/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

Amazon's (AMZN) massive grocery expansion sent shockwaves through delivery stocks, with Uber (UBER) shares falling 1% after the announcement as the e-commerce giant cranked up competitive pressure on gig-economy platforms.

Amazon announced same-day grocery delivery to over 1,000 cities, expanding to 2,300 locations by year-end, which Wedbush analysts called a "shot heard round the warehouse." The service integrates fresh groceries into Amazon's existing logistics network, allowing Prime members to order milk alongside electronics with free delivery on orders over $25.

The expansion represents Amazon's most significant grocery push, addressing a category where it has "struggled historically" with perishables. Previously, Prime grocery orders required separate Amazon Fresh or Whole Foods deliveries with higher minimums and fees.

Despite the competitive headwinds, Uber maintains its "Strong Buy" rating from analysts. The company's diversified platform extends beyond grocery delivery into ride-sharing, freight, and advertising, revenue streams that Amazon's grocery push doesn't directly threaten.

Amazon's move validates the massive grocery delivery market opportunity, which remains fragmented with room for multiple players. Uber's established driver network, restaurant partnerships, and operational efficiency could help defend market share.

Is Uber Stock a Good Buy Right Now?

Uber delivered a record-breaking quarter in Q2, showcasing the resilience of its platform strategy amid intensifying competition. CEO Dara Khosrowshahi highlighted the company's unique competitive advantage: consumers using both mobility and delivery services generate 35% higher retention rates and 3x the gross bookings of single-service users. With fewer than 20% of consumers currently active across both platforms, Uber sees massive expansion potential.

The appointment of Andrew McDonald as COO signals a focus on platform integration, with both mobility and delivery leaders now reporting to him. This structural change should accelerate cross-promotion efforts that leverage the company's 36 million Uber One members, who spend 3x more than non-members.

Uber's autonomous vehicle (AV) partnerships expanded significantly, with new deals involving Baidu (BIDU), Lucid (LCID), Nuro, and Wayve complementing existing Waymo operations. Uber revealed that average Waymo vehicles achieve higher utilization than 99% of human drivers, validating the economic model.

Management outlined three potential AV business models: merchant (predictable partner revenue), agency (revenue sharing), and asset ownership with software licensing. The $20 billion share buyback authorization demonstrates confidence in balancing AV investments with shareholder returns.

Uber's "barbell strategy" showed strong momentum, with premium services exceeding $10 billion in gross bookings (up 35%) while Moto two-wheeler services reached $1.5 billion (up 40%). Its ability to capture both ends of the market spectrum provides multiple growth vectors while competitors typically focus on single segments.

What is the Target Price for UBER Stock?

Analysts tracking UBER stock forecast revenue to increase from $44 billion in 2024 to $81.6 billion in 2029. Comparatively, free cash flow (FCF) is forecast to expand from $6.9 billion to $16 billion in this period. Today, the stock trades at 18.5x forward FCF, which is reasonable. If it can maintain a similar multiple, it could gain over 60% over the next three years.

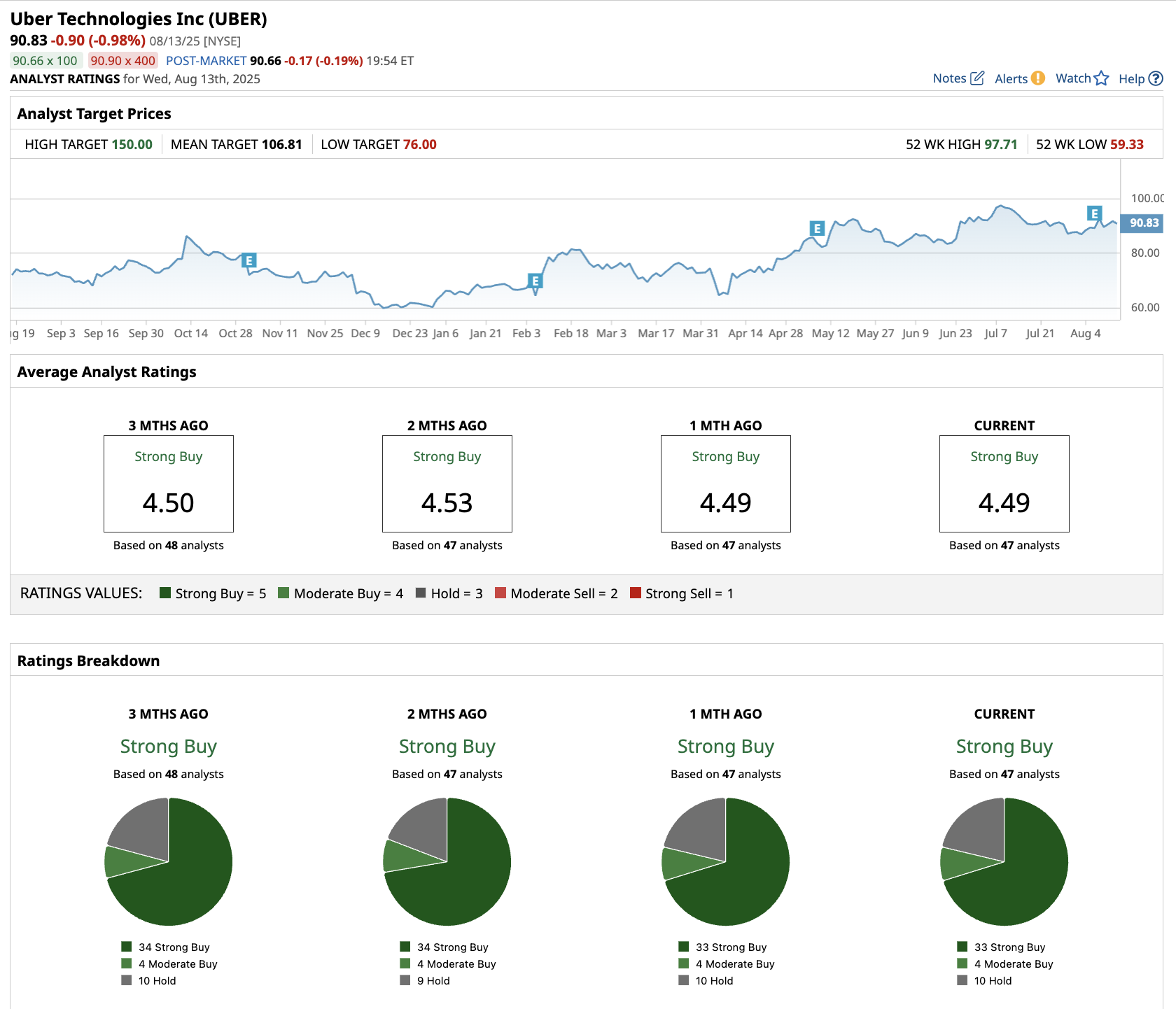

Of the 47 analysts covering UBER stock, 33 recommend “Strong Buy,” four recommend “Moderate Buy,” and 10 recommend “Hold.” The average price target is $107, above the current price of $91.

While Amazon's grocery expansion creates near-term pressure, Uber's broader ecosystem and execution track record suggest investors shouldn't rush to sell. The delivery wars are intensifying, but Uber has proven resilient in competitive battles before. Indeed, UBER stock has already bounced back about 2% since Amazon's announcement earlier this week.