In an uncertain stock market where volatility keeps investors on edge, dividend stocks remain a source of stability and steady returns. These five dividend-paying companies continue to stand out for their resilient earnings, solid balance sheets, and consistent payouts, making them safe bets for those seeking passive income.

Income Stocks #1: Realty Income (O)

Realty Income (O) continues to shine as one of the most dependable dividend stocks available. Known widely as “The Monthly Dividend Company,” Realty Income has built its reputation on delivering predictable cash flow and steady growth, two essential traits of a safe income stock.

Realty Income is a real estate investment company (REIT) largely focused on freestanding, single-tenant commercial properties with long-term net lease agreements. This structure requires renters, not Realty Income, to bear property expenses like taxes, insurance, and upkeep, resulting in constant rental income and little cost fluctuation. What truly sets Realty Income apart is its monthly dividend. Since its inception, the company has distributed over 664 consecutive monthly dividends. It has also grown its dividends over the last 30 years, earning the Dividend Aristocrat title. Its current dividend yield is 5.45%, making it one of the most attractive among REITs.

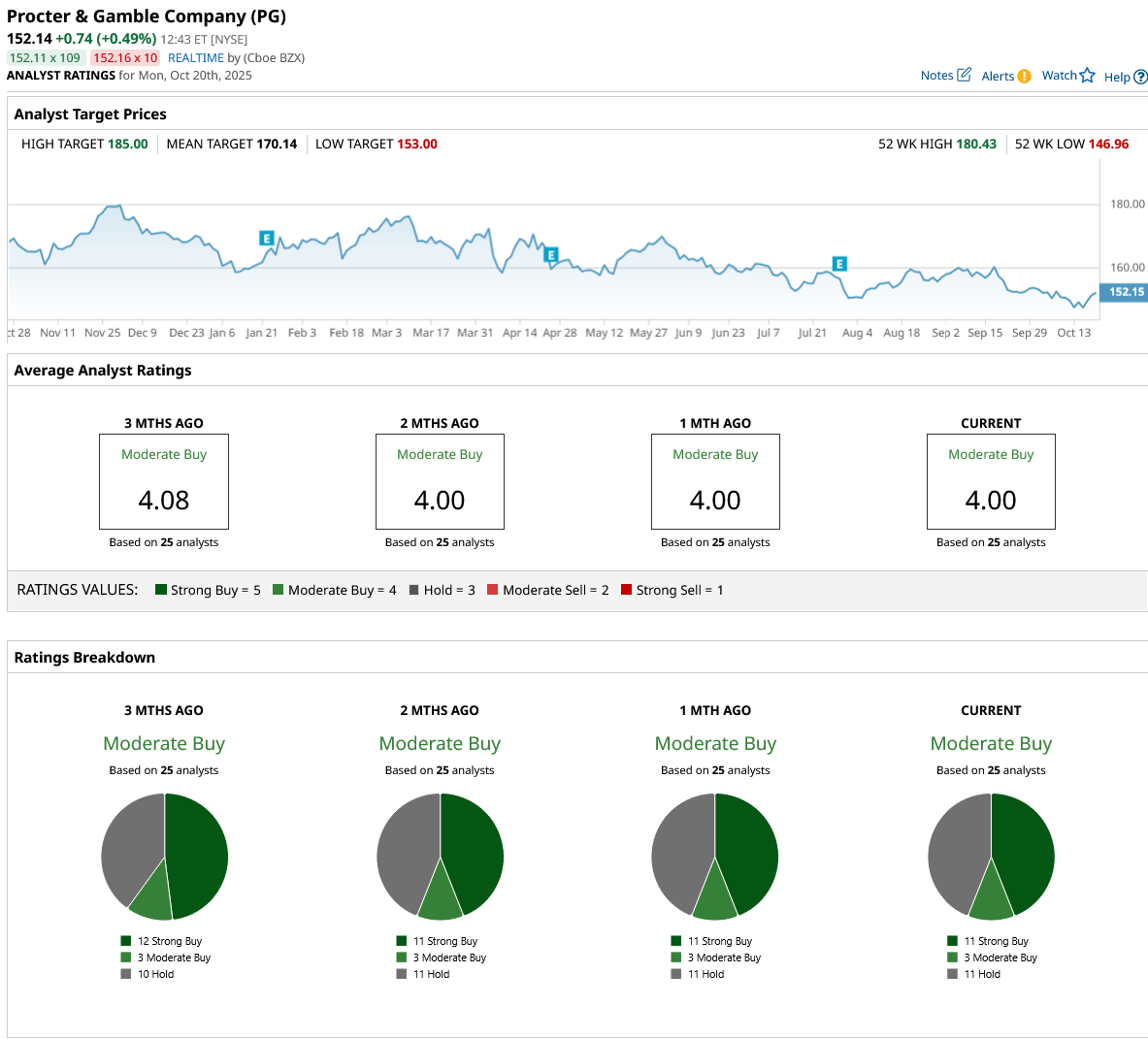

Overall, on Wall Street, O stock is a “Hold.” Out of the 25 analysts that cover the stock, four rate it a “Strong Buy,” one rates it a “Moderate Buy,” and 20 rate it a “Hold.” The mean target price for the stock is $62.18, which is 3.7% above current levels. The Street-high estimate of $69 implies upside of 15.1% over the next 12 months.

Income Stocks #2: Enbridge

Valued at $143.9 billion, Enbridge (ENB), the Canadian energy infrastructure giant, remains one of the longest and most reliable dividend track records in North America. The company transports oil and natural gas through one of the largest pipeline networks in North America. It also runs natural gas utilities, storage facilities, and renewable energy projects such as wind and solar.

The company has grown its payout annually for nearly three decades, earning the reputation of a Dividend Aristocrat. Its attractive forward dividend yield of 5.8% is considerably better than the energy industry average. Importantly, these dividends are supported by steady, utility-like cash flows rather than unpredictable oil prices, as the majority of its revenue is from stable, long-term contracts.

