/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

In the blink of an eye, CoreWeave (CRWV) became one of Wall Street's most closely watched artificial intelligence (AI) infrastructure bets. CRWV stock jumped on Cantor Fitzgerald’s initiation at “Overweight” with a $116 price target in reference to its strategic partnership with Nvidia (NVDA) and increasing Nvidia-based generative AI workload demand. It followed shortly after Nvidia’s record-breaking quarter, which reaffirmed its spot at the epicenter of the AI juggernaut.

Everything is in place: hyperscale spending on data centers is skyrocketing, inference computational workloads are rising exponentially, and infrastructure investment driven by artificial intelligence is outpacing supply. That is why CoreWeave’s role as an artificial intelligence-focused hyperscaler, based entirely on Nvidia GPUs, has become a prime enabler in the artificial intelligence economy.

About CRWV Stock

CoreWeave is a New Jersey cloud computing company with a specialty in AI infrastructure. Also known as the “AI hyperscaler,” it offers access to GPU-accelerated computing power for research labs, developers, and enterprises. As it is an entirely Nvidia-powered infrastructure company, it is a partner of choice for large language model (LLM) training, inference, and other high-demanding applications for artificial intelligence. Its market capitalization is over $47 billion.

CRWV has had a bumpy ride since the IPO, ranging between $33.51 and $187 per share over the last 52 weeks. CoreWeave now trades in the $104 handle, up more than 13% in the recent five days but still far short of its 2025 highs. That compares with a nearly 25% increase in the same period by the S&P 500 Index ($SPX), which reflects risk as well as upside potential in CoreWeave’s story of growth.

Valuation remains stretched in line with robust expectations for expansion. CoreWeave has a 13.4x price-to-sales (P/S) multiple and 15.8x price-to-book (P/B) multiple, but still incurs net losses on a GAAP basis since debt costs are so onerous in addition to spending for expansion. Most cloud infrastructure peers are lower-multiple compared, though its 62% adjusted EBITDA margin shows it benefits equally in scalability relative to larger hyperscalers.

As it does not pay a dividend at this time, it invests heavily in expansion.

CoreWeave Beats on Earnings

CoreWeave in Q2 2025 generated record revenue of $1.21 billion, compared with $395 million in the same quarter a year ago, which is over three times larger. Its adjusted EBITDA rose to $753 million, reflecting margin strength, whereas GAAP results reported a net loss of $290 million due to $267 million in interest expense. Its GAAP operating margin dropped sharply to a 2% result, while its adjusted margins remained robust at 16%.

Management hasn't provided formal EPS guidance but has indicated that demand visibility is supported by a $30.1 billion revenue backlog, including the expansion of its $11.9 billion OpenAI contract, along with new enterprise deals with BT Group, Cohere, LG CNS, and Woven, a subsidiary of major automobile maker Toyota (TM). It further revealed technology leadership achievements, including the first at-scale deployment of Nvidia’s Blackwell GB200 systems, besides announcing new developer products based on its acquisition of Weights & Biases.

Besides financial results, CoreWeave is expanding aggressively as well. It ended Q2 with operating power capacity at 470 MW and raised total contracted power to 2.2 GW, a sign of the infrastructure race underway in AI. CoreWeave raised $2 billion in senior notes at 9.25% last month, but its liquidity is still robust enough for expansion financing.

