/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

IonQ (IONQ) shares soared some 20% on Friday after the quantum-tech firm said the United Kingdom’s Investment Security Unit (ISU) has cleared its over $1 billion acquisition of Oxford Ionics.

Now that IONQ has received the regulatory greenlight, it “looks forward to closing the deal in the near term,” the company’s chief executive, Peter Chapman, said in the press release today.

Including today’s rally, IonQ stock is up a whopping 200% versus its year-to-date low in March.

Why Oxford Ionics Acquisition Is Bullish for IonQ Stock

IONQ’s chief executive Peter Chapman expects the Oxford Ionics acquisition to supercharge the company’s roadmap toward massively scalable quantum systems.

Within the next two years, IonQ, powered by Oxford’s silicon-based ion control, will deliver chips with 10,000 qubits, making today’s supercomputers “look aged and dated.”

Speaking with Bloomberg, Chapman said even Nvidia’s (NVDA) latest Blackwell chips will be outclassed.

The acquisition is bullish for IONQ shares as it enables the quantum computing specialist to leap-frog classical architectures, unlocking exponential gains in compute power and energy efficiency.

Together, Oxford Ionics and IonQ will essentially position quantum processing units as the final frontier in computing’s evolution.

CEO Peter Chapman Sees Big Future for IONQ Shares

With a market cap of more than $13 billion, IonQ is currently “the world’s largest quantum firm in the world,” with leadership in both quantum computing and quantum networking, according to CEO Peter Chapman.

In the Bloomberg interview, the company’s top executive also dubbed quantum processing units (QPUs) as the “final leg” of computing’s evolution and declared the era of quantum computing “has absolutely started now.”

According to him, IONQ’s next-gen chip, developed in collaboration with Oxford Ionics, will “wipe the floor with any other supercomputer that exists on Earth.”

Chapman’s remarks suggests IonQ stock could prove a lucrative long-term investment even though it’s trading at a rather stretched price-sales (P/S) multiple of more than 300x at the time of writing.

How Wall Street Recommends Playing IonQ

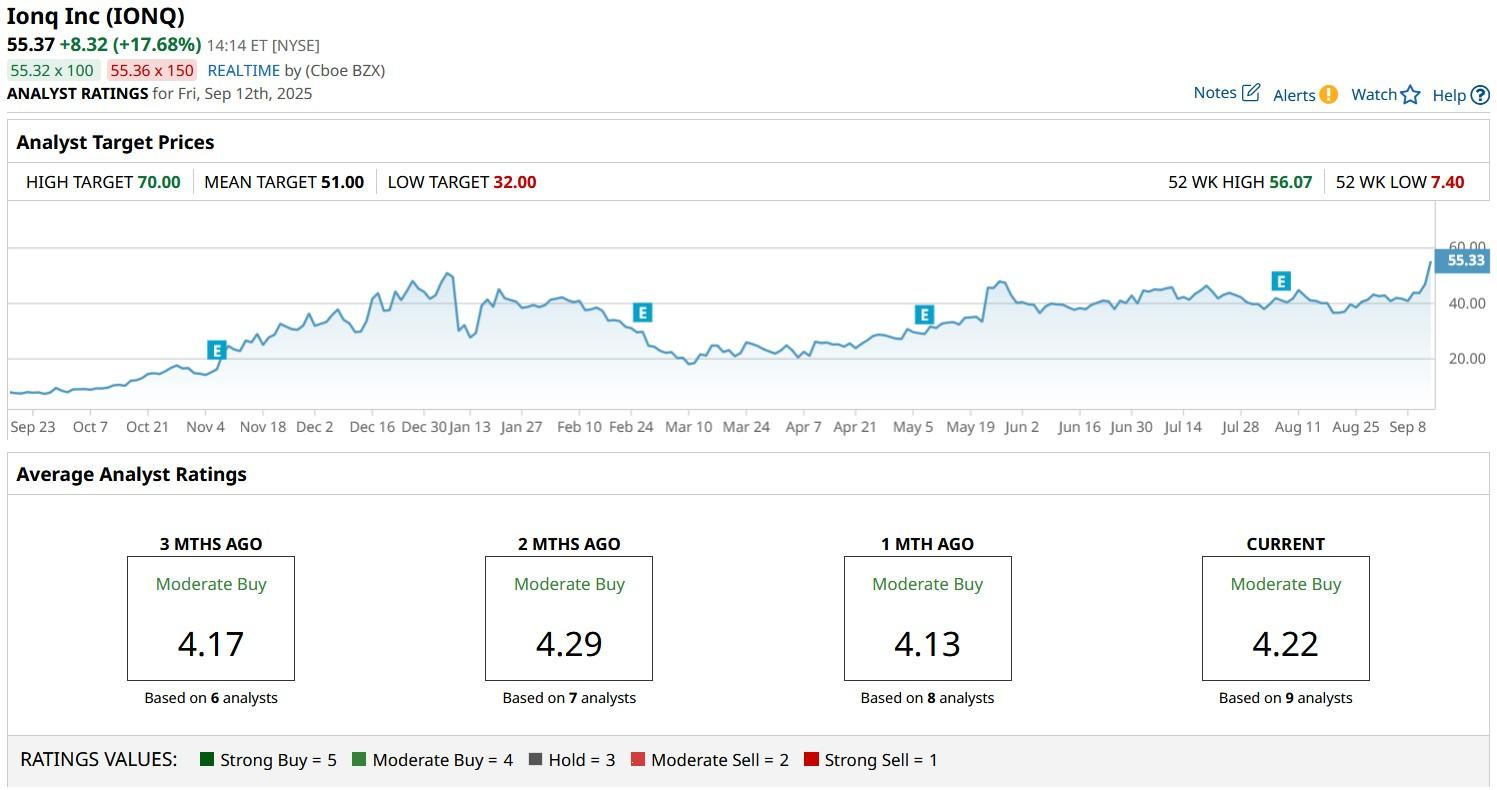

Investors should also note that Wall Street firms are keeping bullish on IONQ shares for the next 12 months as well.

The consensus rating on IonQ stock currently sits at “Moderate Buy” with price objectives going as high as $70 indicating potential upside of another 25% from here.