/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

A stock rising over 100% in nine months certainly raises eyebrows. People automatically associate such tickers with words like “overvalued,” “running ahead of its fundamentals,” and even an outright “bull trap.” CNBC financial commentator Josh Brown's opinion does make sense when considered in isolation. But none of those usual terms apply to Advanced Micro Devices (AMD), a company that continues to rise amid the artificial intelligence (AI) spending spree, including by OpenAI.

It may seem that AMD has risen too much too fast, but calling it “ludicrous” isn't entirely accurate. People forget that it is still a $420 billion company that is sitting on the cusp of a major technological shift.

Chipmakers recently have benefitted massively from the training of large language models (LLMs). These models required high processing speed and high memory bandwidth, and the training cost was not much of a concern for many hyperscalers.

We are now moving to a point where these models need to be deployed to millions of users. This is where AMD’s expertise comes in. Its MI300X accelerators have started to gain commercial traction, and it is this excitement that is driving the stock higher. People realize efficiency and cost per token are where model deployment will succeed. AMD already does this effectively. Together with its EPYC processors, which already dominate the data center market, AMD is set to continue rising under the leadership of Lisa Su.

About Advanced Micro Devices Stock

AMD is a maker of AI accelerators, CPUs, and GPUs and is based in Santa Clara, California. Its stock is touching new highs today, having already generated 118% returns through 2025. This results in an outperformance by 5.2x compared to the Nasdaq Composite’s ($NASX) year-to-date (YTD) returns of 24.2%. After touching a 2025 low of $76.48 in April, there has been a major spike as AMD stock has risen 244.7% since then. In the process, it has become one of the most trending stocks on Wall Street. A major jump occurred after the first week of October when the company announced its deal with OpenAI for AI chips over a multi-year period.

AMD is among the stocks that have exhibited some unprecedented bullish momentum amid recent activities within the AI market. Just like many of its peers, the stock seems clearly overheated after garnering a significant amount of investor interest in recent times. Using many of the traditional valuation metrics for analysis might therefore push investors away from the stock at this point. AMD’s forward price-to-sales (P/S) multiple of 13x is 252% higher than the sector median. The stock is currently trading at a forward GAAP price-to-earnings (P/E) multiple of 114x, which is 238% more than the sector median. In terms of the forward price-to-cash flow (P/CF) metric, AMD stands at 73.4x relative to the sector median of 20.6x.

AMD Outperforms Revenue and Earnings Consensus

AMD announced its second-quarter earnings on Aug. 5, and the company delivered very impressive results. Revenues of $7.7 billion exceeded the estimates by almost $256 million and were 32% higher compared to the same period last year. The company posted quarterly earnings of $872 million, leading to GAAP earnings per share (EPS) of $0.54. Second quarter EPS beat the consensus by a whopping $0.59 margin.

During the second quarter earnings call, AMD management provided guidance for the third quarter. The company is expected to generate $8.7 billion in revenues, which will result in a 28% YoY growth and would comfortably beat estimates of $8.3 billion.

Management highlighted an $800 million write-down on its inventory due to U.S. export controls, which are expected to continue weighing down on the stock. The firm will also exclude MI308 China revenue from its near-term guidance. AMD is expected to report its third-quarter earnings on Nov. 4.

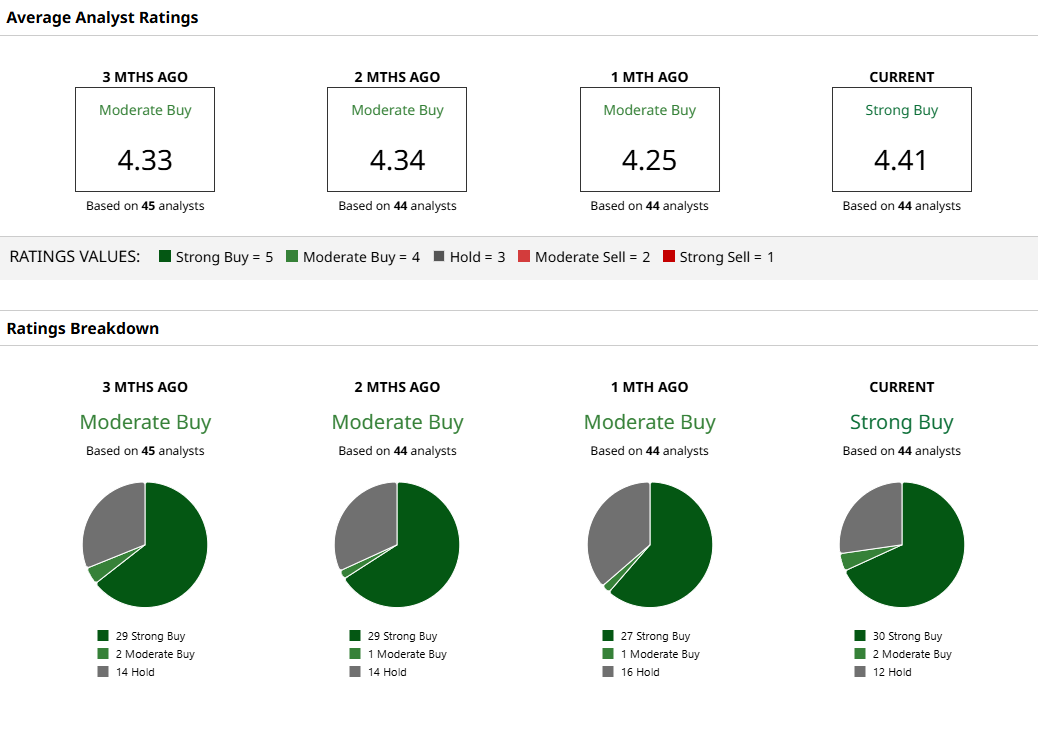

What Are Analysts Saying About AMD Stock?

44 analysts cover AMD stock on Wall Street, and 30 of them have a “Strong Buy” rating, a bullish sentiment that is consistent with AI stocks. There are no “Sell” or “Strong Sell” ratings. The stock is trading just above the mean target price of $253.7, though about 18% below the highest target price of $310. AMD stock’s meteoric rise this year means upside seems limited. However, one should keep an eye on AMD analyst estimates as its MI300X AI accelerators continue to become popular.