Adtran Holdings Inc. (NASDAQ:ADTN) shares dropped 9.96% to $9.40 in after-hours trading on Monday after announcing a $150 million convertible senior notes offering.

According to Benzinga Pro data, the stock closed regular trading at $10.44, up 3.26%.

Check out the current price of ADTN stock here.

Notes Structure And Terms

The Huntsville-based networking company plans to offer convertible notes due in 2030 through a private placement to qualified institutional buyers. Initial buyers will have the option to purchase an additional $22.5 million in notes.

See Also: Ahead Of Fed Rate Meeting, BlackRock Remains ‘Risk-On’ US Equities Despite Sticky Core Inflation

These unsecured notes will mature on September 15, 2030, with interest paid semi-annually. Noteholders will be able to convert the notes under certain conditions, with Adtran settling up to the principal amount in cash.

Redemption, Capital Use

The telecom provider can redeem notes starting September 20, 2028, if the stock exceeds 130% of the conversion price. Proceeds will fund capped call transactions and repay existing credit agreement borrowings from July 2022.

Market Impact Concerns

According to the company’s press release, as part of the offering, Adtran plans to enter into capped call transactions to help minimize dilution when the notes are converted. However, the company cautioned that if the stock price surpasses certain thresholds, this could still result in dilution or the need for extra cash payments.

In 2025, Adtran saw a high of $11.83 on February 13 with a volume of 2.4 million shares, and a low of $7.18 on April 21 with 605,000 shares traded, reflecting a 25.33% gain for the year.

Adtran Holdings has an annual price range of $5.26 to $12.44, a market capitalization of $835.74 million, and an average trading volume of 961,010 shares.

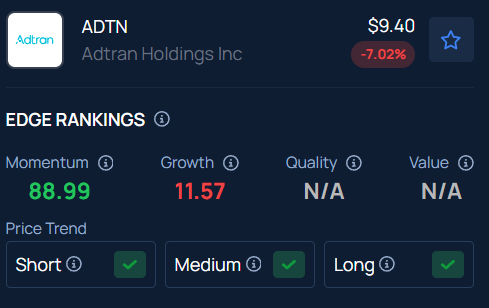

Benzinga’s Edge Stock Rankings show Adtran with strong Momentum at 88.99 and moderate Growth at 11.57, with an uptick in price trend across short, medium, and long-term periods. Track the performance of other players in this segment.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock