As you approach retirement, you may start to worry whether you have enough saved to fund your golden years. Things like unexpected healthcare costs and a rising cost of living can easily drain your savings if you’re not prepared. Even though these concerns are common, with the right strategy, you can still build a secure and sustainable financial future for yourself.

Learn More: 6 Key Signs You’ll Run Out of Retirement Funds Too Early

Read Next: How Much Money Is Needed To Be Considered Middle Class in Your State?

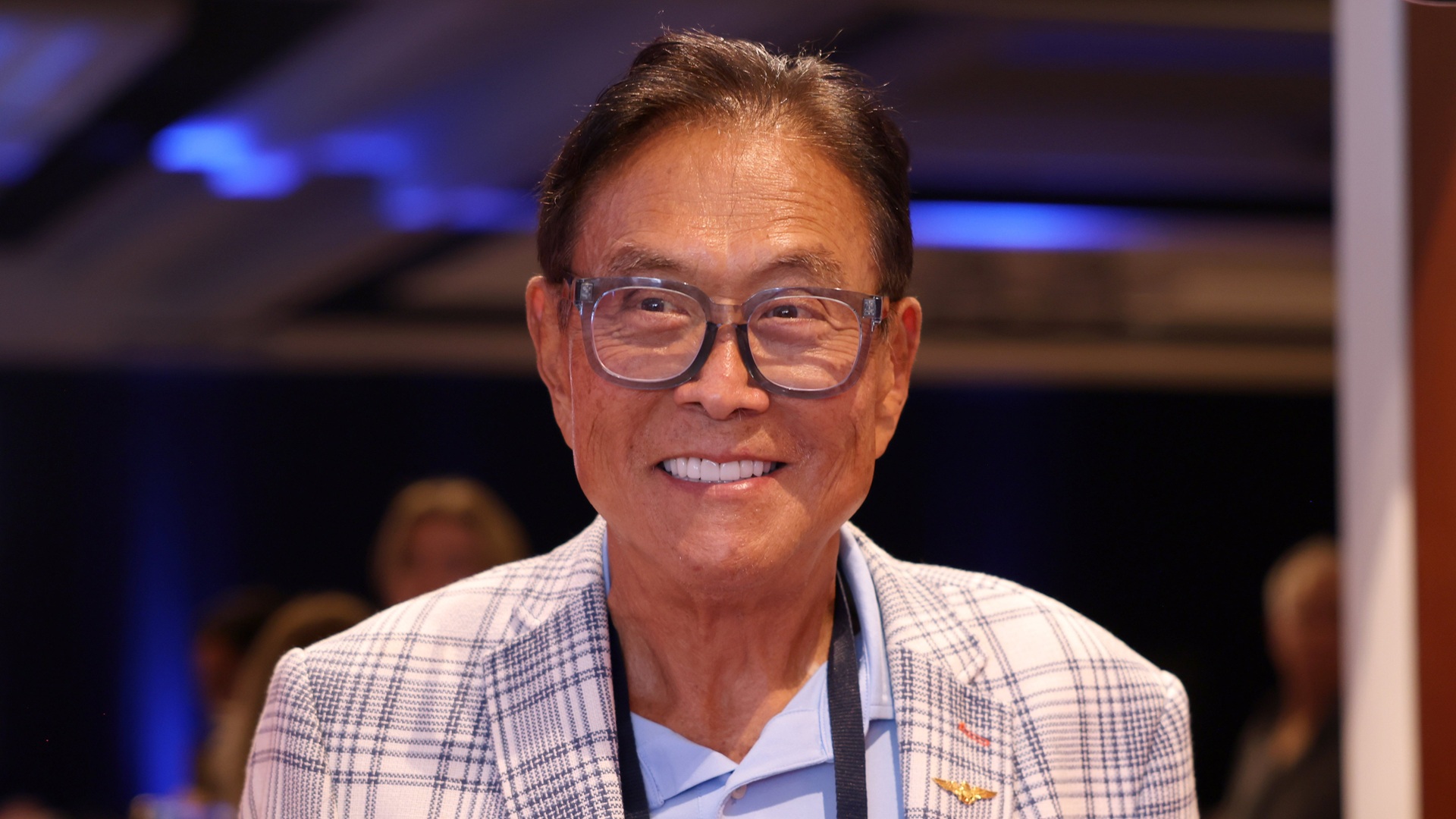

Robert Kiyosaki, renowned author of “Rich Dad Poor Dad,” has long shared unconventional yet practical advice on wealth-building and retirement planning. From diversifying beyond traditional assets to generating passive income, here are four retirement tips he swears by to help you retire smarter and stronger.

Avoid Hoarding Cash

You may feel tempted to keep a lot of cash on hand to protect yourself against market downturns or lower-than-expected retirement benefits. However, this could be a bad financial move if you’re seeking sustainable retirement income as part of your plan.

According to Kiyosaki, inflation can have a negative impact on your savings account balances. He said, “Rather than save cash, keep your liquidity in assets that can be quickly liquefied and that hedge against inflation, not lose value with it. That can be gold, silver, oil, etc.”

By investing in inflation-resistant assets, you can preserve your wealth and ensure your retirement income keeps pace with rising costs.

Diversify Your Investments

When you diversify your retirement portfolio, you might focus on types of traditional investments, such as mutual funds, stocks and bonds. While this can balance out some risk, you should also look into alternative investments to protect your retirement savings.

“True diversification involves investing in as many of the five asset classes as possible: paper, real estate, commodities, business and cryptocurrency,” explained Kiyosaki. Be sure to do your due diligence, however, since these investment options all have varying returns, risks, potential fees and tax implications.

For You: I’m Retiring a Multimillionaire: Here’s What I Wish I Knew in My 30s

Generate Cash With the Right Assets

Healthcare costs in retirement can be unpredictable–and expensive. While long-term care insurance might seem like a smart safety net, it often comes with high premiums, limited coverage and no guarantee you’ll ever use it.

Instead, Kiyosaki suggests investing in income-generating assets that can support you as you age. As he put it, “Rather than hand your money over to an insurance company or stock it away at a zero return for an old-age annuity, begin now to invest in assets that will provide the cash flow you need to cover your expenses as you grow older.”

Reduce Your Taxes

Taxes can significantly eat into your investment income, making it harder to grow and preserve your retirement savings. That’s why minimizing your tax burden is a key part of any smart retirement strategy.

Kiyosaki recommends using pre-tax dollars to invest whenever possible and learning about tax-advantaged strategies that can boost your returns. One effective approach is to hold investments for over a year to qualify for long-term capital gains tax rates, which are typically lower than standard income tax rates.

You can also explore tax-exempt investment options like municipal bonds or contribute to Health Savings Accounts (HSAs), which offer triple tax benefits: tax-deductible contributions, tax-free growth and tax-free withdrawals for qualified medical expenses.

By being strategic with your investments and understanding how taxes impact your returns, you can keep more of your money working for you in retirement.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- 5 Luxury SUVs That Will Have Massive Price Drops in Fall 2025

- I Help People Retire Every Day -- Here's the Most Common Retirement Mistake People Make

- 10 Unreliable SUVs To Stay Away From Buying

- 9 Downsizing Tips for the Middle Class To Save on Monthly Expenses

This article originally appeared on GOBankingRates.com: 4 Retirement Planning Tips Robert Kiyosaki Swears By