Bitcoin (BTCUSD) mining companies were expected to quickly go bust as they were unable to cope with Bitcoin's block rewards being halved in the last halving event. Even though the significant increase in Bitcoin's price compensated for that and then some, mining companies were still unable to pull off a notable recovery.

This caused many to take a creative approach. These companies use GPUs to mine Bitcoin, and the same hardware can be used for artificial intelligence (AI) and cloud computing purposes. As such, some of them started to use AI as a fig leaf to drive investor attention, but it is quickly becoming a serious endeavor. Applied Digital (APLD) has successfully pulled it off, and more are following in its footsteps.

Tech giants are racing to secure as much capacity as possible, and this demand is expected to lift the following two companies, which are mainly known for being crypto miners.

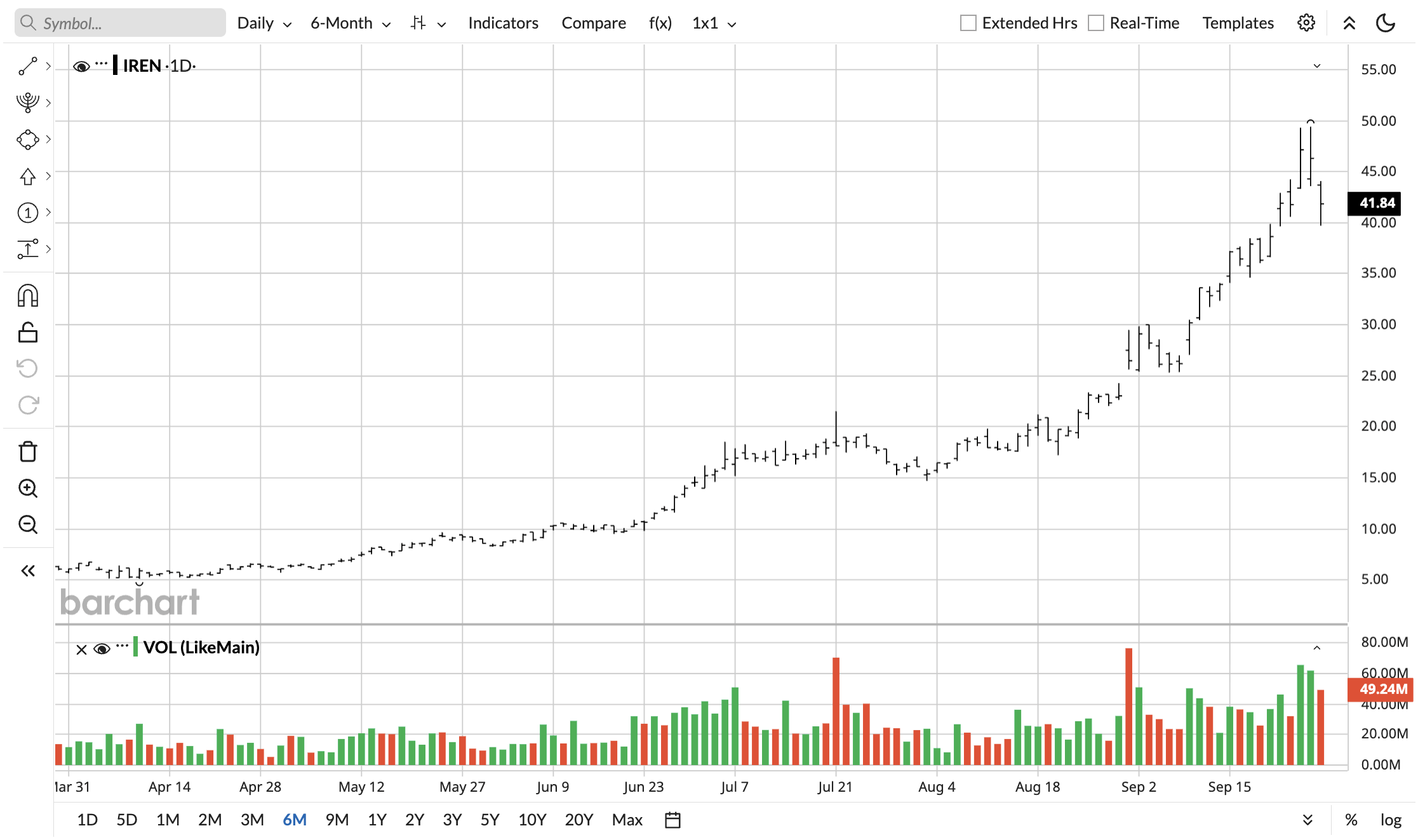

IREN Limited (IREN)

IREN Limited (IREN) is one of the standout performers among companies pivoting from Bitcoin to AI. The company recently doubled its AI cloud capacity to 23,000 GPUs after purchasing an additional 12,400 units for approximately $674 million. This purchase included 7,100 Nvidia (NVDA) Blackwell B300s, 4,200 B200s, and 1,100 AMD (AMD) MI350X processors.

IREN is now targeting $500 million in AI cloud annualized recurring revenue (ARR) by the first quarter of 2026. In Q1 2025, ARR was $14 million.

