/American%20Express%20Co_%20credid%20card-by%20RYO%20Alexandre%20via%20Shutterstock.jpg)

American Express (Amex) (AXP), the global financial services company, reported another robust quarter. Amex, best known for its credit cards, charge cards, and payment network, proved once again that its premium model and relentless innovation are paying off. In the third quarter, millennials and Gen Z accounted for 36% of total spending, matching Gen X. Amex stock has gained 16.6% year-to-date (YTD), surpassing the overall market index.

Let’s see if AXP stock is a good buy now at current levels.

Platinum Strategy Delivers Record Q3

In the third quarter, revenue increased 11% year-on-year (YoY) to a record $18.4 billion, while earnings per share climbed 19% to $4.14. Cardmember spending rose by 9%, boosted by healthy retail sales and a strong rebound in travel. The company's credit performance remained good, reflecting the strength of its high-quality client base. Management reported that annual card fees had hit $10 billion following 29 consecutive quarters of double-digit growth. The company acquired 3.2 million new cards in the quarter, with 70% of these being fee-paying products, supporting the company's premium profile.

The standout story of the quarter was the introduction of updated U.S. Consumer and Business Platinum Cards, which were aimed at strengthening Amex's position in the premium market. Since 2019, American Express has carried out over 200 product refreshes worldwide, a strategy critical to its success. These regular upgrades keep its offers current, increase customer engagement, and attract new generations of members. The Platinum revamp followed the same strategy of striking a mix between intriguing benefits, unique experiences, and digital innovation that keeps members loyal despite higher annual fees. Platinum card spending outside the U.S. grew 24% during the quarter. Amex's Platinum business alone generates around $530 billion in global yearly spending. With its ties with 160 million merchants worldwide, Amex has unrivaled scale and data advantages.

A Proven Playbook for Premium Growth

The Platinum Card, created over 40 years ago, was originally intended just for wealthy frequent travelers. However, Amex has effectively widened its appeal to younger, digitally aware customers. Management underlined that millennials and Gen Z now use the Platinum Card extensively, completing 25% more purchases than older clients.

Following the pandemic, Amex discovered that members, particularly younger ones, place equal value on digital entertainment, fitness, and delivery services as they do on travel perks. The most recent revamp was created with this in mind, as well as partnerships with world-class brands to provide even more lifestyle and travel value. Early results indicate that new Platinum account acquisitions have doubled from pre-refresh levels. Notably, the company has received over 500,000 requests for the new mirror card, and retention rates are consistent despite a planned yearly fee hike.

The Platinum relaunch also increased travel activity. Amex Travel experienced record reservations, thanks in part to the September launch of a new all-in-one travel app. Looking ahead, Amex intends to broaden merchant coverage beyond the U.S., strengthening its global membership environment. Despite major investments in product development and technology, the company returned $2.9 billion to shareholders, including $2.3 billion in share repurchases and $0.6 billion in dividends. Amex's dividends have climbed by 58% over the last three years.

Following such steady performance, management updated the full-year 2025 outlook, now projecting sales growth of 9% to 10% and earnings per share of $15.20 to $15.50. This forecast update highlights the company's confidence in its business momentum heading into the end of the year.

Meanwhile, analysts expect 8% growth in revenue followed by a 15.5% increase in earnings for 2025. Revenue and earnings are expected to increase by 8.5% and 12.6% in 2026, respectively. Currently, AXP stock trades slightly at a premium of 22x forward earnings.

What Does Wall Street Say About AXP Stock?

Recently, William Blair analyst Christopher Kennedy reiterated his “Buy” rating on American Express. Kennedy highlighted that the successful launch of the refreshed Platinum has driven higher spending, engagement, and profitability per account. While admitting the increased costs associated with the refresh, he believes Amex's various development strategies and customer-focused innovations will continue to drive expansion.

