Much like Meta Platforms (FB) yesterday, Amazon.com (AMZN) might not have to deliver a very strong earnings report to please Wall Street, but simply one that’s better than feared, given current e-commerce headwinds.

Among analysts polled by FactSet, the consensus is for the e-commerce and cloud giant to report first-quarter revenue of $116.45 billion (+7% Y/Y) and GAAP EPS of $8.35 (down 47%).

Amazon shares quarterly sales and operating income guidance in its reports. The company’s second-quarter revenue consensus stands at $125.33 billion (up 11%), and its GAAP operating income consensus stands at $6.78 billion (down 12%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Amazon’s earnings report, which is expected after the bell, along with an earnings call scheduled for 5:30 P.M. Eastern Time. (Please refresh your browser for updates.)

6:18 PM ET: Amazon's call has ended. Shares are currently down 9.2% after-hours to $2,627.

Amazon reported roughly in-line revenue, with AWS and North American segment sales beating consensus estimates and International sales (impacted some by a strong dollar) missing. Operating income missed estimates due to heavy spending and an estimated ~$6B in cost headwinds related to inflation and excess labor and infrastructure capacity. EPS also missed, but wasn't as bad as it first looks after backing out the impact of a $7.6B charge related to Amazon's investment in Rivian.

Q2 sales and op. income guidance were both below consensus. Amazon says the guidance is impacted by Prime Day's timing (it'll take place in July this year after happening in June last year), as well as another ~$4B in cost headwinds from the aforementioned factors.

On the earnings call, CFO Brian Olsavsky disclosed Amazon has cut its fulfillment/warehouse capex plans for the year. And IR chief Dave Fildes disclosed that AWS' contract backlog rose 68% Y/Y to $88.9B.

Thanks for joining us.

6:08 PM ET: A question about AWS backlog, and one about whether supply chain pressures are impacting ad sales.

Fildes: The AWS backlog was $88.9B at the end of March, up 68% Y/Y. Weighted-average contract length was 3.8 years.

Olsavsky: We're still pleased with how the ad business is performing. We continue rolling out new ad tools for sellers to leverage.

Of note: AWS backlog growth is well above revenue growth of 37%. That bodes well for AWS' ability to keep growing at a strong clip in the coming quarters.

6:05 PM ET: A question about buying habits for Prime and non-Prime customers.

Olsavsky: We're not seeing any difference in Prime versus non-Prime patterns. We're not seeing any signs of weakening consumer demand. But we're cognizant that consumers are dealing with higher inflation. We'll keep looking for ways to improve the customer experience.

6:03 PM ET: A question about the ~$4B in incremental costs Amazon expects in Q2. Does that cover all of the cost pressures Amazon is now seeing? Also one about whether spending seasonality will be different this year due to Amazon having excess capacity right now.

Olsavsky: Fixed-cost deleverage has been a cost headwind this year. Also, labor shortages created a lot of disruptions last year. That led us to hire aggressively, which then led us to be overstaffed. We expect this to dissipate in time.

He adds that other inflationary pressures, such as higher fuel and shipping costs, are lasting longer than Amazon once hoped. Says Amazon went through a very tumultuous two years and is now seeing a return to more normalized demand patterns. Also notes Q1 sales were up 60% relative to Q1 2020 levels.

5:57 PM ET: Olsavsky notes that Amazon's headcount (1.62M at the end of March) hit a peak of 1.7M in Q1 before decreasing a bit. He reiterates that Amazon is now working to improve warehouse/transportation productivity.

5:56 PM ET: A question about whether one-day/same-day shipping is driving incremental sales. Also one about high tech/content spending growth.

Olsavsky: We're approaching our pre-pandemic service levels. Lower shipping times drive additional sales. We're hopeful this will create more demand elasticity.

Fildes: For Q1, tech/content spending growth fell relative to 2021 levels. We're still investing heavily in AWS, and that shows up in this line item.

5:52 PM ET: A question about passing on higher costs. Also one about shipping cost growth: Is Amazon seeing savings from bringing more delivery in-house?

Olsavsky: We saw very high growth during the first year of the pandemic. This led paid units to jump. Our shipping costs are very competitive and we are seeing savings relative to using third parties. In addition, we wouldn't have all the capacity we have if solely relying on third parties. And 1-day shipping wouldn't be cost-effective.

Fildes: We're not immune to inflationary pressures on the cost side. Our pricing philosophy hasn't changed. We try to offer competitive pricing for our first-party sales. But we don't control the prices set by marketplace sellers. We did increase some fees for seller services due to the higher costs we're seeing.

5:47 PM ET: First question is about the Q2 sales guide. Also one about the Q2 op. income guide.

Olsavsky: Customer spending is still strong. We're still seeing strong activity among Prime members. We don't see macro headwinds on the demand side, though we do see them on the cost side.