Bitcoin mining generates approximately $1 billion in annualized revenue under current market conditions, and its AI cloud business is scaling at nearly 100% incremental margins. The company is approaching $1.25 billion in annualized revenue with significant growth potential.

IREN stock has already been up 526% in just the past six months and 1,080% in the past 24 months.

It recently received its highest-ever price target of $82 from Roth/MKM. The mean price target of $36.2 still implies 14% downside, but the momentum may woo more analysts to the bullish side.

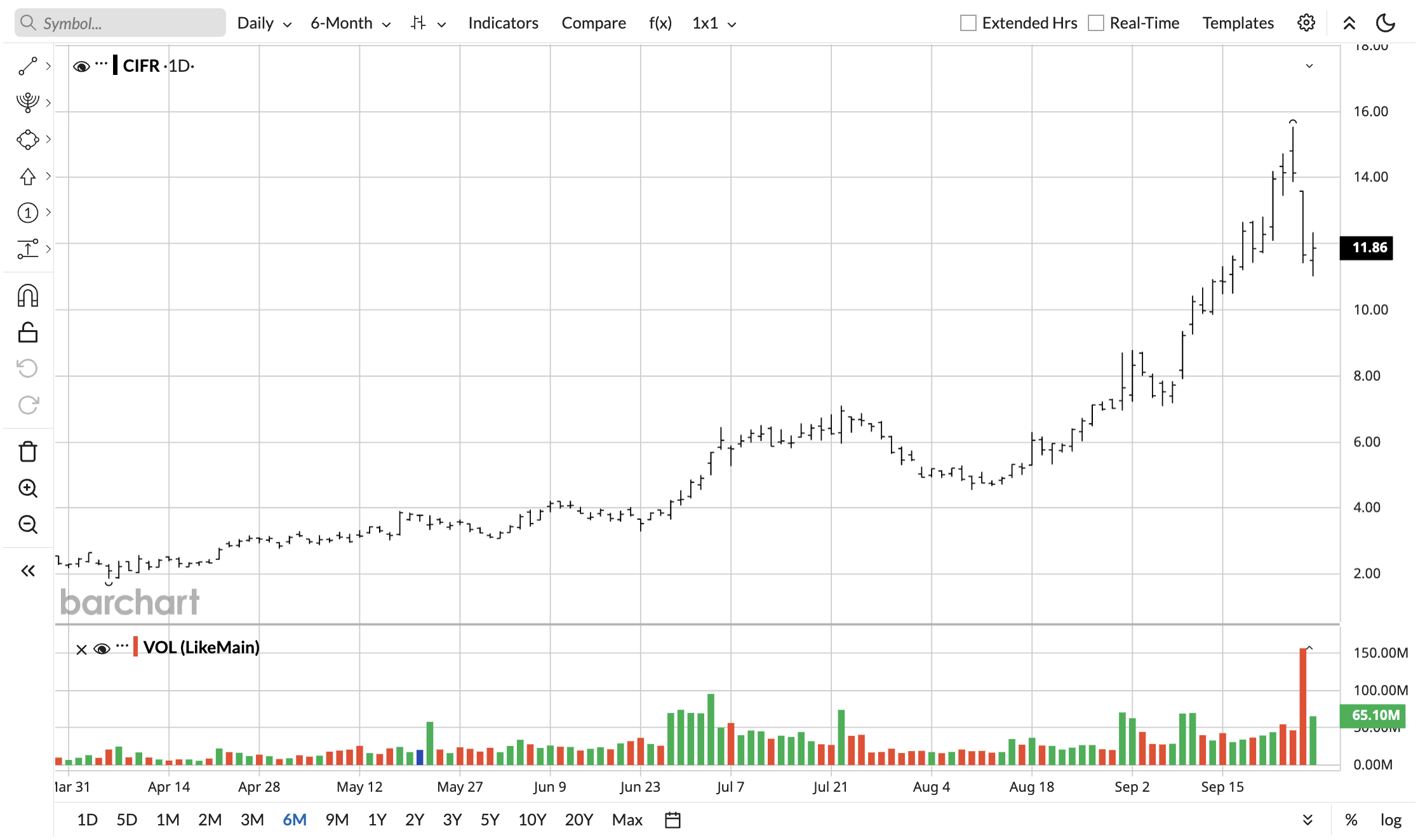

Cipher Mining (CIFR)

Cipher Mining (CIFR) has been similarly explosive, up 70.6% in just the past month.

It secured one of the most significant validation deals in the Bitcoin-to-AI transition. It inked a $3 billion agreement with AI computing firm Fluidstack that includes Google's (GOOG) (GOOGL) backing of $1.4 billion in lease commitments. The total contract revenue could be up to $7 billion.

Alphabet's investment comes with a 5.4% equity stake in Cipher Mining through warrants for approximately 24 million shares. Cipher's 587-acre facility in Colorado City, Texas, will provide 168 megawatts of computational power with potential expansion to 500 megawatts.

The caveat is that Cipher has heavier exposure to debt and has been quite dilutive. However, bulls believe that the growth offsets the negative bottom line and the debt.

CIFR stock's highest price target is $12, with the mean price target of $7.82 still implying some downside risk. Like IREN, analysts can get more bullish if the crypto plus AI rally restarts in earnest.