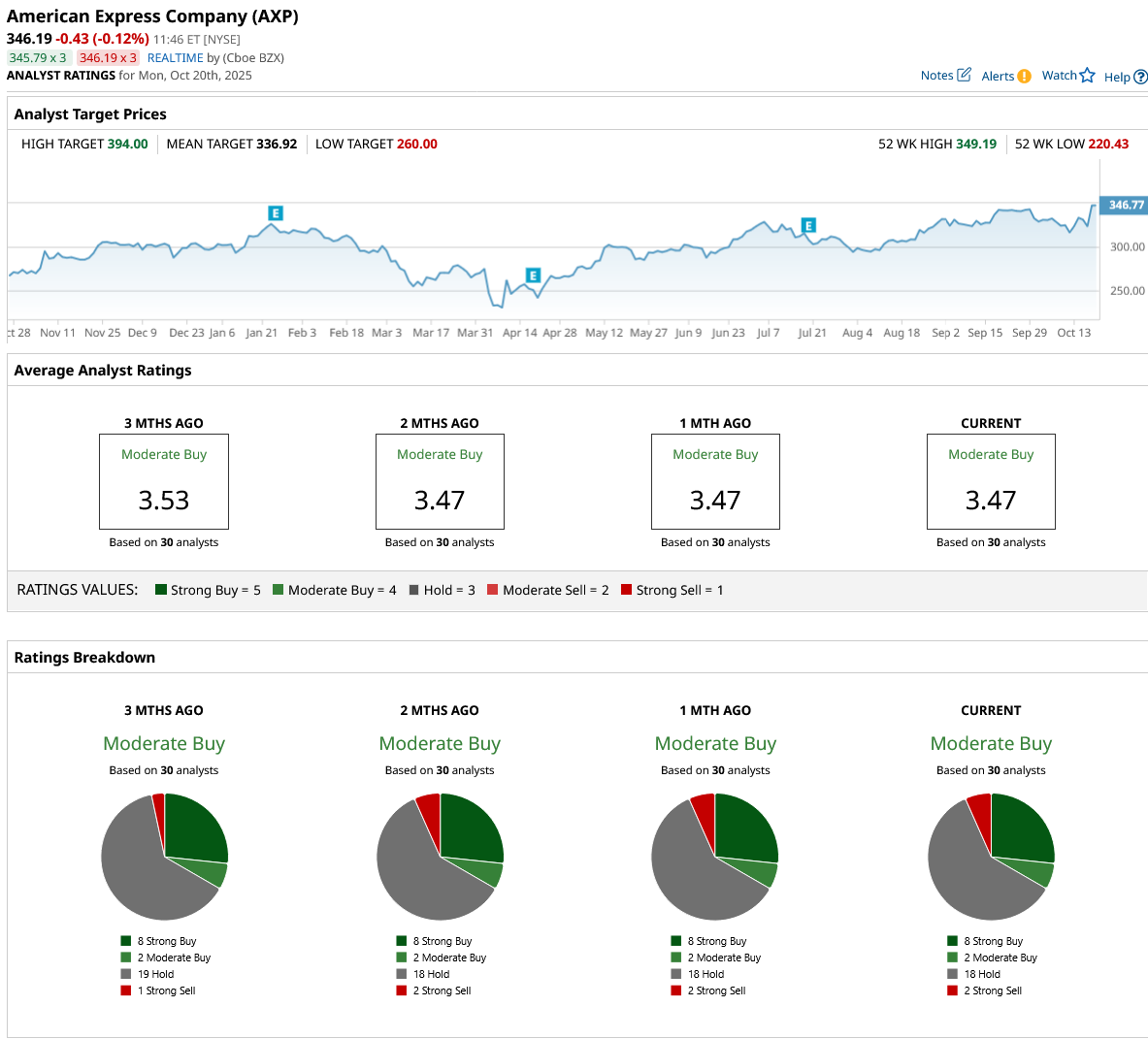

Overall, Wall Street remains moderately bullish on AXP stock. Out of the 30 analysts who cover the stock, six rate it a “Strong Buy,” two say it is a “Moderate Buy,” 18 rate it a “Hold,” and two recommend a “Strong Sell.” The stock has surpassed its average price target of $336.92. However, its high target price of $394 implies a potential upside of 14% in the next 12 months.

With strong earnings power and continuing brand strength among affluent and younger generations alike, American Express continues to prove that its premium, high-spending customer base is a long-term growth driver. Amex combines the dependability of a blue-chip business with actual growth potential, making it an excellent growth stock to grab now for the long run. However, risk-averse investors might want to buy AXP stock at around $316 or $333 levels to invest with a margin of safety.