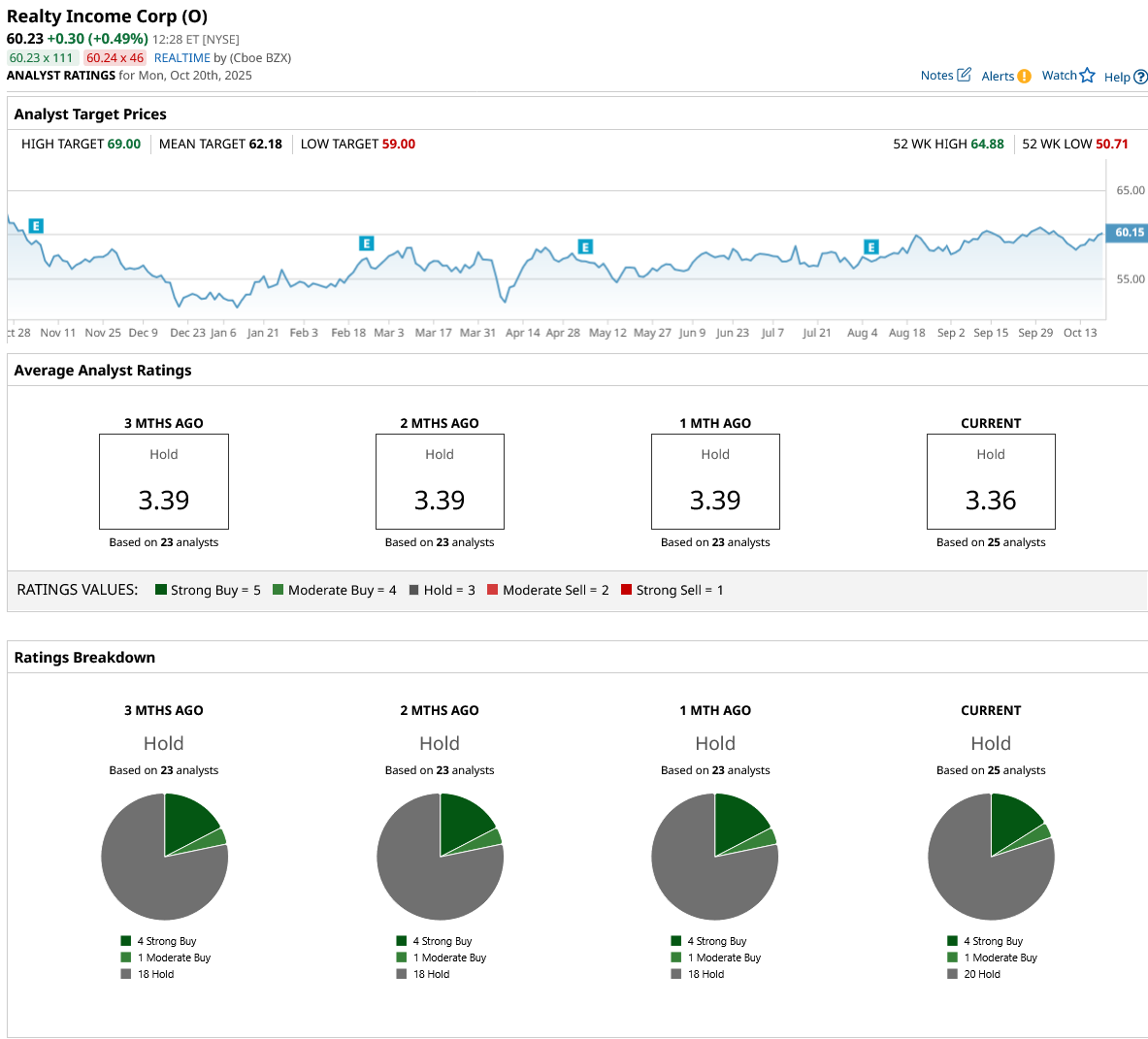

Overall, Wall Street rates ENB stock a consensus “Moderate Buy.” Of the 20 analysts in coverage, eight recommend a “Strong Buy,” two rate it a “Moderate Buy,” nine say it's a “Hold,” and one rates it a “Strong Sell.” Its average analyst target price of $49.91 suggests the stock could climb by 6% from current levels. Furthermore, its Street-high price estimate of $55.88 implies an upside potential of 19% over the next 12 months.

Income Stocks #3: Johnson & Johnson

With almost a century of history, an unbroken dividend payment streak, and 63 straight years of dividend increases, Johnson & Johnson (JNJ) is still one of the most dependable income stocks investors can buy. Johnson & Johnson's continuing success comes from its diverse business portfolio. Following the spin-off of its consumer health company, Kenvue (KVUE), in 2023, J&J now focuses on two high-margin segments: pharmaceuticals and MedTech (medical equipment). These segments focus on areas where the company maintains extensive knowledge, worldwide reach, and pricing power.

It currently offers a dividend yield of around 2.69%, comfortably above the healthcare sector average of 1.58%. More importantly, it has raised its payment for 63 straight years, earning it the prestigious title of "Dividend King."

