Activist investors have long been known to shake up underperforming companies, unlocking hidden value through restructuring or strategic asset sales. From Carl Icahn’s bold boardroom battles to Elliott Management’s high-profile interventions, activist funds often act as catalysts for stock re-ratings when they see untapped potential.

One such opportunity may be emerging in Fluor Corporation (FLR), a global engineering and construction giant. Shares of Fluor gained attention this week after Starboard Value revealed a nearly 5% stake in the company. The activist fund, led by Jeff Smith, is reportedly urging Fluor to explore options for its 40% ownership in NuScale Power (SMR), an investment that has surged nearly 110% this year.

With Fluor’s market value near $8 billion and its NuScale stake now worth billions, investors are wondering if Starboard’s involvement could unlock significant shareholder value. Here’s a closer look at why activist investors are betting big on Fluor and whether that makes FLR stock a potential buy right now.

About FLR Stock

Based in Texas, Fluor Corporation is a global engineering, procurement, and construction (EPC) firm that provides construction, maintenance, and project management services in the energy, infrastructure, mining, government, and advanced technology sectors. The company’s nearly 27,000 employees execute large-scale contracts worldwide, from oil and gas and chemicals to power and life sciences.

Fluor’s shares have been relatively flat in 2025. They remain roughly 3% below year-to-date (YTD) levels. However, FLR stock modestly jumped about 2% after Starboard’s stake was reported but has otherwise underperformed broader markets. FLR stock's decline stems from weak quarterly results, project delays, and lowered guidance, partly offset by optimism over its NuScale stake and government-backed infrastructure momentum.

On the valuation front, FLR trades at attractive multiples. Its EV/Sales ratio of 0.35 and P/E ratio of 3 are significantly lower than the sector medians of 2.18 and 23, respectively, indicating the stock is trading at a substantial discount and is relatively inexpensive.

Fluor Q2 Miss Hits Hard Despite NuScale Windfall

Fluor stock nosedived about 30% after reporting its second quarter in early August, which shows both pressure and potential. Revenue came in at around $4.0 billion, down 6% year-over-year (YoY), missing expectations. While GAAP net income surged to $2.5 billion, that was mainly due to a $3.2 billion equity gain from its NuScale Power stake, not from core operations.

On an adjusted basis, results were weaker. EBITDA dropped 42% to $96 million, and EPS fell 49% to $0.43. Operating cash flow swung to negative $21 million from $282 million a year ago, highlighting higher working capital needs. Still, Fluor ended the quarter with a solid $2.3 billion in cash and marketable securities.

Segment results were mixed. Urban Solutions revenue rose to $2.1 billion, but profit fell sharply due to cost overruns on large projects. Energy Solutions saw a revenue decline to $1.1 billion, and Mission Solutions grew modestly. Total backlog slipped 13% YoY to $28.2 billion.

CEO Jim Breuer blamed “infrastructure headwinds” and short-term project delays but called them temporary, emphasizing that Fluor’s long-term strategy in growth markets remains intact.

Following the quarter, Fluor lowered its full-year adjusted EPS guidance to $1.95 to $2.15, down from $2.25 to $2.75 previously. Management now expects operating cash flow of $200 to $250 million for 2025, citing client delays and project timing issues.

Recent News and Developments

Fluor has been making headlines lately. Activist involvement has reignited investor interest. Hedge fund Starboard Value recently took a big stake in Fluor, and that’s turned up the spotlight. With NuScale now worth more than Fluor’s own core business, investors think a partial sale or spin-off, as Starboard suggests, could unlock major shareholder value.

Meanwhile, on the project side, Fluor’s LNG Canada venture is progressing smoothly. The company celebrated the first LNG cargo shipment under its facilities in Q2 and secured a contract for Phase 2 engineering work, a solid win for its energy portfolio.

Fluor’s backlog remains healthy at $28.2 billion, even after new awards fell 43% in the quarter. The company also returned $153 million to shareholders through stock buybacks, signaling confidence in its balance sheet.

What Do Analysts Think About FLR Stock?

Analysts are largely positive on Fluor. Baird maintained a “Hold” rating, noting that execution risks justify its lower $46 price target. Truist and UBS remain upbeat, calling Fluor’s energy exposure “a long-term growth play,” with price targets of $51 and $56, respectively.

Meanwhile, Citigroup argued that the market undervalues Fluor’s NuScale stake, which now accounts for more than 60% of its market capitalization. The bank added that activist pressure from Starboard Value could unlock “meaningful upside.”

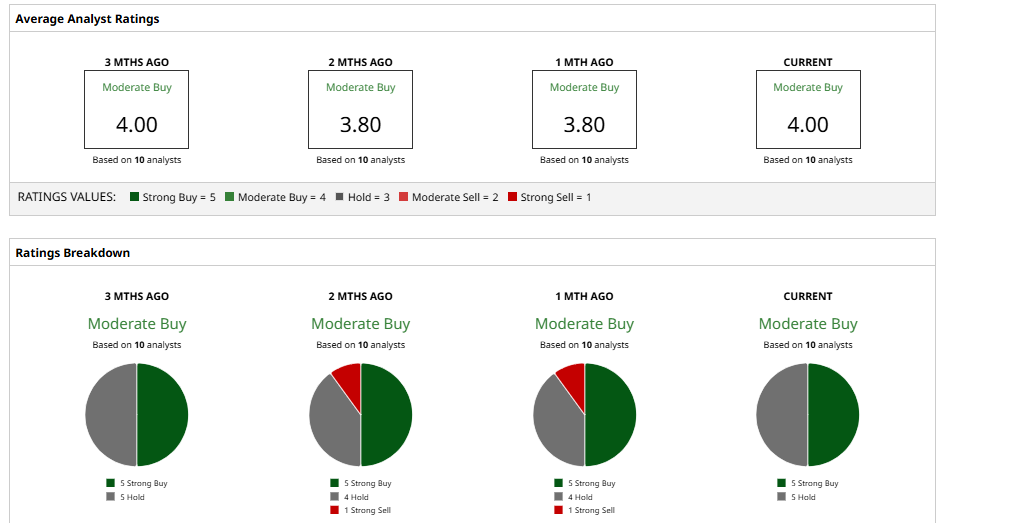

Overall, among 10 analysts, Fluor carries a “Moderate Buy” consensus rating, split evenly between five “Strong Buy” and five “Hold” recommendations. The mean price target of $49 implies an expected 2.5% upside from current levels.

In my view, Fluor sits at an inflection point. The entry of a high-profile activist validates that an underlying value exists, but unlocking it is not guaranteed. At current prices, FLR appears inexpensive on a standalone basis. Investors betting on Fluor must weigh execution risks in its engineering business against the potential upside if NuScale is monetized or if infrastructure demand accelerates.