/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon (AMZN) just scored a landmark victory in the space race with its satellite internet venture, Project Kuiper, which has officially signed on its first airline customer. JetBlue Airways (JBLU) plans to roll out Kuiper-powered in-flight Wi-Fi starting in 2027.

The deal not only brings commercial validation to Amazon’s bold bid to take on SpaceX’s Starlink, but it also sparked a surge in AMZN stock, highlighting mounting investor optimism for Kuiper’s long-term potential. So, does this breakthrough make Amazon stock a compelling buy at today’s levels?

About Amazon Stock

Headquartered in Seattle, Washington, Amazon is a leading technology and e-commerce company operating across multiple sectors — such as online retail, cloud computing (Amazon Web Services), digital streaming, advertising, artificial intelligence (AI), and more — solidifying its place among the “Magnificent Seven.” Amazon's market capitalization stands at about $2.5 trillion, making it one of the world’s most valuable publicly traded companies.

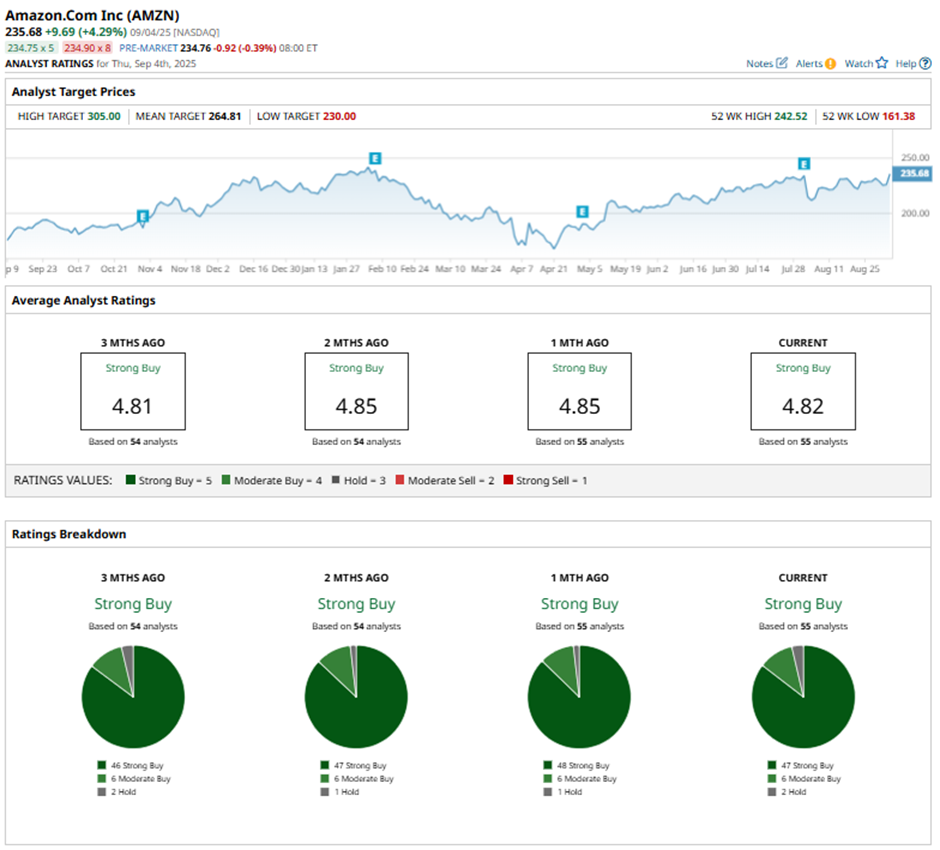

AMZN stock has delivered strong recent gains, rising approximately 4.3% on Sept. 4 after news broke that JetBlue will adopt Amazon’s Project Kuiper satellite internet service. On a year-to-date (YTD) basis, shares are up 6%, while over the past 52 weeks, the total return stands at around 31%. The stock is trading just 4% below its 52-week high of $242.52, which was reached on Feb. 4.

AMZN stock currently trades at a premium compared to the sector median at 35 times forward earnings.

Amazon’s Q2 Results Surpassed Projections

Amazon released its second-quarter 2025 earnings on July 31, reporting net sales of $167.7 billion, marking a 13% year-over-year (YOY) increase and surpassing expectations. Operating income rose sharply to $19.2 billion. Net income also came in significantly ahead of forecasts, climbing to $18.2 billion, or $1.68 per share, compared to $13.5 billion, or $1.26 per share, in the prior-year quarter.

Strength across key segments — like 11% sales growth in North America, 16% growth in International and a 17% increase in AWS revenue — powered the results.

Amazon guided for Q3 2025 net sales of $174 billion to $179.5 billion, or growth between 10% and 13% compared to Q3 2024. The firm also expects operating income between $15.5 billion and $20.5 billion, compared with $17.4 billion in the third quarter of 2024. However, the company also acknowledged mounting uncertainties stemming from geopolitical conditions, tariffs and trade policies.

Analysts remain optimistic. They predict EPS to be around $6.73 for fiscal 2025, up 22% YOY, before surging another 12% annually to $7.55 in fiscal 2026.

What Do Analysts Expect for Amazon Stock?

Barclays recently reaffirmed its “Overweight” rating on Amazon, putting its price target at $275. The firm sees Anthropic as a key growth driver for AWS, estimating its workloads contributed about 100 basis points to AWS growth in Q2. Barclays sees potential for that to expand to 400 basis points per quarter.

Wall Street is majorly bullish on AMZN stock. Overall, shares have a consensus “Strong Buy" rating. Of the 55 analysts covering AMZN stock, 47 advise a “Strong Buy,” six suggest a “Moderate Buy,” and the remaining two analysts are on the sidelines with a “Hold” rating.

The average analyst price target for AMZN is $264.81, indicating potential upside of 14% from here. The Street-high target price of $305 suggests that the stock could rally as much as 31% from current levels.