/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

Lucid Group (LCID) has announced a 1-for-10 reverse stock split effective Aug. 29, and the shares will trade on a split-adjusted basis beginning Sept. 2. The company joins the growing list of electric vehicle (EV) startups that opted for a reverse stock split. Among others, Nikola and Lordstown Motors did reverse stock splits but eventually went out of business. In this article, we’ll examine Lucid’s forecast after the reverse stock split.

Why Is Lucid Motors Doing a Reverse Stock Split?

Companies announce a traditional stock split when their stock rises and becomes too expensive (in dollar terms) for investors. Splits help artificially lower the stock price, which leads to higher liquidity. Conversely, companies announce a reverse stock split when their stock price plunges. Often, these are done to meet the minimum exchange listing requirements, as companies whose share price falls below $1 become delisting candidates.

In Lucid’s case, the reverse stock split is not borne out of regulatory requirements, as the shares are still comfortably above $1. However, it is in the penny stock category as it trades below $5. Looking at the reverse split ratio, LCID shares will trade in the ballpark of $20 after the split is completed.

During the Q2 2025 earnings call earlier this month, Lucid Group’s CFO Taoufiq Boussaid said that the then-planned reverse stock split wasn’t a “cosmetic action” but a “deliberate and targeted measure to ensure Lucid’s equity remains accessible to broader universe of long-only institutional investors.”

He added, “It also aligns our share price with the strategic trajectory of the company as we move into the next chapter of scaling our operations and deepening our capital market engagement.”

To decode that, a higher share price might make Lucid shares appealing to institutional investors as the company will need to do share sales soon, given the upcoming 2026 debt maturities and the depleting cash pile, which stood at $3.6 billion at the end of June.

Are Reverse Stock Splits Good?

While fundamentally, splits and reverse stock splits don’t change anything for a company, markets perceive a stock split as a positive and a sign that the management is feeling good about the company’s outlook. Similarly, a reverse stock split is invariably seen as a negative, and shares tend to fall on such announcements.

That said, after the reverse stock split, Lucid shares could become investment-worthy for funds that otherwise avoid penny stocks. It’s been quite a reversal of fortunes for Lucid, whose market cap topped $90 billion in December 2021, and it looked set to join the league of $100 billion companies, like fellow EV startup Rivian (RIVN), which also went public that month. But then, that was a different era altogether for EV startups, and most of the companies that went public at the time have either gone bankrupt or are on the verge of doing so. Rivian and Lucid Motors are perhaps the only two companies of any consequence in the U.S. startup EV space now.

Should You Buy or Sell LCID Stock?

The reverse stock split does not significantly alter the investment case for Lucid Motors. The company needs to become a sustainable business sooner rather than later, and it cannot perpetually rely on share sales and investments from Saudi Arabia’s Public Investment Fund (PIF).

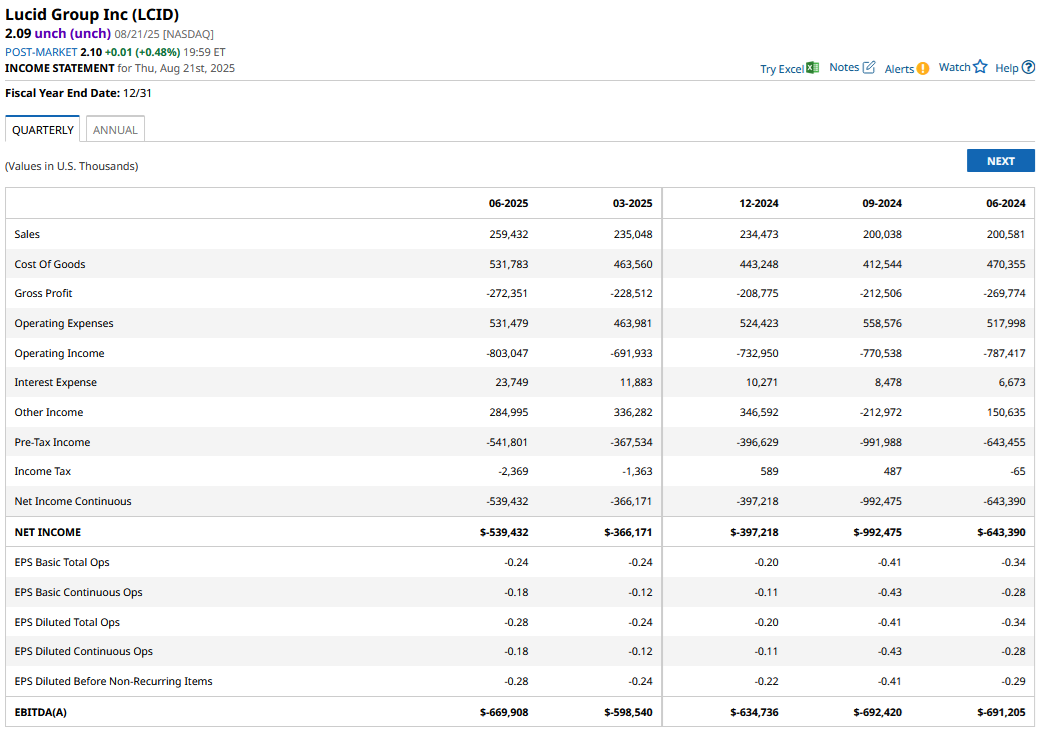

Lucid currently does not have a clear path to profitability in the short to medium term, and its gross loss margin in Q2 was 105%. While it does include the tariff impact of $54 million, the company’s losses and cash burn are simply too high for comfort, even in an industry where not many players apart from Tesla (TSLA) have been able to make money.

Lucid Group is saddled with excess capacity, and even the top end of its 2025 guidance (20,000 units) is a fraction of the planned 90,000-unit capacity. Lower capacity utilization only adds to the per-unit fixed costs, and Lucid has been looking to increase production by pivoting to more affordable models, including the upcoming midsize platform.

To be sure, Lucid has an impressive product portfolio, and its cars have received rave reviews. Luxury carmaker Aston Martin partnered with Lucid to buy electric motors and batteries, which provides credence to Lucid’s claim that it offers a world-class product.

Last month, Uber (UBER) also partnered with Lucid in a three-way partnership with Nuro, wherein the ride-hailing giant will buy at least 20,000 Lucid cars fitted with Nuro’s autonomous driving system, which it will deploy in its robotaxi fleet.

Lucid’s management is working on more such deals, which will help it improve its earnings. That said, the company needs to scale up its volumes significantly and bridge its losses and cash burn, as the Saudi backstop might not last forever. I continue to remain invested in Lucid and even added more positions amid the crash earlier this year. However, if the company is not able to significantly improve its financial performance over the next few quarters, I will consider exiting the name.