Chipmaker Advanced Micro Devices Inc. (NASDAQ:AMD) is doubling down on its AI ambitions, with CEO Lisa Su highlighting multiple tailwinds supporting the company's long-term vision and seeing a clear path to scaling the segment to “tens of billions of dollars in annual revenue.”

Check out the current price of AMD stock here.

Highest Performance AI System In The World

During the company’s second-quarter earnings call on Tuesday, Su outlined the chipmaker's roadmap to transform itself into a full-stack AI infrastructure player.

Central to that vision are the company's upcoming MI400 series GPUs and its new Helios rack-scale system, which she described as purpose-built for the “most demanding AI workloads.”

See Also: Under AMD, Qualcomm Competitive Heat, Intel Gets Hit With Fitch Credit Downgrade

“These are the most advanced GPUs we have ever built with up to 40 petaflops of FP4 AI performance and 50% more memory, memory bandwidth and scale out throughput than the competition,” she says, adding that Helios will “deliver up to a 10x generational performance increase” and could become “the highest performance AI system in the world.”

Sovereign AI Opportunity

According to Su, the long-term opportunity lies in sovereign AI infrastructure. She says, “We announced a multibillion-dollar collaboration with Humain,” which is a Saudi state-backed artificial company.

As part of the deal, Humain’s infrastructure will be powered entirely with AMD’s stack, including CPUs, GPUs and software. Su further notes that her company has “more than 40 active engagements globally” with governments.

She emphasized the role of AMD’s open ecosystem for its growing traction among global governments. “What's attractive about our offering is our open ecosystem. And I think that really resonates with the sovereign community,” she says.

AMD Beats Sales Estimates, Misses On Earnings

The company released its second-quarter results on Tuesday, reporting $7.69 billion in sales, ahead of consensus estimates at $7.41 billion, according to Benzinga Pro. Earnings came in at $0.48 per share, marginally missing analyst estimates at $0.49 per share.

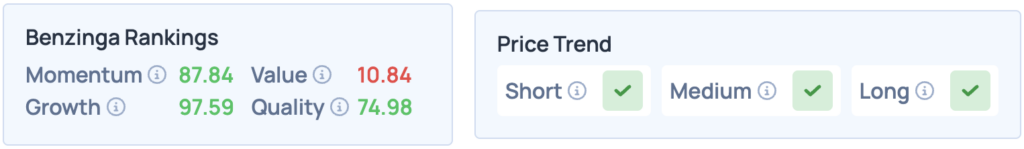

Shares of AMD were down 1.40% on Tuesday, closing at $174.31, and are down 6.34% after hours, following the company’s earnings announcement. The stock does well in Benzinga’s Edge Stock Rankings, scoring high on Momentum, Growth and Value. It also has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo Courtesy: jamesonwu1972 On Shutterstock.com