Fildes: We expect to see $4B in incremental costs in Q2 related to the headwinds previously described, compared with $6B in Q1. We're working to reduce our fixed costs per unit.

5:44 PM ET: The Q&A session is starting.

5:44 PM ET: Regarding Q2 sales guidance, Olsavsky not surprisingly says it accounts for the impact of reopening headwinds. He also reiterates that the timing of Prime Day is a factor.

5:42 PM ET: Regarding capex, Olsavsky says infrastructure (driven by AWS capex) is now expected to account for 50% of 2022 capex, up from a recent 40%. Fulfillment capex is expected to be down Y/Y and transportation capex is now expected to be flat to down.

5:40 PM ET: Olsavsky notes that as Omicron subsided, Amazon transitioned from being understaffed to being overstaffed. He adds this created another $2B in incremental costs, and that Amazon expects to improve productivity in Q2.

Notably, he also says Amazon has cut its capex plans for 2022, and that excess capacity also created $2B in incremental costs in Q1.

5:37 PM ET: Olsavsky says labor and physical space are no longer the constraints they were last year, while adding Amazon is seeing widespread inflationary pressures (creating an estimated $2B in incremental costs). High shipping and fuel costs are called out.

5:35 PM ET: Olsavsky notes Q1 sales were near the high end of Amazon's guidance range. Also says spending/engagement among Prime members remains strong, and that (amid a U.S. Prime price hike) "millions" of new Prime members were added during the quarter.

5:34 PM ET: Olsavsky is talking.

5:32 PM ET: Amazon IR chief Dave Fildes is going over the safe-harbor statement. In recent quarters, Amazon's calls have featured prepared remarks from CFO Brian Olsavsky, after which Olsavsky and Fildes take questions from analysts.

5:31 PM ET: The call is starting.

5:27 PM ET: Amazon's earnings call should kick off in a few minutes.

5:20 PM ET: Amazon's stock is now down 11.6% after-hours to $2,545, hitting levels last seen in June 2020.

Considering how Meta's stock jumped post-earnings partly due to the company's decision to pare its spending growth, Amazon's decision to keep its foot on the pedal might be contributing some to its losses. Of course, such a willingness to sacrifice short-term profits to drive more long-term growth is completely in line with how Amazon has historically been run.

5:11 PM ET: As a reminder, Amazon's Q1 call starts at 5:30 ET. I'll be covering.

5:10 PM ET: Amazon ended Q1 with $66.4B in cash and marketable securities, and with $47.6B in long-term debt.

The unearned revenue balance, much of which consists of annual Prime fees that Amazon hasn't yet recognized on its income statement, rose by $1B Q/Q to $12.8B.

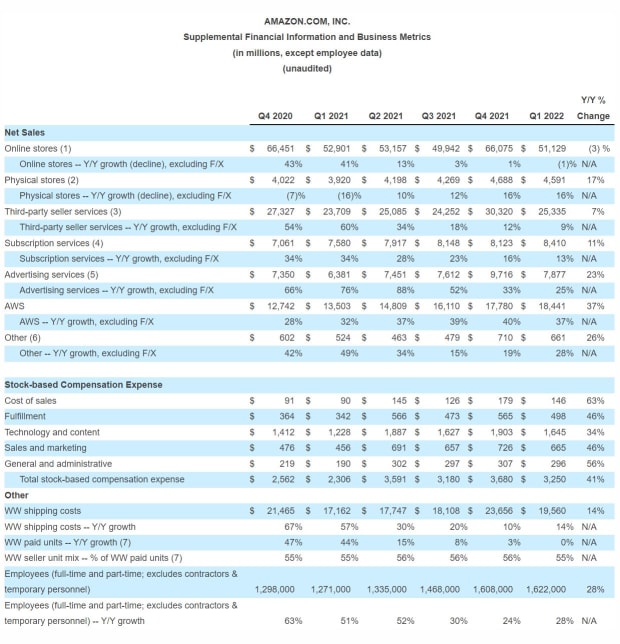

5:03 PM ET: Some of Amazon's key Q1 metrics. The non-stop shift towards services revenue streams stands out (though there might be a question or two on the call about the slowdown in ad growth), as does the headcount growth.

Also notable that (amid a broader slowdown in e-commerce spend) Amazon's paid units were flat Y/Y. But worth noting that with paid units up 44% in the year-ago quarter, the company was facing a tough annual comp.

4:57 PM ET: Amazon continues spending a ton on capex, much of it to build its fulfillment and delivery infrastructure. Direct purchases of property and equipment rose 24% Y/Y to $14.95B. That spelled trailing 12-month (TTM) purchases of $63.92B.

4:54 PM ET: Amazon's Q1 operating expenses:

Fulfillment +23% Y/Y to $20.27B

Tech and content +19% to $14.84B

Sales and marketing +34% to $8.32B

G&A +30% to $2.59B

Fulfillment and G&A's growth rates increased slightly relative to Q4, while tech/content and sales/marketing's growth rates were lower. But growth rates for all 4 expense line items were soundly above Q1 revenue growth of 7%, which in turn pressured Amazon's op. income.

