With a market cap of $10.7 billion, Albemarle Corporation (ALB) is a leading global specialty chemicals company with strong positions across diverse end markets. Through its Energy Storage, Specialties, and Ketjen segments, the company delivers advanced lithium, bromine, and catalyst solutions that power cleaner energy, advanced materials, and sustainable technologies worldwide.

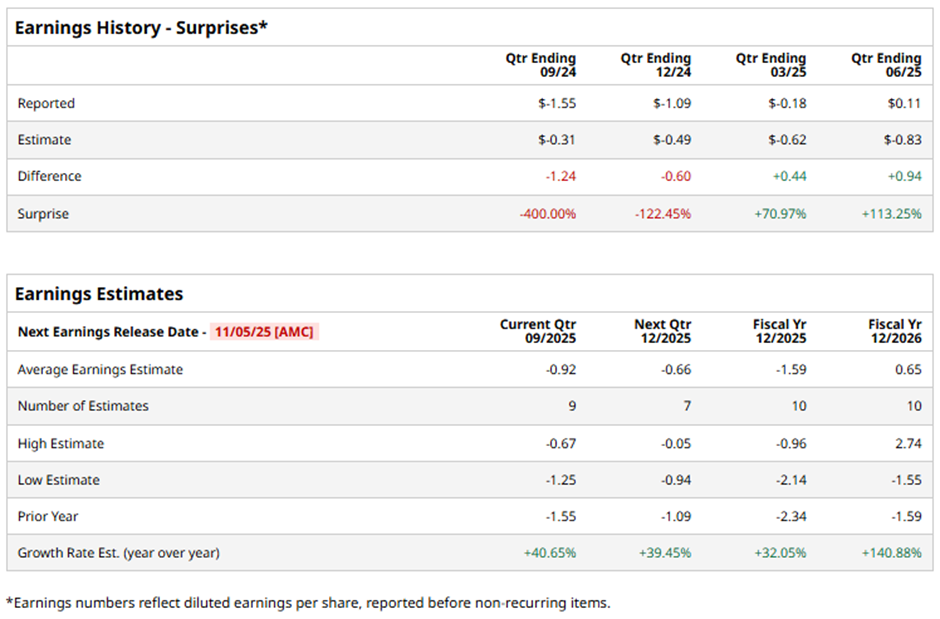

The Charlotte, North Carolina-based company is expected to release its fiscal Q3 2025 results after the market closes on Wednesday, Nov. 5. Ahead of this event, analysts project ALB to report an adjusted loss of $0.92 per share, an improvement of 40.7% from the adjusted loss of $1.55 per share in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in two of the last four quarterly reports while missing on two other occasions.

For fiscal 2025, analysts forecast the specialty chemicals company to report an adjusted loss of $1.59 per share, up 32.1% from the adjusted loss of $2.34 per share in fiscal 2024. Moreover, adjusted EPS is anticipated to grow significantly 140.9% year-over-year to $0.65 in fiscal 2026.

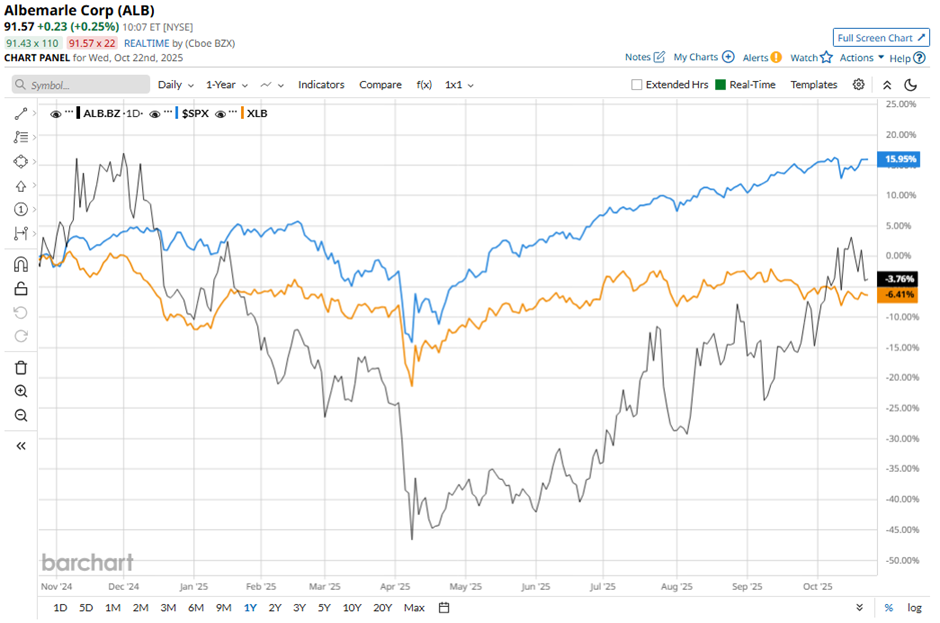

ALB stock has declined 5.5% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 15.2% gain. However, the stock has shown a less pronounced dip than the Materials Select Sector SPDR Fund's (XLB) 7.7% drop over the same time frame.

Despite Albemarle’s better-than-expected Q2 2025 adjusted EPS of $0.11 and revenue of $1.3 billion on Jul. 30, shares fell 1.5% the next day due to lingering concerns over the lithium market. Lithium prices have plunged more than 90% in the past two years, pressuring margins and driving Albemarle to cut jobs, cancel projects, including a key U.S. refinery and lower its annual capital expenditure guidance to $650 million - $750 million.

Analysts' consensus view on ALB stock is cautious, with an overall "Hold" rating. Among 25 analysts covering the stock, six suggest a "Strong Buy," two give a "Moderate Buy," 15 recommend a "Hold," and two "Strong Sells." As of writing, the stock is trading above the average analyst price target of $91.17.