/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon’s (AMZN) second-quarter results last night exceeded expectations, showcasing the strength and resilience of its core businesses. Yet, the market responded with a sharp selloff, sending AMZN shares down more than 6% in early trading today. The pullback was driven by cautious forward guidance and near-term margin pressures, both factors that don’t reflect the company’s robust long-term trajectory.

The key issue spooking investors is Amazon’s guidance for third-quarter operating income, which is expected to arrive between $15.5 billion and $20.5 billion. The midpoint of $18 billion fell short of the $19.5 billion analysts were anticipating. Additionally, Amazon’s cloud arm, Amazon Web Services (AWS), is facing short-term margin pressure as the company pours billions into artificial intelligence (AI) infrastructure, including chips, data centers, and energy resources to support the next generation of AI applications.

AMZN: Strategic Investments Now, Massive Payoffs Later

While Amazon’s current-quarter outlook missed Street’s expectations, the company’s strategic investments are positioning it for outsized growth in the years ahead. Management noted that AWS is building one of the fastest-growing generative AI businesses in the industry, and is already generating multibillion-dollar revenues with triple-digit year-over-year growth. Demand remains extremely strong, an encouraging sign for future monetization and scaling.

What the market seems to be missing is how Amazon is setting itself up for a powerful earnings resurgence. Beyond AI, Amazon is also expanding its use of robotics and automation, an effort that is likely to drive significant efficiency and margin improvements over time. Meanwhile, the company’s high-margin advertising business continues to thrive and remains a key engine of profitability. Let’s take a closer look.

Amazon’s Growth Engine is Kicking into High Gear

Amazon is entering a new phase of growth that could significantly boost its earnings and its stock price. Its latest quarterly results show that the company is firing on all cylinders and is laying the foundation for accelerating its profitability.

The company’s ongoing efforts to streamline its e-commerce operations are paying off, particularly in North America, where second-quarter operating income was $7.5 billion, up $2.5 billion from the prior year. The region's operating margin also expanded by 190 basis points to 7.5%. Meanwhile, Amazon's international business posted $1.5 billion in operating income, a substantial year-over-year increase, with margins rising by 320 basis points to 4.1%.

Much of this growth stems from gains in Amazon’s transportation and logistics networks. Improved inventory placement, higher order volumes, and better availability of in-demand items helped reduce costs and speed up delivery times. These improvements reflect Amazon’s broader strategy to enhance cost efficiency, with targeted investments in robotics, automation, and same-day delivery facilities. The company’s focus on optimizing its inbound network and reducing packaging waste is not just improving customer experience but also supporting long-term profitability.

Amazon's advertising business is also proving to be a significant profit center. In the latest quarter, ad revenues climbed 22% year-over-year, showing that the platform remains a highly valuable space for marketers. Advertising is becoming an increasingly important piece of the puzzle for profitability in both domestic and international markets.

But the key catalyst behind Amazon’s long-term earnings potential is AWS. In the second quarter, AWS posted revenue of $30.9 billion, up 17.5% from the same period last year, pushing its annualized run rate beyond a staggering $123 billion. AWS continues to benefit from rising demand for cloud infrastructure, particularly around generative AI. That said, AWS's operating income did drop due to increasing depreciation from ongoing investments in scaling AI infrastructure. Margins also dipped from a record 39.5% in Q1 to 32.9% in Q2, which could be a short-term tradeoff as Amazon builds out its AI and cloud capabilities.

Looking forward, Amazon's continued investments in its own chips, building more data centers, and securing energy resources will help to capture higher demand and generate significant operating income. These moves, combined with an expanding fulfillment network and more efficient delivery infrastructure, are positioning the company for continued earnings acceleration in 2026 and beyond.

Is Amazon Stock a Buy Now?

While Amazon’s near-term guidance may appear cautious, the broader picture reveals a company investing aggressively in AI, logistics, and cloud computing, which are all designed to secure its dominance for years to come. These strategic moves are expected to supercharge Amazon’s growth over time, and in turn, significantly lift its stock price.

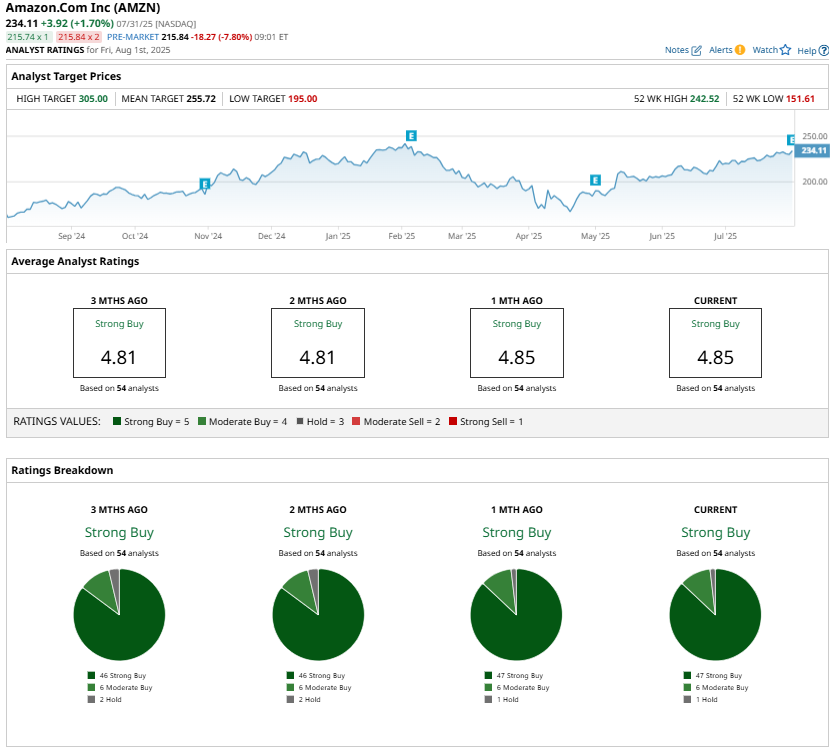

Wall Street is also bullish about Amazon stock. AMZN carries a “Strong Buy” consensus rating from the 54 analysts in coverage, reflecting widespread confidence in its long-term prospects.

In light of this, the recent dip in Amazon’s share price is a buying opportunity.