4:45 PM ET: On the flip side, Amazon reported a $1.57B op. loss for its North American segment and a $1.28B op. loss for its International segment. Those numbers respectively compare with year-ago op. income of $3.45B and $1.25B.

4:44 PM ET: AWS remains a clear bright spot for Amazon: In addition growing 37% and topping its revenue consensus, the public cloud giant post Q1 op. income of $6.52B, up 57% Y/Y and soundly above a $5.62B consensus.

4:41 PM ET: Shipping costs rose 14% Y/Y to $19.56B. That's up from 10% in Q4 and exceeded both Amazon's North American and International growth rates (+8% and -6%, respectively).

4:39 PM ET: Amazon's GAAP gross margin (GM) came in at 42.9%, up from 42.6% a year ago and slightly above a 42.7% consensus.

The company's ongoing mix shift towards services revenue streams (AWS, seller services, ads, subscriptions) remains a GM tailwind, while heavy capex and shipping cost growth have been GM headwinds.

4:33 PM ET: Amazon's headcount rose by 28% Y/Y to 1.62M. Also, unlike many prior years, headcount rose slightly relative to seasonally big Q4.

4:32 PM ET: Amazon's Q1 sales by revenue stream:

Online stores (direct e-commerce) -3% Y/Y to $51.12B, below a $51.76B consensus

Third-party seller services (marketplace commissions, fulfillment services, etc.) +7% to $25.34B, above a $24.64B consensus

Subscription services (dominated by Prime fees) +11% to $8.41B, below an $8.61B consensus

Ad sales +23% to $7.88B, below an $8.18B consensus

Physical stores (dominated by Whole Foods) +17% to $4.59B, above a $4.29B consensus

"Other" revenue +26% to $661M, below a $1.08B consensus (might not be an up-to-date consensus # given accounting changes)

4:25 PM ET: Regarding Prime Day, Amazon says it'll take place in July this year in more than 20 countries. Given that Prime Day took place in June last year, some analysts might've baked Prime Day sales into their Q2 revenue estimates.

4:22 PM ET: Here's the earnings release.

4:20 PM ET: Amazon spent $2.67B on buybacks in Q1. Not a huge number for a company of its size, but still the first repurchases the company has made since 2012. A $10B buyback authorization was announced in March.

4:18 PM ET: Andy Jassy: "Today, as we’re no longer chasing physical or staffing capacity, our teams are squarely focused on improving productivity and cost efficiencies throughout our fulfillment network. We know how to do this and have done it before. This may take some time, particularly as we work through ongoing inflationary and supply chain pressures, but we see encouraging progress on a number of customer experience dimensions, including delivery speed performance as we’re now approaching levels not seen since the months immediately preceding the pandemic in early 2020."

4:16 PM ET: Amazon is still off sharply: Shares are down 9.5% AH and making new 52-week lows, The operating income numbers might be more of a concern for markets than the top-line numbers, given pre-earnings expectations.

4:14 PM ET: Q1 GAAP operating income, which isn't affected by the Rivian charge, came in at $3.67B. That's down from $8.87B a year ago and below a $5.32B consensus.

4:11 PM ET: Amazon's Q1 sales by segment:

North America +8% Y/Y to $69.22B, above a $68.04B consensus

International -6% to $28.76B, below a $30.1B consensus

AWS +37% to $18.44B, above an $18.34B consensus

Notably, International growth saw a 6-point forex hit. That compares with a 4-point hit in Q4.

4:06 PM ET: Notably, Amazon says its Q2 sales guidance assumes Prime Day occurs in Q3 this year. It took place in Q2 last year.

4:06 PM ET: Amazon is guiding for Q2 operating income of negative $1B to positive $3B, below a consensus of $6.78B.

4:04 PM ET: Shares are down 9.8% after-hours to $2,610.

4:03 PM ET: For Q2, Amazon is guiding for revenue of $116B-$121B, below a $125.33B consensus.

4:02 PM ET: Results are out. Revenue of $116.44B is roughly in-line. EPS is officially negative $7.56, but that's due to a $7.6B charge related to Amazon's investment in Rivian.

4:00 PM ET: Amazon's stock rose 4.7% today heading into its report amid a broad tech rally, but still down 13% YTD and 16% over the last 12 months. Results should be out any minute.

3:55 PM ET: The FactSet consensus is for Amazon to report Q1 revenue of $116.45B and GAAP EPS of $8.35.

For Q2, Amazon’s revenue consensus is at $125.33B. It’s possible that informal expectations are lower, given what’s been reported lately about e-commerce trends.

3:52 PM ET: Hi, this is Eric Jhonsa. I’ll be live-blogging Amazon’s Q1 report and call.