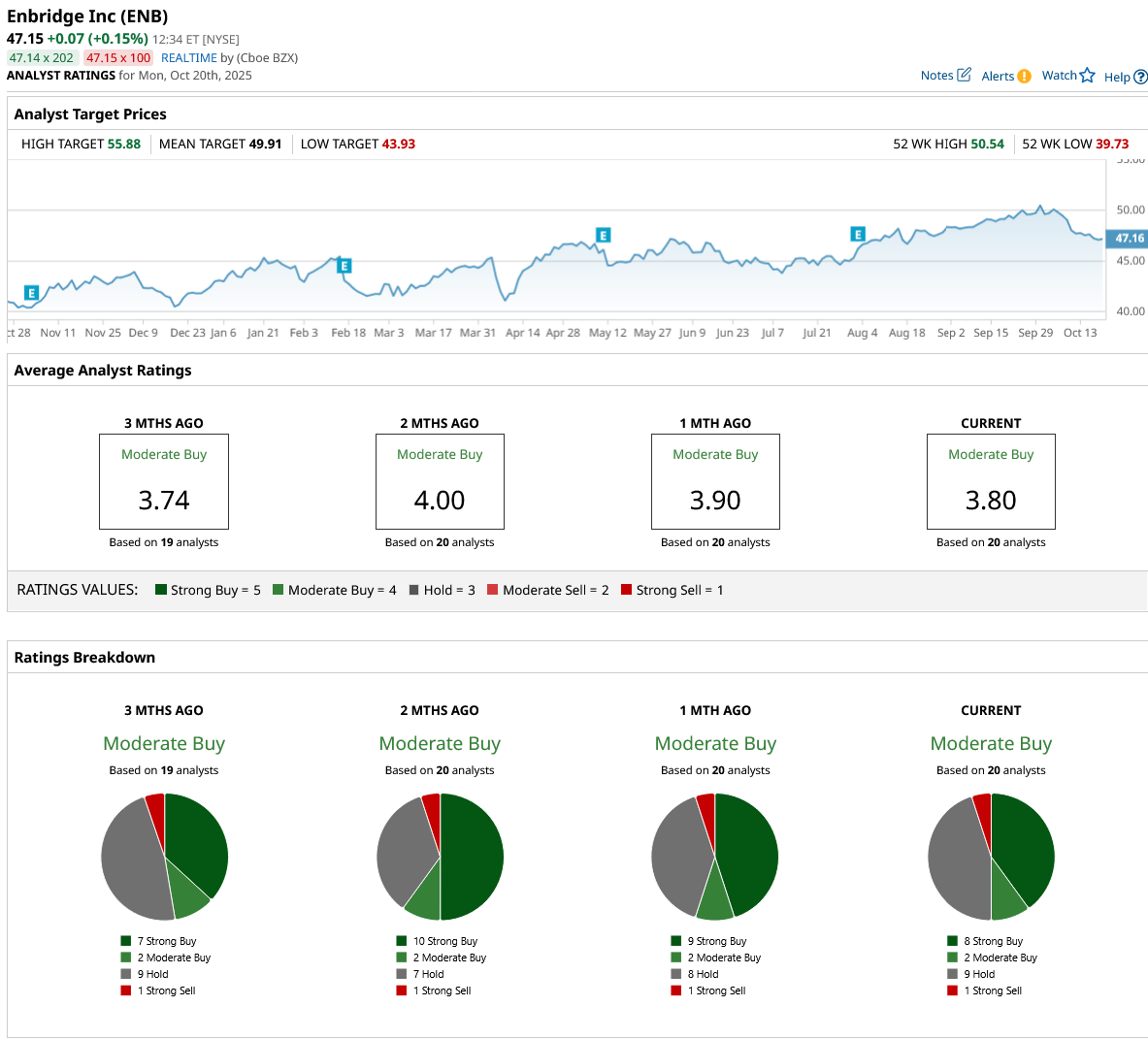

Overall, Wall Street has assigned a “Moderate Buy” rating to JNJ. Out of the 25 analysts covering the stock, 12 rate it a “Strong Buy,” two rate it a “Moderate Buy,” and 11 rate it a “Hold.” The mean target price on the stock is $199.83, which is 3% above current levels. Meanwhile, its high target price of $225 implies a potential upside of 17% in the next 12 months.

Income Stocks #4: PepsiCo

PepsiCo (PEP), known globally for its renowned products and reliable dividend payouts, provides a perfect balance of stability, resilience, and moderate growth, making it a stock still worth owning for income-oriented investors.

The company has increased its dividend for 53 years in a row, cementing its place among the elite Dividend Kings. PepsiCo's dividend yield is 3.7%, providing investors with a strong return backed by consistent earnings and free cash flow creation.

