Jensen Huang never promised you a rose garden

In fact, Nvidia's (NVDA) chief executive thinks you'd be better off stumbling through weeds for a while than tiptoeing through the tulips.

Huang was making his point recently at the 2024 Siepr Economic Summit at Stanford University as he described how early disappointments can be the path to success.

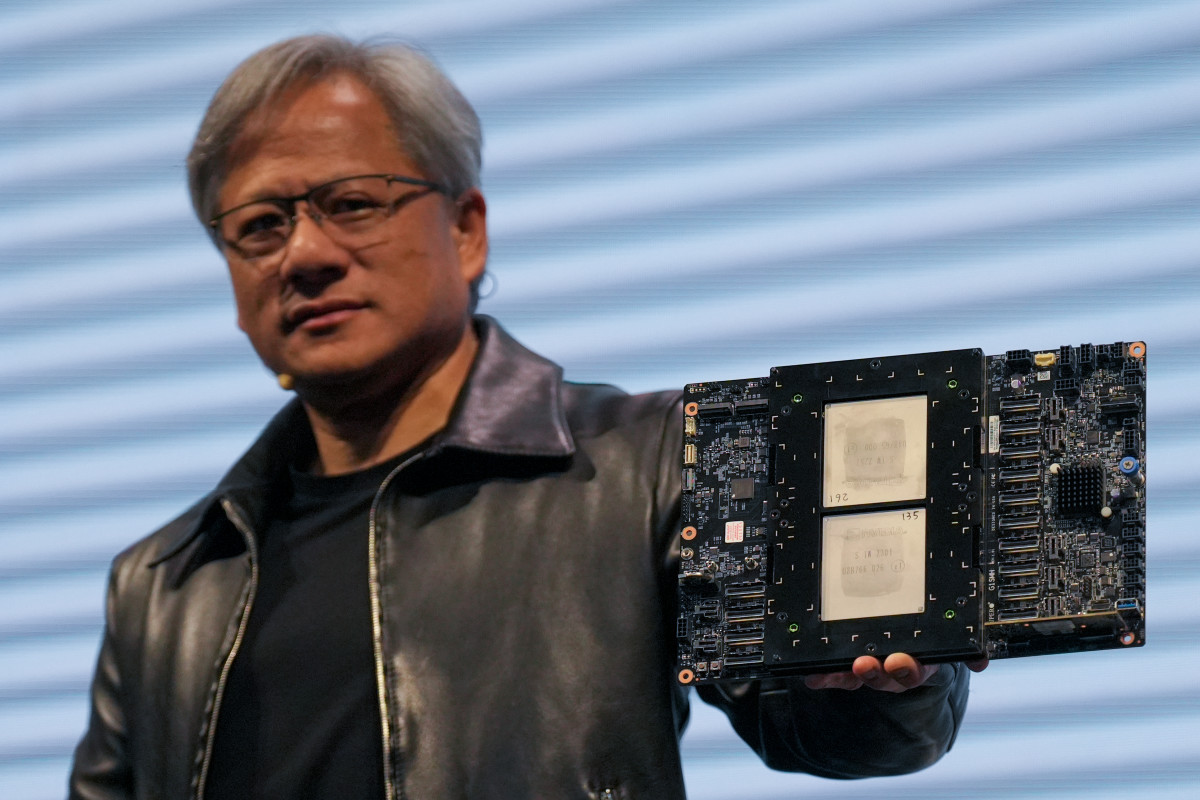

Nvidia is the leading provider of chips specially designed to train and run AI applications. And if you want true artificial general intelligence, he said, “you need to know what the definition of success is," according to Stanford University.

Greatness, he explained, comes from smart people who have suffered setbacks. Huang talks openly about pain and suffering “with great glee.”

“For all of you Stanford students,” he said, “I wish upon you ample doses of pain and suffering.”

Yeah, you won't see that in a Hallmark graduation card, but given the success of Huang's company, you may want to keep his words in mind.

Nvidia clobbered Wall Street's elevated fourth-quarter-earnings estimates last month and forecast 2024 sales in the region of $24 billion and an implied bottom line of $5.41 a share.

The S&P 500 closed at a record on Tuesday, thanks in part to a 7% surge in Nvidia and the biggest single-day gain for Oracle (ORCL) since 2021.

TheStreet/Shutterstock/Slaven Vlasic/Stringer/Getty Images

Upcoming conference

Nvidia shares were off about 2.5% at last check, but the company has a market capitalization of $2.24 trillion, which ain't bad.

Now all eyes in the tech world will be focusing on Nvidia's upcoming GTC event, which is scheduled from March 18 through 21.

Related: Analyst reveals new Tesla price target, Mag 7 risk as shares extend slump

Billed as "the #1 AI Conference for Developers," the event brings together developers, engineers, researchers, inventors, and IT professionals in a kind of techy Woodstock.

Now, a lot of big numbers are floating around the AI game.

A recent McKinsey report estimated that generative AI — deep-learning models that can generate high-quality text, images, and other content — could add between $2.6 trillion and $4.4 trillion to the economy annually, while increasing the impact of all artificial intelligence by 15% to 40%.

The report said that "it seems possible that within the next three years, anything not connected to AI will be considered obsolete or ineffective."

With all the attention, talk in some circles has suggested that AI has been overhyped. Perhaps the conference could help clear things up?

"Nvidia’s GTC conference will feature a keynote from CEO Jensen Huang, and the tagline for it — This Transformative Moment in AI — tells us it and the event will prominently feature AI," TheStreetPro contributor Chris Versace said in a March 12 column.

"What I want to see during the four-day event is real-world applications across industries that not only show the promise of AI but also showcase tangible benefits," he added.

Versace said examples like these will help move AI from being “hopium” — irrational optimism — to tools and applications that can drive productivity, savings and other benefits.

“In turn that should help drive adoption, all of which will drive data-center and other digital infrastructure capacity levels higher, spurring additional capital spending,” he added.

Nvidia analyst: AI is 'critical'

The GTC event was also on the minds of analysts from Bank of America Securities, who raised their price target on Nvidia from $1,100 from $925, while maintaining a buy rating on the stock.

"AI is critical in countries developing tools to assist in applications such as cybersecurity, academic research, climate initiatives, and much more," the firm said in a research note.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

Bank of America said the raised price objective reflects Nvidia's growing addressable market in artificial intelligence.

The upcoming GTC event is expected to highlight several key developments, including the increasing influence of generative AI and omniverse/digital twins across various industries.

The firm said that it justified the new price target by applying a price-to-earnings ratio of 37 times estimated 2025 profit. This valuation is noted to fall within Nvidia's historical price-to-earnings range of 26 to 69 times.

The conference will likely discuss the potential for Nvidia's technology to transform global computing infrastructure, the investment bank said. This could represent an annual market of $250 billion to $500 billion over the next three to five years, an increase from the previously estimated $250 billion market size.

The GTC is also anticipated to provide updates on Nvidia's product pipeline, including accelerators like the B100 and N100, Ethernet switches, data processing units, and edge AI solutions.

In addition, B of A Securities expects Nvidia to share new details on the monetization of its recurring software services, such as AI Enterprise, and other offerings like DGX cloud services, automotive solutions, and gaming.

The firm also believes Nvidia will reveal expanded enterprise use cases and growing demand from sovereign entities and on-premises deployments.

Related: Veteran fund manager picks favorite stocks for 2024