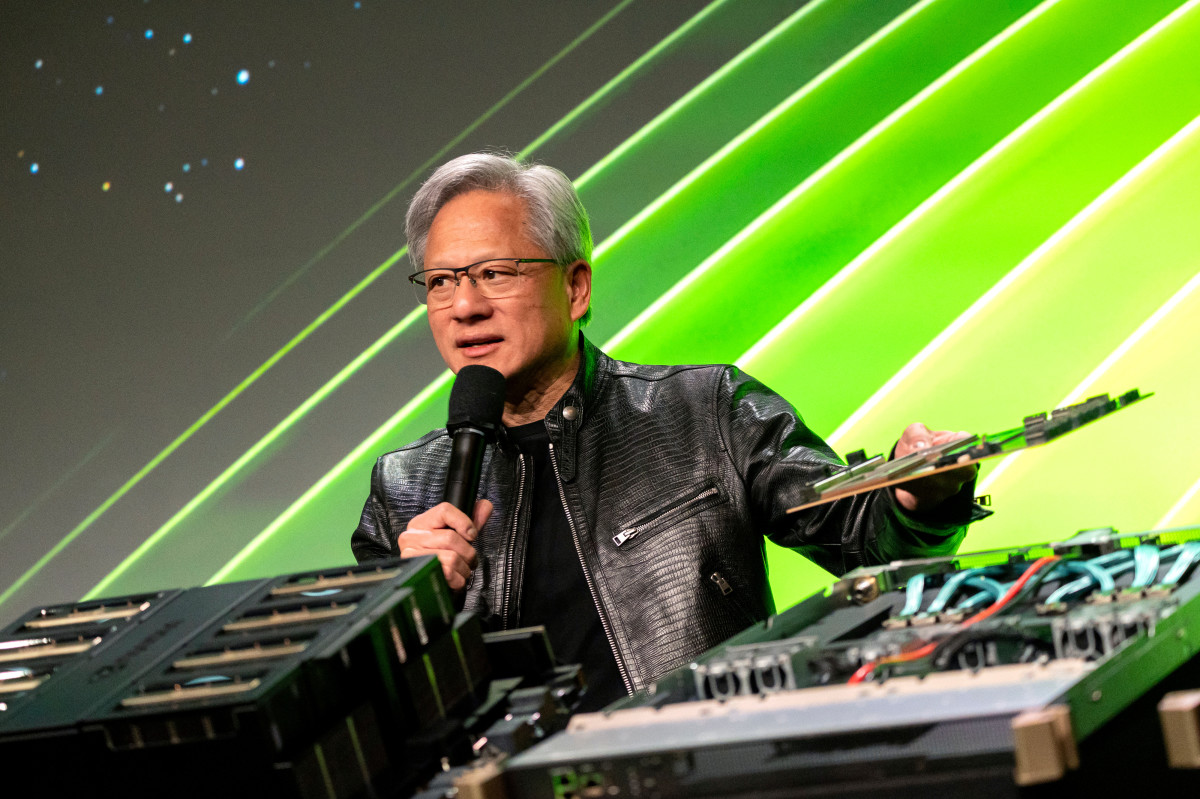

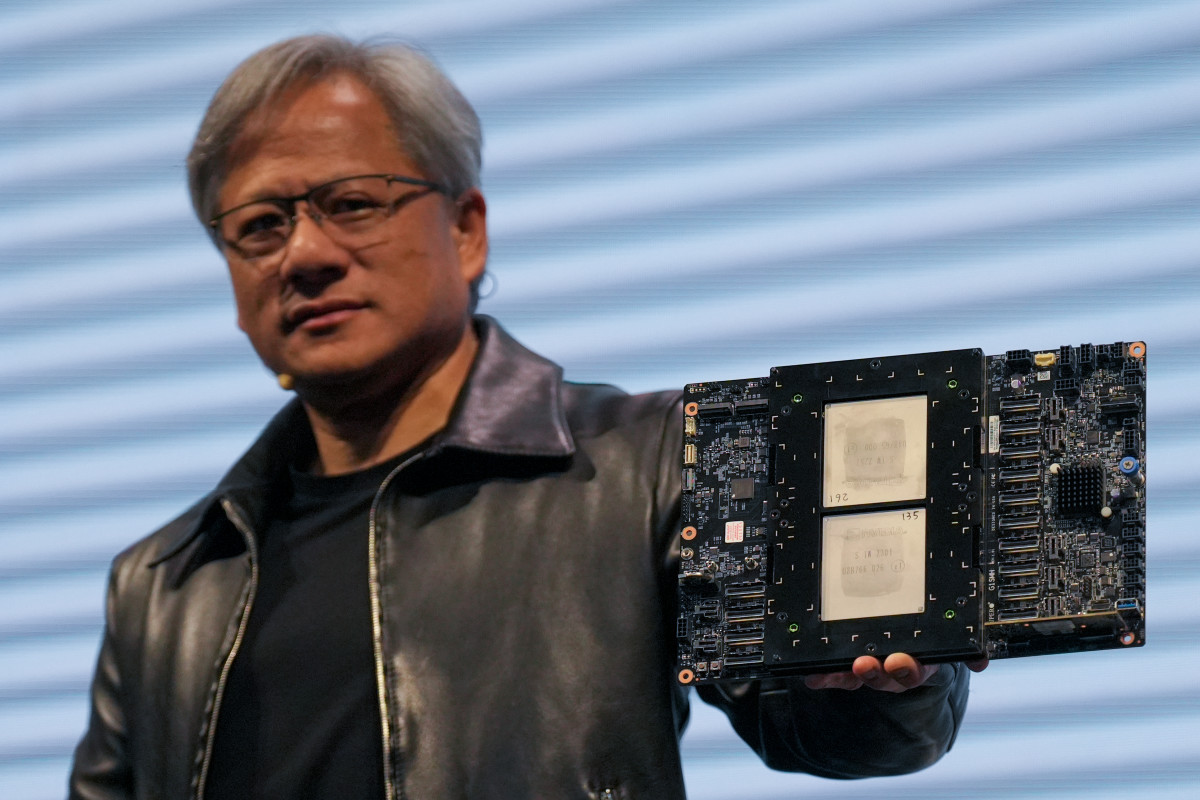

The latest iteration of those processors, a new GPU architecture known as Blackwell, was released earlier this spring, with a promise to perform AI tasks at more than twice the speed of Nvidia's current Hopper chips while using less energy and providing more bespoke flexibility.

“Blackwell’s not a chip; it’s the name of a platform,” CEO Jensen Huang told investors during the launch event. "Hopper is fantastic, but we need bigger GPUs."

HSBC analyst Frank Lee, in fact, cited the group's ability to leverage pricing power through the new GB200 platform as he lifted his price target on Nvidia by $300 to $1,350 a share.

GB200 platform pricing

Lee sees the overall GB200 pricing in the region of $60,000 to $70,000 per server, twice the $30,000 to $35,000 cost of a stand-alone B100 processor.

Lee sees the server-rack pricing potentially helping revenue for Nvidia's next fiscal year, which ends in January 2026, rise to $196 billion, a 38% premium to current Wall Street estimates.

“We believe Nvidia will continue to demonstrate its strong pricing power via its NVL36/NVL72 server-rack system and GB200 platform, which will once again surprise the market on the upside in FY26," Lee said in a note published on May 12.

Related: Nvidia shares get boost from key supplier ahead of earnings