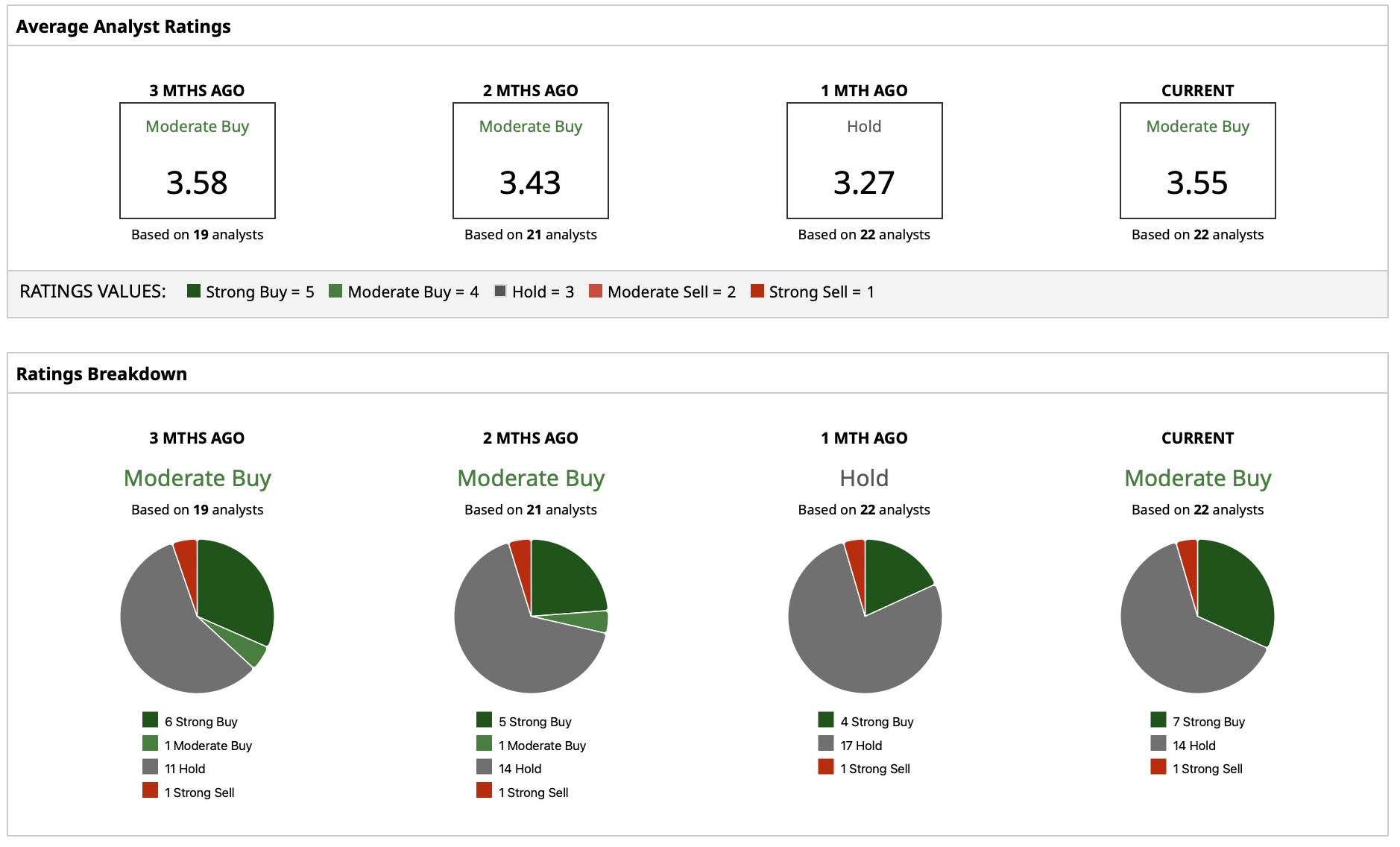

What Do Analysts Expect for CRWV Stock?

Wall Street sentiment became bullish in reaction to Nvidia’s quarter and CoreWeave’s Q2. Cantor Fitzgerald’s “Overweight” rating and $116 target reflect the company's robust secular exposure to artificial intelligence trends and its unique software-driven hyperscaler position.

CoreWeave receives a “Strong Buy” rating consensus with an average target price of $128.10, indicating a potential upside of nearly 23% compared to current levels. The street-record high target is $200, while the low is $32, which embodies both bullish conviction and increased risk.

.png?w=600)