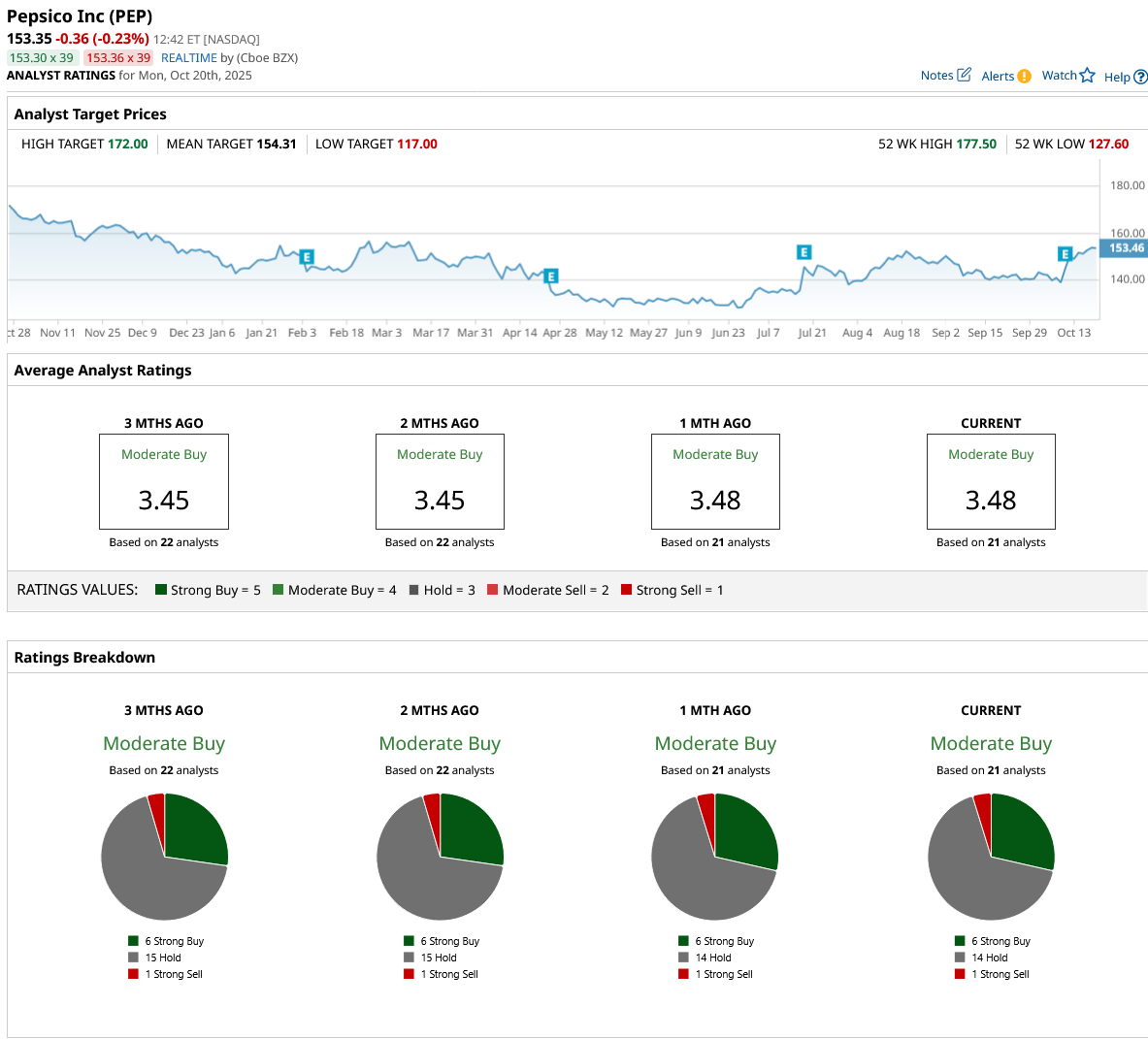

Overall, analysts have rated PEP stock a “Moderate Buy.” Out of 21 analysts covering the stock, six have a “Strong Buy” rating, 14 have a “Hold” rating, and one suggests a “Strong Sell.” The stock is trading close to its mean target price of $154.31. But the high price estimate of $172 implies PEP stock can go as high as 12% over the next 12 months.

Income Stocks #5: Procter & Gamble

Procter & Gamble's (PG) robust portfolio of trusted brands, consistent cash flow, and great dividend track record make it a secure income stock that is still worth holding despite inflation and economic instability. It has paid and increased its dividends for 70 consecutive years, giving it the prestigious title of Dividend King. Its dividend yield is around 2.79%, which is supported by excellent free cash flow and a cautious payout ratio of approximately 57%.

Its products span virtually every corner of the household, from grooming and cleaning to baby care and beauty. Brands like Tide, Pampers, Gillette, Oral-B, Head & Shoulders, and Olay dominate their categories globally, giving P&G unmatched consumer reach and pricing power.

