/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

Alibaba (BABA) stock has rallied significantly, climbing nearly 72% year-to-date as investor confidence remains high for one of China’s top technology companies. The rally is not just a relief bounce after years of regulatory pressure. It reflects structural improvements across Alibaba’s core businesses, particularly e-commerce and cloud. Moreover, management’s effort to streamline operations and drive earnings is a positive.

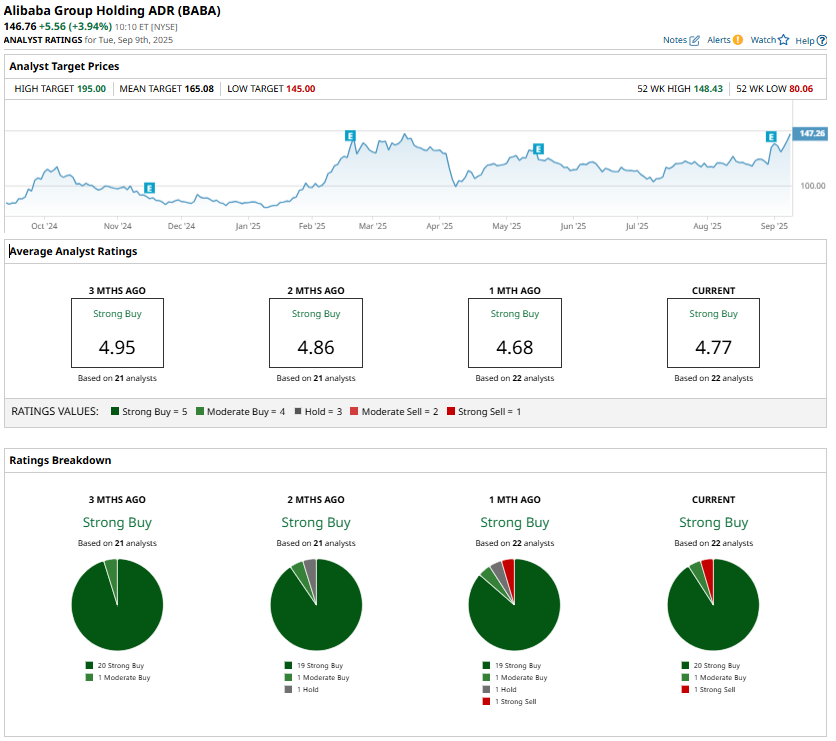

Thanks to these positive developments and significant artificial intelligence (AI)-driven opportunities, Wall Street analysts maintain a bullish stance on BABA stock. The highest price target for BABA stock is $195, reflecting 35% upside from current price levels.

Alibaba E-Commerce: A Rebound in Domestic Consumption

Alibaba’s e-commerce segment remains its key growth catalyst, and recent numbers suggest a steady consumer demand. Revenue from the China e-commerce business rose 10% year-over-year during the latest quarter. Moreover, customer management revenue also improved, thanks to better monetization through higher take rates.

Its high-value customers are also sticking around. The number of 88VIP members, Alibaba’s premium consumer group, rose by double digits to surpass 53 million, showing resilience in high-spending segments.

Alibaba has been expanding into quick commerce as well, a sector that has seen fast adoption in China. Revenue in this segment grew 12%, with Taobao Instant Commerce driving order growth since its rollout earlier this year. It has broadened product categories beyond food and increased front warehouse coverage. Moreover, by linking quick commerce with its broader ecosystem, Alibaba is starting to capture synergies across supply chains, memberships, and user bases.

However, not everything is moving in the same direction. Adjusted EBITDA for the China e-commerce business fell 21% due to heavy investments in quick commerce. Stripping out these investments, profitability actually grew year-over-year, highlighting that the core business remains healthy despite short-term costs.

Alibaba International Digital Commerce (AIDC), which includes cross-border operations, grew 19%. Its EBITDA losses narrowed significantly, bringing the business close to breakeven, a positive sign for long-term global expansion.

Cloud and AI: Alibaba’s Emerging Growth Engine

While e-commerce provides a solid foundation for future growth, Alibaba’s Cloud Intelligence Group is quickly emerging as the company’s new growth driver. Revenue growth in the segment accelerated to 26% year-over-year, with AI-related products posting triple-digit growth for the eighth consecutive quarter.

AI is no longer just a side bet for Alibaba, as it now contributes over 20% of the company's external cloud revenue. AI is also driving demand for compute, storage, and other public cloud services to support AI adoption. This growing adoption reflects Alibaba’s position as a key infrastructure provider for China’s AI-driven digital transformation.

With AI adoption across industries accelerating, Alibaba’s investments in AI and cloud infrastructure are positioning it to capture long-term enterprise demand.

Alibaba Stock Outlook: Can the Rally Continue?

Looking ahead, Alibaba’s growth strategy revolves around two pillars, including China’s e-commerce business and AI-driven cloud infrastructure. In commerce, integrating multiple businesses under the China e-commerce umbrella is creating stronger synergies across supply chains, loyalty programs, and user networks. This positions Alibaba to better capture evolving consumer demand in a competitive retail landscape.

On the technology side, AI is emerging as a significant growth driver. As enterprises scale their AI workloads, Alibaba Cloud is set to benefit from rising infrastructure demand. Further, the company’s aggressive investment in AI infrastructure shows that it is well-positioned to capitalize on this secular trend.

Still, risks remain. Heavy investments in quick commerce may continue to pressure margins in the short term, while global economic uncertainty could affect cross-border businesses. On the cloud side, Alibaba faces fierce competition from both domestic rivals and international players.

Nonetheless, Alibaba is expanding its consumption ecosystem and capturing the AI-driven cloud demand, which suggests that the momentum in its business and stock will likely sustain.

Wall Street analysts are optimistic and maintain a “Strong Buy” consensus rating on BABA stock.