/Alibaba%20by%20testing%20via%20Shutterstock.jpg)

With a year-to-date (YTD) gain of nearly 70%, Alibaba's (BABA) stock has outperformed the markets significantly this year. The Chinese tech giant, which was once the face of China’s brutal tech crackdown, is now back in the government’s good graces as the country backs its domestic companies amid the artificial intelligence (AI) upmanship between the U.S. and China.

Alibaba is among the prominent AI plays in China and has attracted interest from investors seeking to capitalize on the China AI story. In my previous article, I had noted that it made sense to buy the dip in BABA stock. The stock has since rebounded and only gained traction following the release of the June quarter earnings. In this article, we’ll look at the forecast for BABA stock, but before that, let’s briefly analyze its fiscal Q1 2026 earnings.

Alibaba Posted Mixed Q1 Earnings

Alibaba posted a mixed set of numbers for the fiscal first quarter. The company’s revenues rose merely 2% to $34.57 billion, and while the growth after accounting for disposed businesses was a healthy 10%, the metric nonetheless fell short of estimates. Alibaba’s operating income also fell 3% to $4.88 billion. Its net income rose 76% year-over-year to $6.01 billion, coming in ahead of Street estimates. However, the sharp rise was predominantly driven by gains on asset disposals and mark-to-market changes in equity investments. The company’s instant commerce business continues to grow at a fast pace, and last month, the monthly active users approached 300 million.

It was at best a moderate performance from Alibaba in Q1, but the stock soared following the confessional amid optimism over the company’s cloud and AI business.

Alibaba’s Earnings Had AI Written All Over It

Alibaba’s earnings had AI written all over them, and the “magic word” featured prominently in both the prepared release and earnings call. The strategic direction management is trying to steer Alibaba was obvious when the management talked about AI first and mentioned other core businesses later.

Cloud Intelligence Group, which houses the company’s cloud and AI businesses, saw a 26% rise in revenues in the June quarter. Alibaba said that AI-related revenue accounted for a fifth of revenues from external customers in its Cloud business, while emphasizing that the business has grown in triple digits for eight consecutive quarters.

The company is also reportedly working on its own AI chip, which would not only help it reduce reliance on Nvidia (NVDA) but also potentially open up revenue opportunities from third-party customers.

What Makes Alibaba a Prominent AI Play

Alibaba is a prominent AI player in China and has partnered with several companies, including BMW (BMWKY) and SAP (SAP). It is also collaborating with Apple (AAPL) to bring “Apple Intelligence” features to iPhones in China.

Given China’s strict data policies, any foreign company looking to offer AI services in China might need to partner with domestic Chinese companies, which is an opportunity for Chinese AI giants like Alibaba.

BABA Stock Forecast

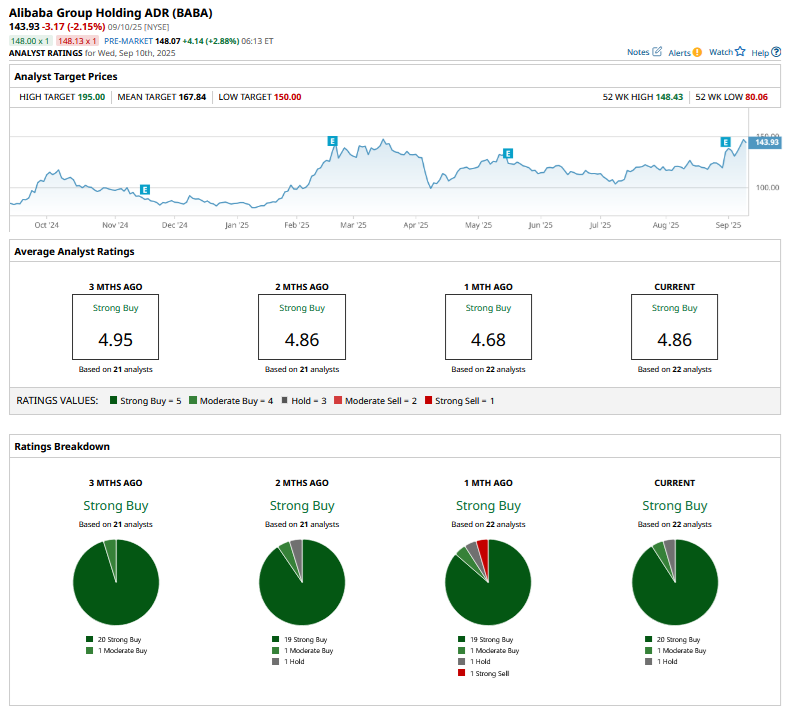

Brokerages turned incrementally bullish on Alibaba, and several raised BABA's target price following the fiscal Q1 earnings. Among others, Benchmark, Bank of America, Baird, J.P. Morgan, Barclays, and Mizuho bumped up BABA's target price, with Benchmark raising its target to a Street-high of $195. Arete Research upgraded BABA stock from a “neutral” to “buy” while raising its target price to $152. Overall, BABA is rated a “Strong Buy” by the 22 analysts polled by Barchart, while the stock’s mean target price is $167.84, about 16% higher than the Sept. 10 closing prices.

Should You Buy BABA Stock?

I have been bullish on BABA stock for quite some time now and have used drawdowns of the kind we saw earlier this year to add to my positions. I remain bullish on Alibaba, and while the forward price-to-earnings (P/E) multiple of 19.1x might seem a bit high for comfort, the multiple looks elevated given the short-term earnings impact from the losses in its instant e-commerce business.

Life has come full circle for Chinese tech companies, particularly Alibaba, and far from cracking down, the Chinese government is now backing its tech companies amid the apparent AI war with the U.S. The changed stance bodes well for valuations of Chinese companies, which had become “uninvestible” for many funds following the 2021 tech crackdown.

Both AI and instant commerce, which Alibaba has termed “2 huge historic opportunities,” would drive the company’s growth over the long term, and I feel comfortable holding my shares at the current price levels even as arguably the stock’s margin of safety in the short term is not as enticing as it was a couple of months back.