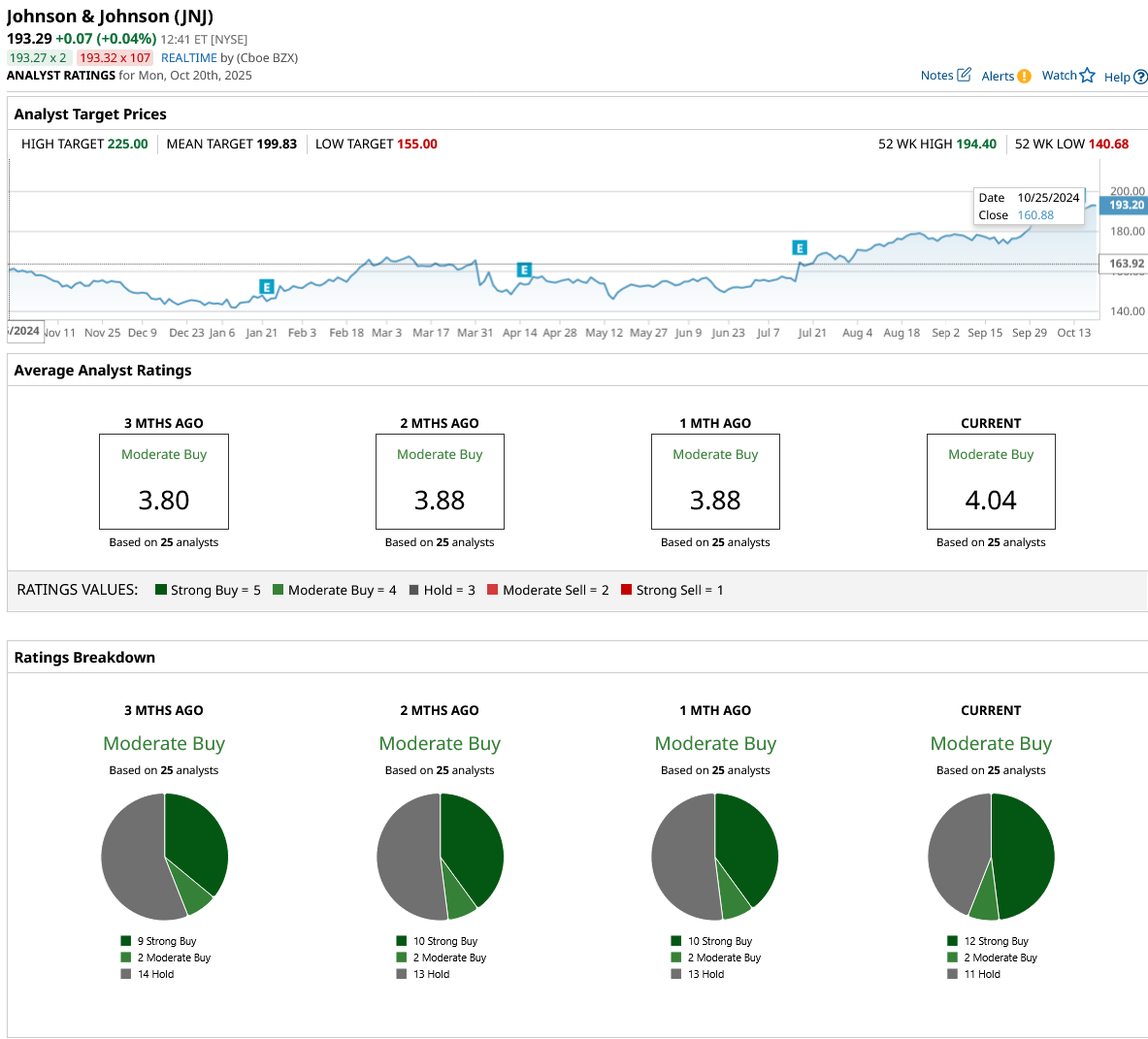

Overall, Wall Street rates PG stock a “Moderate Buy.” Out of the 25 analysts who cover the stock, 11 have given it a “Strong Buy,” while three say it is a “Moderate Buy,” and 11 suggest a “Hold.” Based on the mean target price of $170.14, PG stock has upside potential of 12% compared to current levels. However, the high target price of $185 suggests that the stock could rise more than 20% over the next 12 months.