Jefferies analyst Blayne Curtis, meanwhile, added $420 to his Nvidia price target, taking it to $1,200 per share, saying that he expects a a strong ramp for the GB200 NVL 36/72," which includes both Nvidia and Arm Holdings-based CPUs.

Nvidia earnings on deck

“We believe it’s too early to sift out winners and losers in the AI basket yet, but Nvidia is our favorite,” said Curtis, who carries a 'buy' rating on Nvidia stock.

“Nvidia maintains control over the entire ecosystem and is taking more pieces of the pie," he added.

Nvidia is scheduled to post fiscal 2025 first-quarter earnings after the close of trading on May 22, with analysts on average estimating profit rose more than fivefold from a year earlier to $5.55 a share.

Related: Analyst adjusts Nvidia stock price target ahead of earnings

The Santa Clara, Calif., group is also expected report revenue more than tripled, to $24.5 billion, with quarterly sales expected to top the $30 billion mark by the end of its current financial year in January 2025.

More AI Stocks:

- Analyst unveils eye-popping Palantir stock price target after Oracle deal

- Veteran analyst delivers blunt warning about Nvidia's stock

- Analysts revamp Microsoft stock price target amid OpenAI reports

Nvidia shares were marked 0.5% higher in early Monday trading to change hands at $902.98 each. The stock hit an all-time high of $974.00 on March 25.

Related: Single Best Trade: Wall Street veteran picks Palantir stock