/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $11.7 billion, Akamai Technologies, Inc. (AKAM) is a prominent cloud and cybersecurity company headquartered in Cambridge, Massachusetts. Founded in 1998, Akamai operates one of the world’s largest distributed computing platforms, known for powering a significant share of global internet traffic.

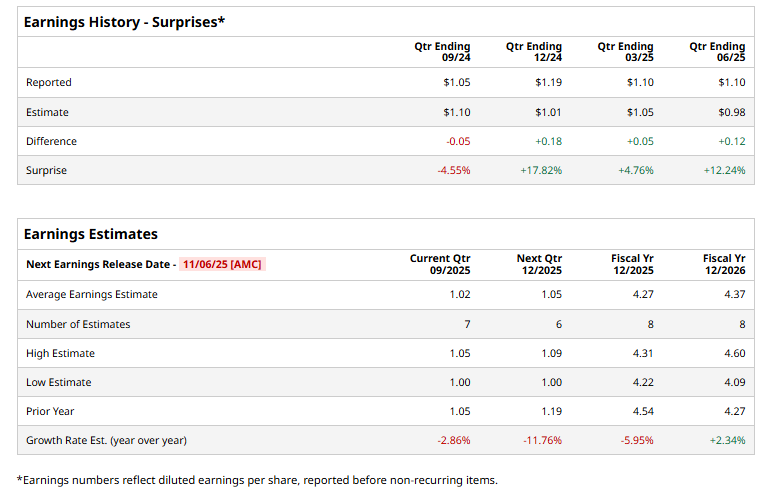

AKAM is slated to announce its fiscal Q3 2025 earnings results after the market closes on Thursday, Nov. 6. Ahead of this event, analysts expect the company to report a profit of $1.02 per share, a 2.9% drop from $1.05 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the company to report EPS of $4.27, a 6% fall from $4.54 in fiscal 2024. However, EPS is anticipated to rebound in 2026, rising 2.3% annually to $4.37.

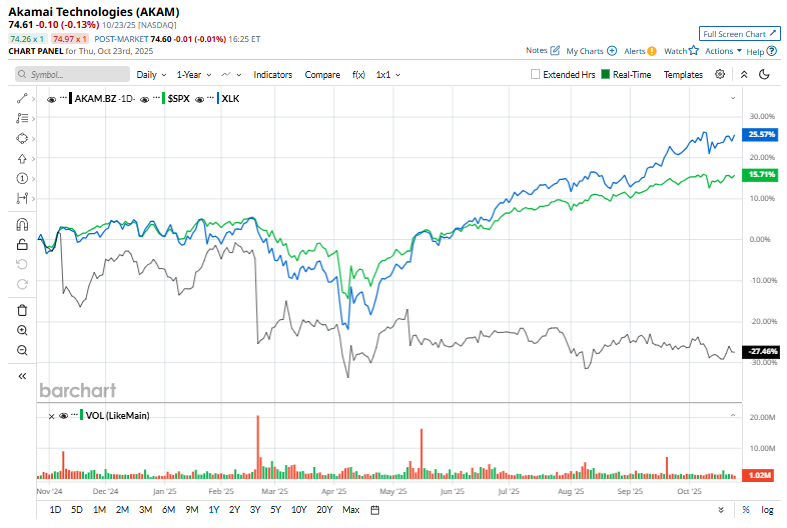

Shares of Akamai Technologies have declined 16% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 14.5% rise and the Technology Select Sector SPDR Fund's (XLK) 7.6% gain over the same period.

Shares of Akamai rose 2.9% on Oct. 2 after the company announced an expanded partnership with Apiiro, a leading agentic application security platform. The collaboration integrates Akamai’s application and API security solutions with Apiiro’s security posture management tools to provide end-to-end protection across the entire software development lifecycle.

Analysts' consensus view on Akamai Technologies stock remains cautious, with a "Hold" rating overall. Out of 21 analysts covering the stock, seven recommend a "Strong Buy," one "Moderate Buy," nine "Holds," one “Moderate Sell,” and three "Strong Sell." Its mean price target of $92.26 represents a premium of 23.7% from the current market prices.