/Agilent%20Technologies%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $30.6 billion, Agilent Technologies, Inc. (A), is a global leader in life sciences, diagnostics, and applied chemical markets, headquartered in Santa Clara, California. Established in 1999 as a spin-off from Hewlett-Packard, Agilent provides laboratories worldwide with instruments, software, services, and consumables.

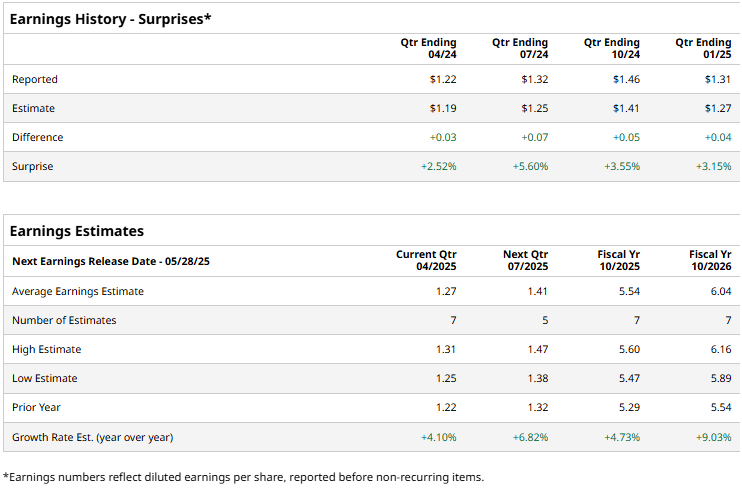

The life science titan is all set to release its fiscal second-quarter earnings after the market closes on Wednesday, May 28. Ahead of the event, analysts expect A to report a profit of $1.27 per share on a diluted basis, up 4.1% from $1.22 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in all of its last four quarterly reports.

For the current year ending in October, analysts expect A to report EPS of $5.54, up 4.7% from $5.29 in fiscal 2024. Moreover, its EPS is expected to rise 9% year over year to $6.04 in fiscal 2026.

Shares of A have declined 23% over the past year, trailing the S&P 500’s ($SPX) 8.7% gains and the Health Care Select Sector SPDR Fund’s (XLV) marginal dip over the same time frame.

Agilent stock plunged 5.5% following its fiscal Q1 earnings release on February 26. The company reported adjusted EPS of $1.31, marking a nearly 2% year-over-year increase and surpassing Wall Street’s forecast of $1.27. Revenue also edged up 1.4% to $1.7 billion, slightly ahead of projections. However, the sharp decline in share price was driven by weaker-than-expected guidance.

For the second quarter, Agilent projected revenue between $1.61 billion and $1.65 billion, below analyst estimates. For FY2025, the company expects revenue to range from $6.68 billion to $6.76 billion, reflecting modest growth of 2.6% to 3.8%, with non-GAAP EPS forecasted between $5.54 and $5.61.

However, analysts’ consensus opinion on A stock is fairly bullish, with a “Moderate Buy” rating overall. Among the 16 analysts covering the stock, opinions are evenly split, with half recommending a “Strong Buy,” while the remaining half suggest a “Hold” for the stock.

A’s average analyst price target is $139, indicating a potential upside of 29.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.