/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $11.8 billion, Akamai Technologies, Inc. (AKAM) is a global leader in content delivery network (CDN) services, cloud cybersecurity, and edge computing solutions. Headquartered in Cambridge, Massachusetts, the company helps businesses deliver and secure digital experiences for users worldwide.

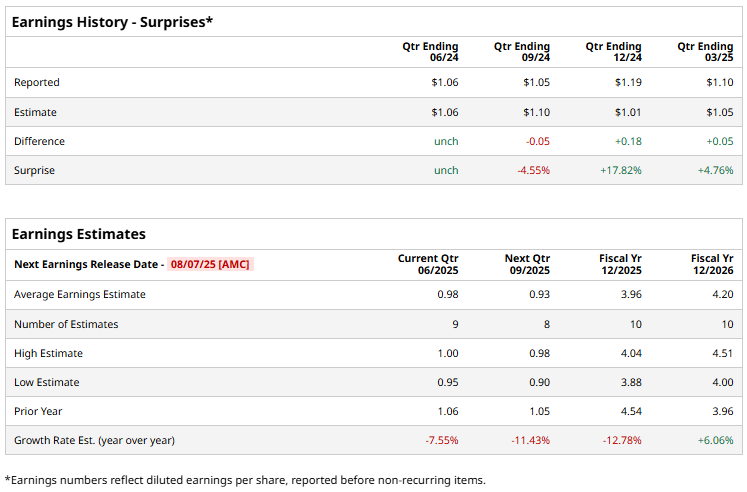

AKAM is slated to announce its fiscal Q2 2025 earnings results after the market closes on Thursday, Aug. 7. Ahead of this event, analysts expect the company to report a profit of $0.98 per share, a 7.6% drop from $1.06 per share in the year-ago quarter. It has exceeded or met Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the company to report EPS of $3.96, a 12.8% fall from $4.54 in fiscal 2024. However, EPS is anticipated to rebound in 2026, rising 6.1% year-over-year to $4.20.

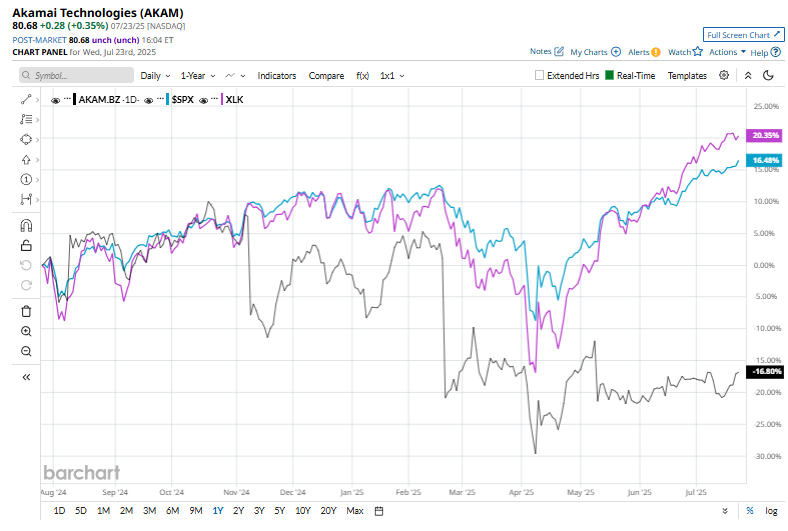

Shares of Akamai Technologies have declined 16% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 14.5% rise and the Technology Select Sector SPDR Fund's (XLK) 7.6% gain over the same period.

On May 8, Akamai Technologies reported its first-quarter earnings, with revenue rising 2.9% year-over-year to $1 billion, slightly ahead of consensus estimates. Adjusted earnings per share came in at $1.70, marking a 3.7% increase from the prior-year quarter and surpassing Wall Street expectations by 7.6%.

Despite the solid beat, the stock plunged 10.8% in the following trading session. The sell-off was likely triggered by a decline in delivery revenue and the company’s underwhelming full-year adjusted EPS guidance of $6.10 to $6.40, which appeared to cast doubt on Akamai’s near-term growth trajectory.

Analysts' consensus view on Akamai Technologies stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 19 analysts covering the stock, eight recommend a "Strong Buy," one "Moderate Buy," eight "Holds," and two "Strong Sell." Its mean price target of $96.78 represents a premium of 20% from the current market prices.